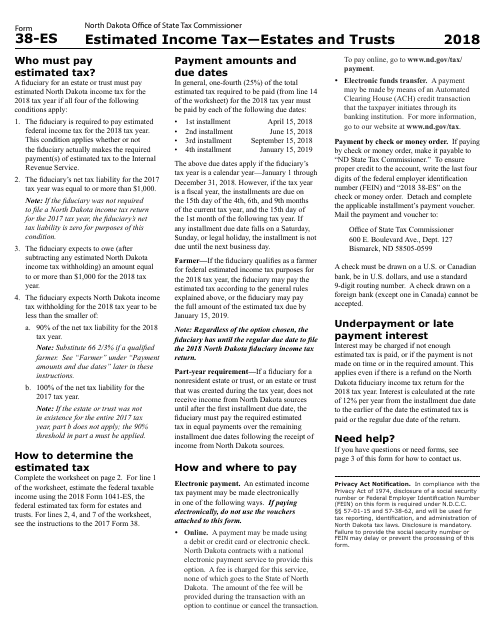

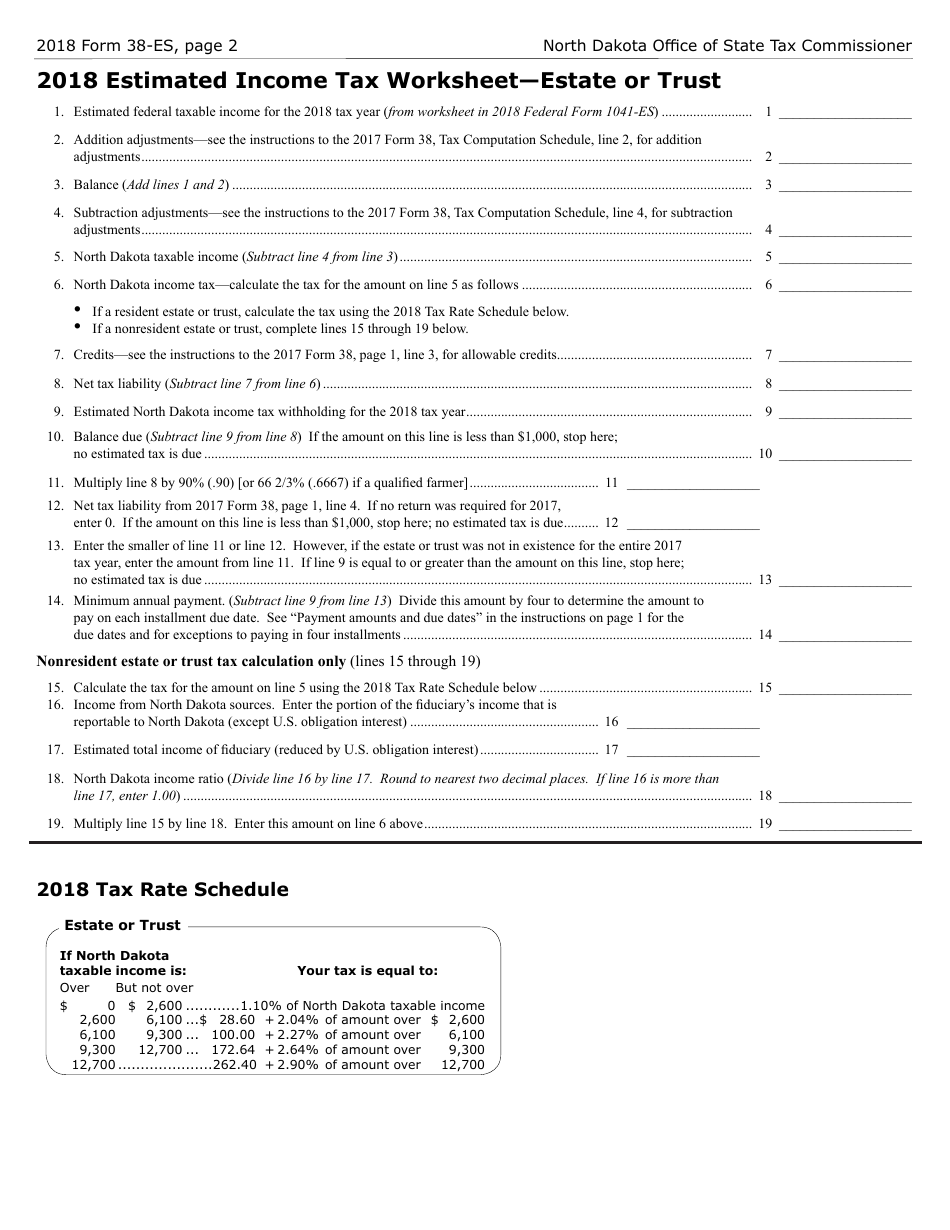

Form 38-ES Estimated Income Tax - Estates and Trusts - North Dakota

What Is Form 38-ES?