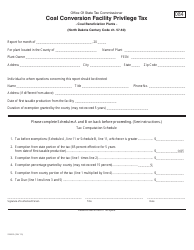

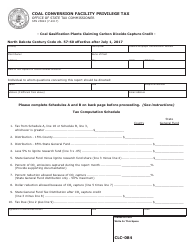

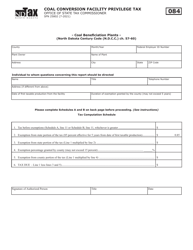

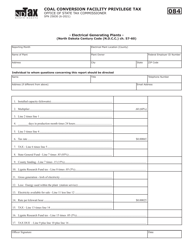

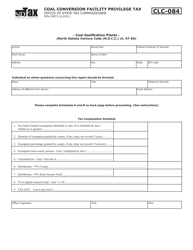

This version of the form is not currently in use and is provided for reference only. Download this version of

Form SFN25831

for the current year.

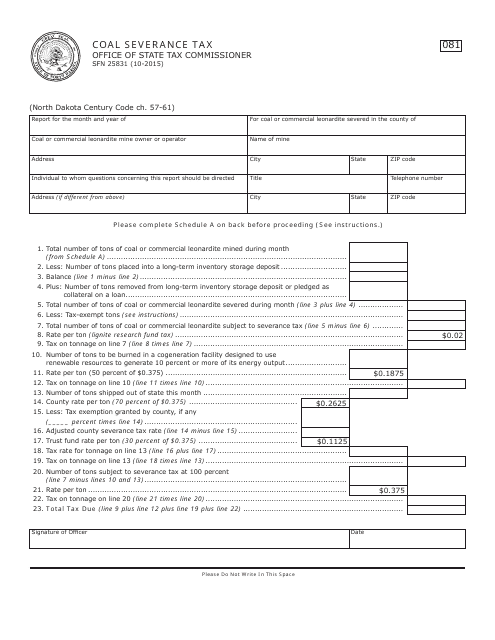

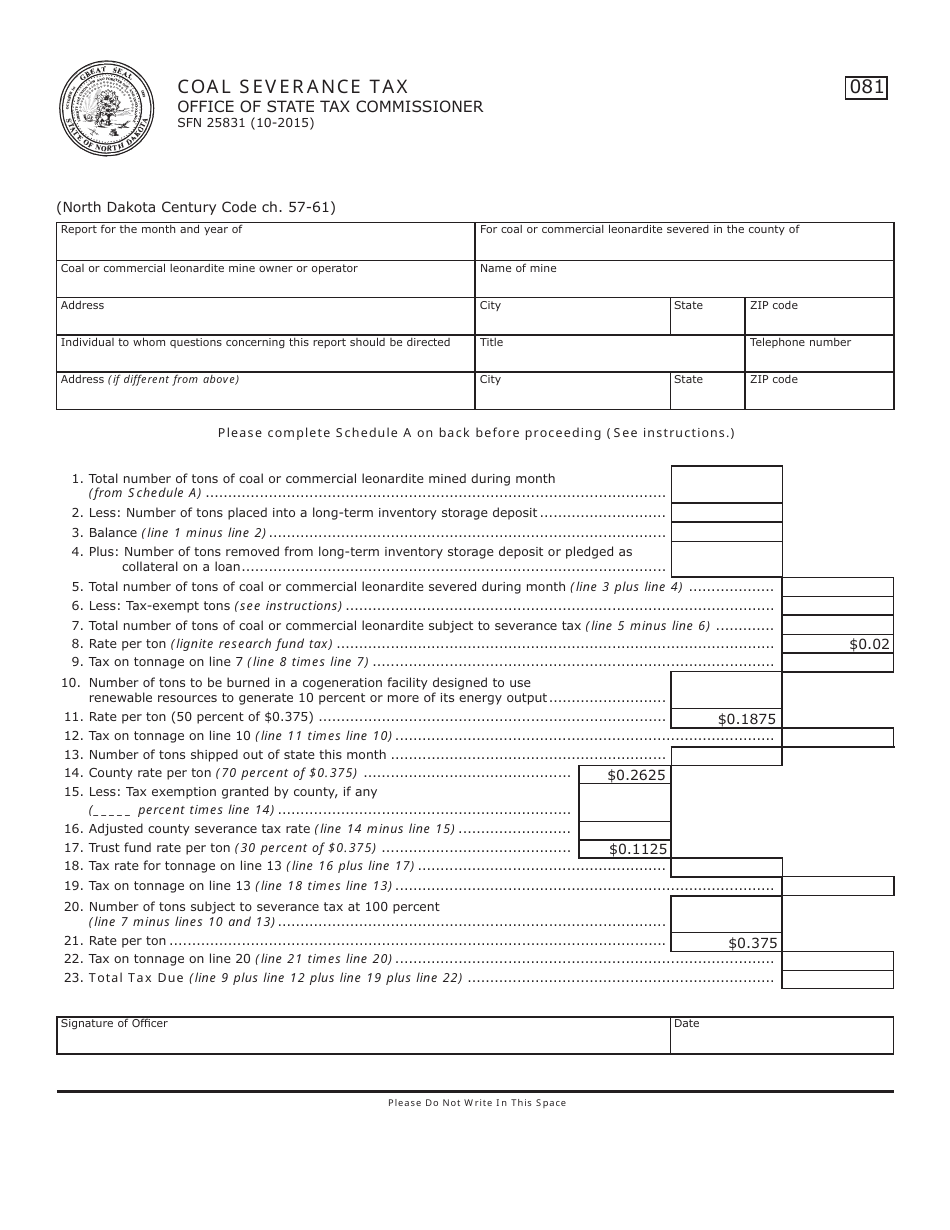

Form SFN25831 Coal Severance Tax - North Dakota

What Is Form SFN25831?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SFN25831 Coal Severance Tax?

