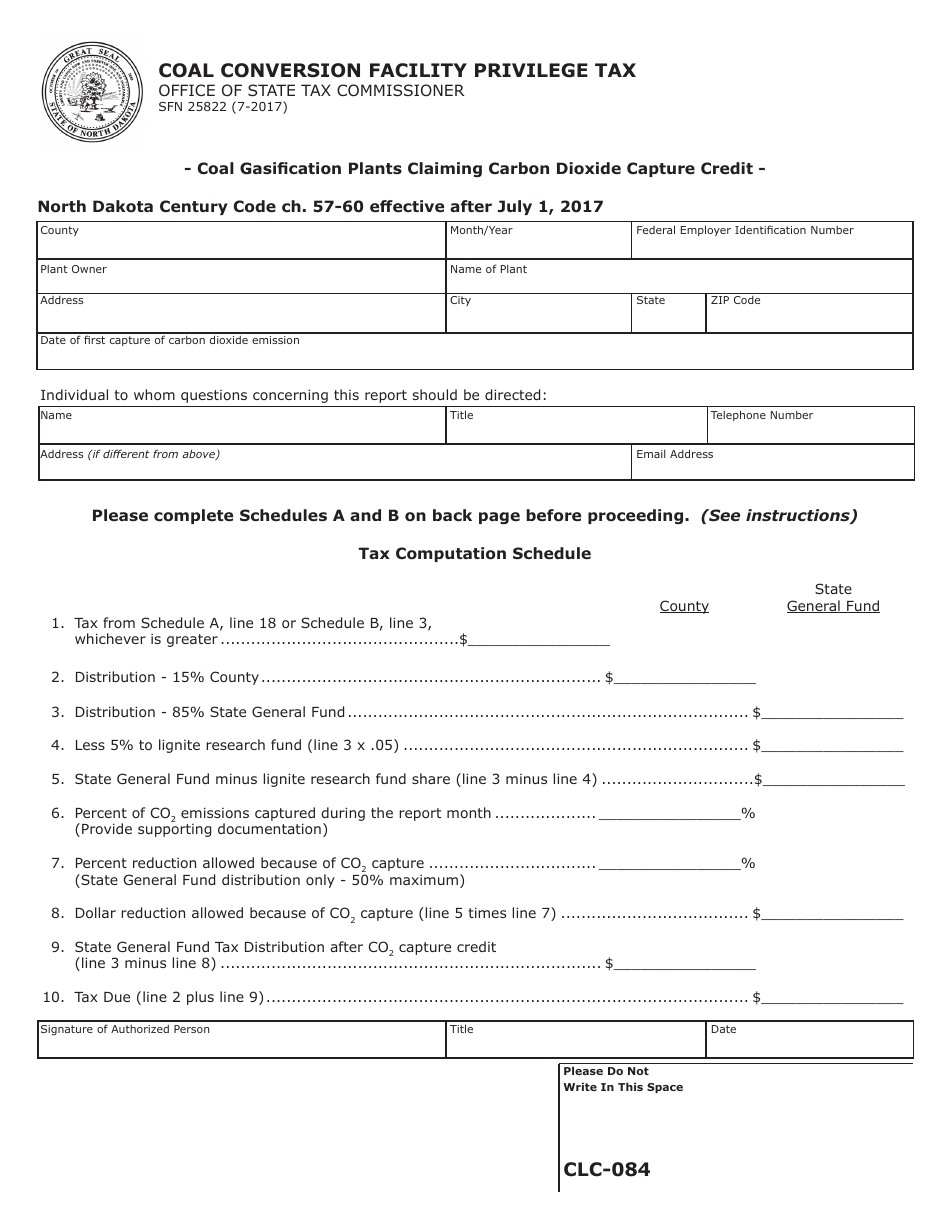

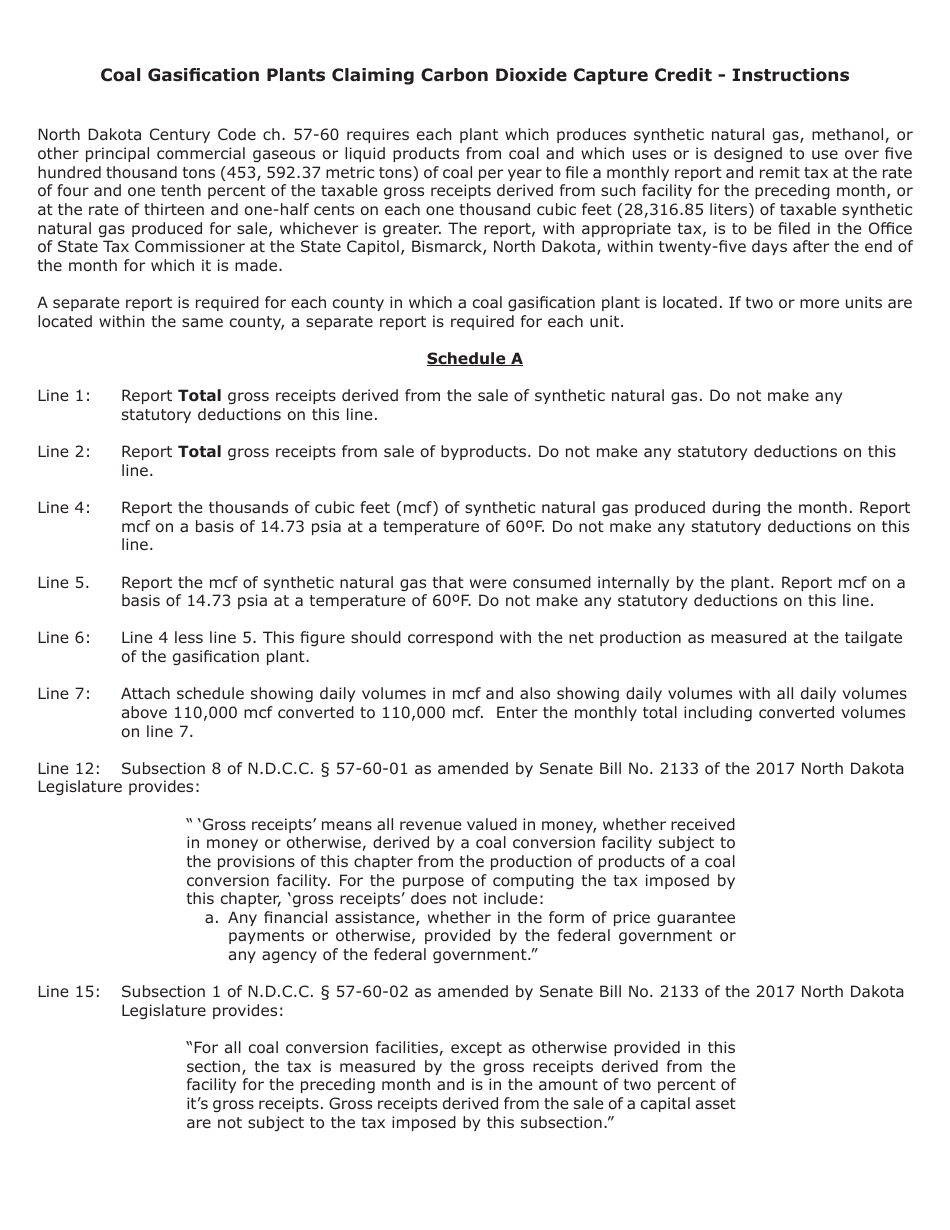

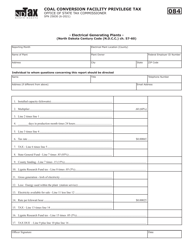

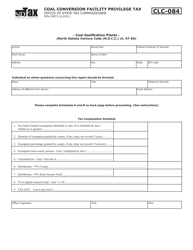

Form SFN25822 Coal Conversion Facility Privilege Tax - Coal Gasification Plants Claiming Carbon Dioxide Capture Credit - North Dakota

What Is Form SFN25822?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN25822?

A: Form SFN25822 is the tax form used by coal gasification plants in North Dakota to claim the carbon dioxide capture credit.

Q: What is the purpose of Form SFN25822?

A: The purpose of Form SFN25822 is to allow coal gasification plants in North Dakota to claim the carbon dioxide capture credit.

Q: Who can use Form SFN25822?

A: Coal gasification plants in North Dakota can use Form SFN25822 to claim the carbon dioxide capture credit.

Q: What is the carbon dioxide capture credit?