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 38-ES?

A: Form 38-ES is the Estimated Income Tax form for Estates and Trusts.

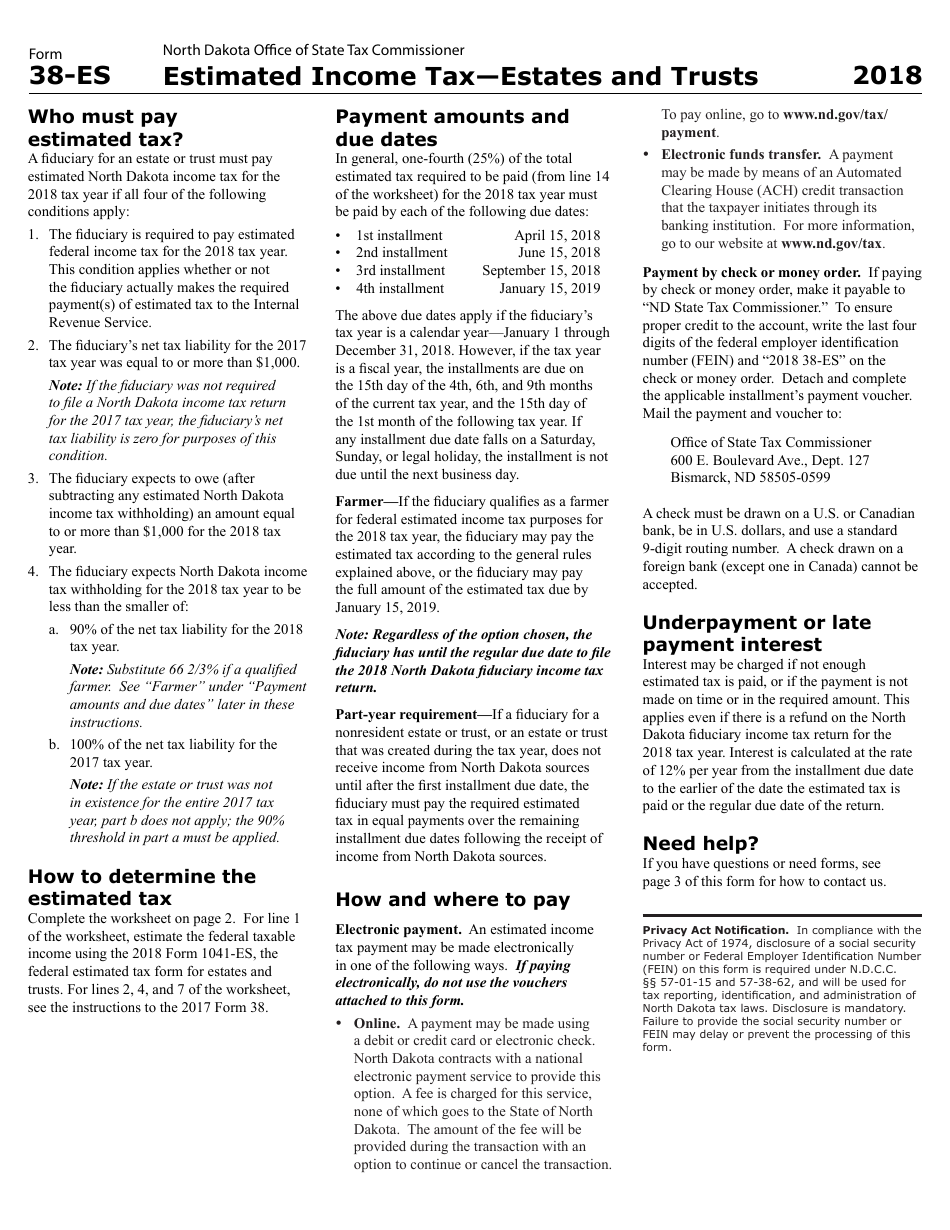

Q: Who should file Form 38-ES?