A: The SFN25831 Coal Severance Tax is a tax levied on the extraction of coal in North Dakota. It is designed to generate revenue for the state.

Q: Who has to pay the SFN25831 Coal Severance Tax?

A: The tax is paid by coal producers or operators engaged in the extraction of coal in North Dakota.

Q: How is the SFN25831 Coal Severance Tax calculated?

A: The tax is calculated based on the value of coal extracted, which is determined by the gross value at the mine site.

Q: What is the current rate of the SFN25831 Coal Severance Tax?

A: As of [insert date], the current rate of the tax is [insert rate]. However, it is subject to change, so it is best to consult the official documentation for the most up-to-date information.

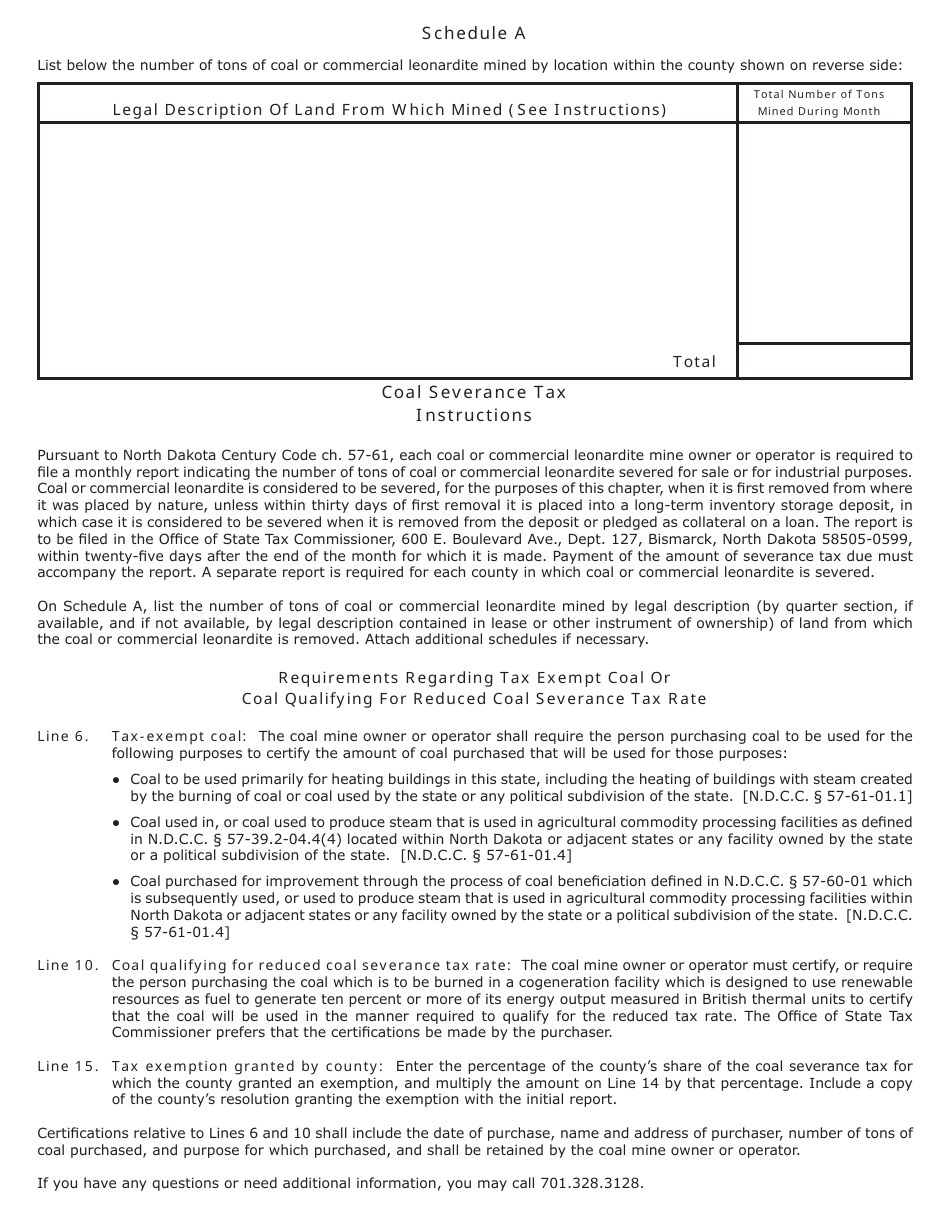

Q: Are there any exemptions or deductions available for the SFN25831 Coal Severance Tax?

A: Yes, there may be exemptions or deductions available for certain circumstances. It is recommended to consult the official documentation or seek professional advice for specific details.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN25831 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.