A: The carbon dioxide capture credit is a tax credit available to coal gasification plants in North Dakota that capture and store carbon dioxide emissions.

Q: What is a coal gasification plant?

A: A coal gasification plant is a facility that converts coal into synthetic gas or "syngas" which can be used for various purposes.

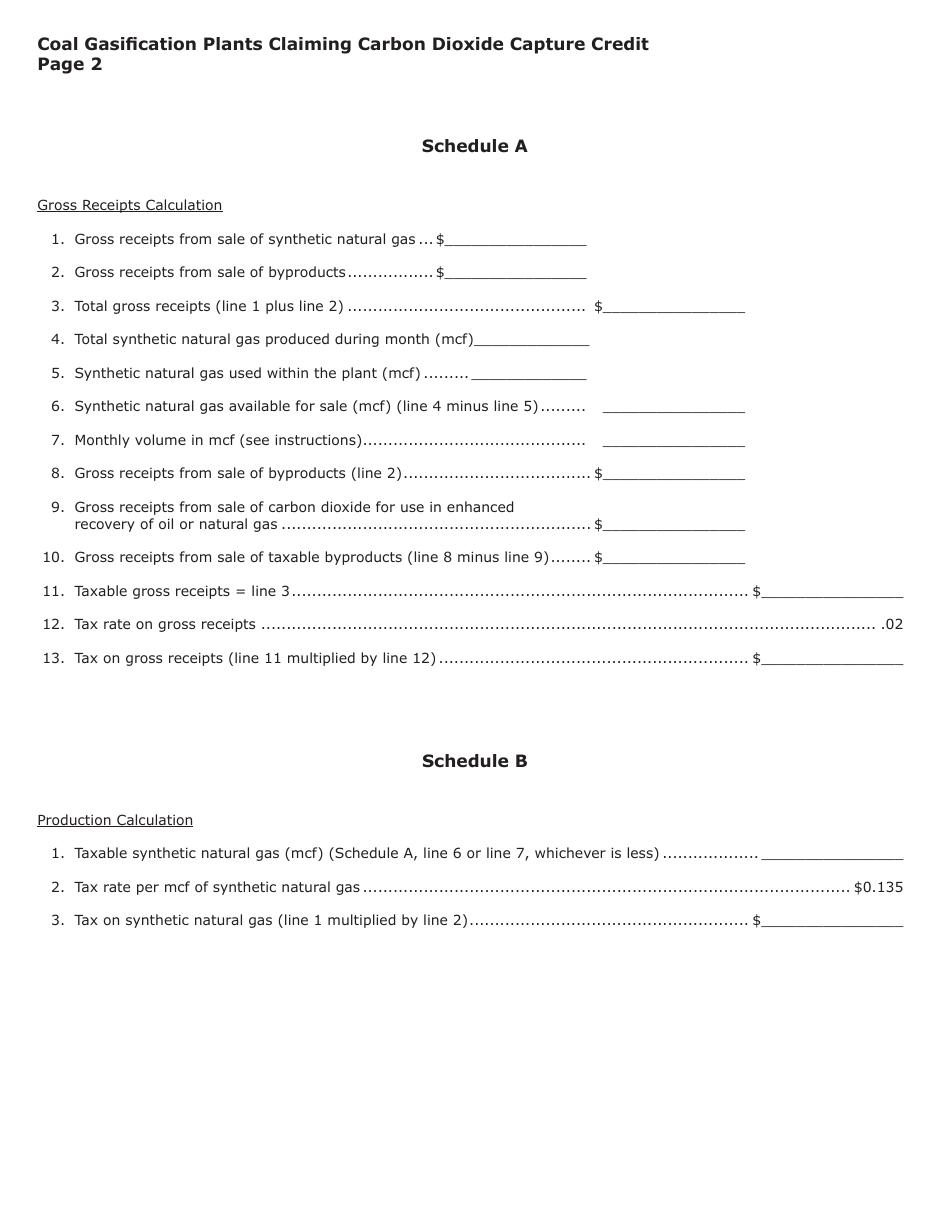

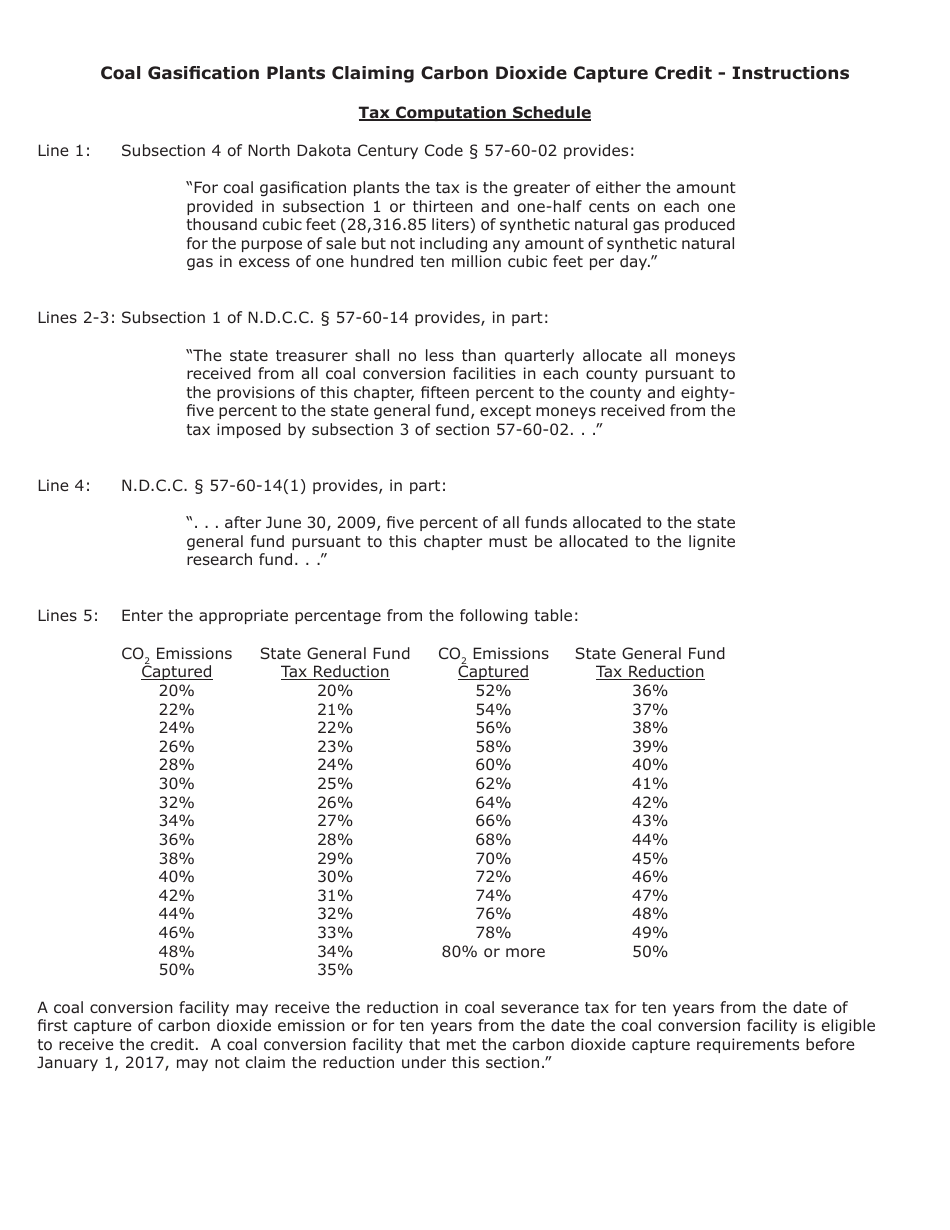

Q: How is the carbon dioxide capture credit calculated?

A: The carbon dioxide capture credit is calculated based on the amount of carbon dioxide captured and stored by the coal gasification plant.

Q: Are there any requirements for claiming the carbon dioxide capture credit?

A: Yes, coal gasification plants must meet certain requirements, such as having an approved carbon dioxide capture and storage plan, in order to claim the credit.

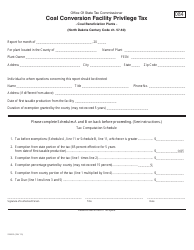

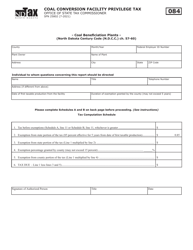

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN25822 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.