A: Estates and Trusts in North Dakota should file Form 38-ES if they are required to pay estimated income tax.

Q: What is the purpose of filing Form 38-ES?

A: The purpose of filing Form 38-ES is to report and pay estimated income tax throughout the year.

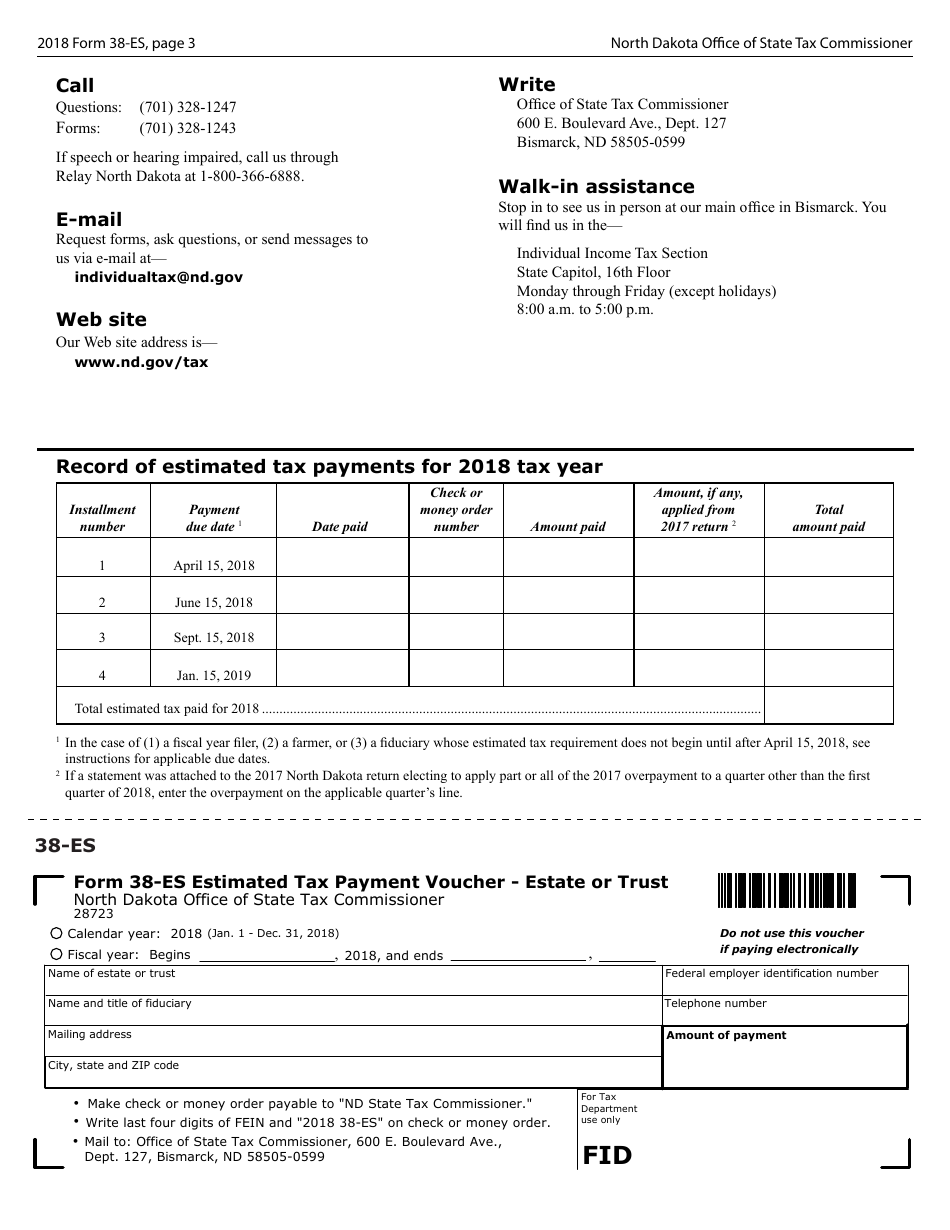

Q: When is Form 38-ES due?

A: Form 38-ES is due on the same dates as individual income tax returns, which is April 15th.

Q: Is there a penalty for not filing Form 38-ES?

A: Yes, there is a penalty for not filing Form 38-ES if you are required to make estimated income tax payments.

Q: What information is needed to complete Form 38-ES?

A: You will need information about your estimated income, deductions, and credits to complete Form 38-ES.

Q: Can I e-file Form 38-ES?

A: Yes, you can e-file Form 38-ES if you prefer to do so.

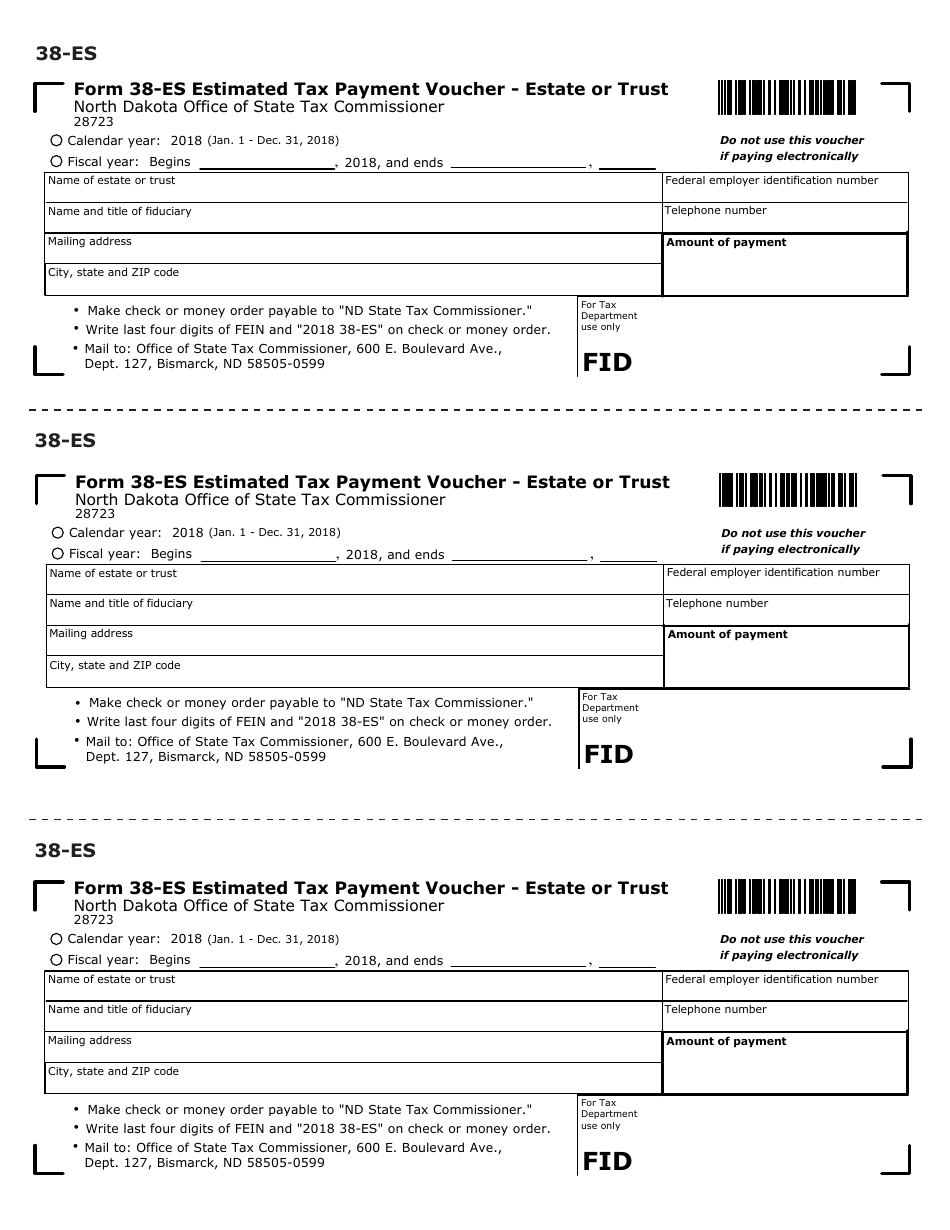

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 38-ES by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.