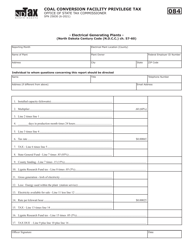

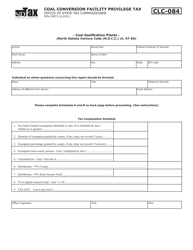

Form 25802 Coal Conversion Facility Privilege Tax - North Dakota

What Is Form 25802?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

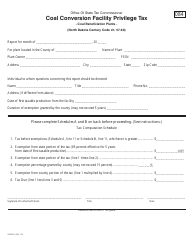

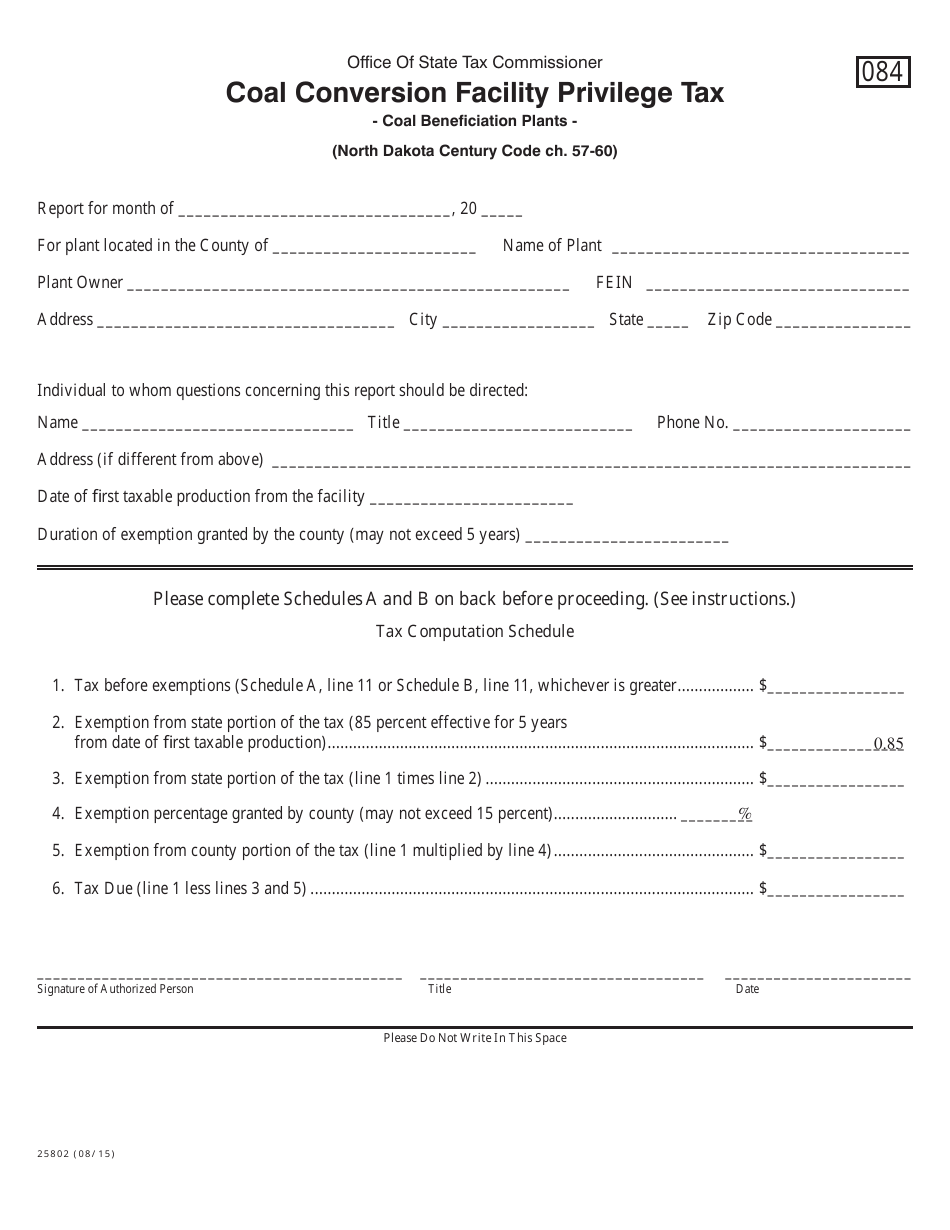

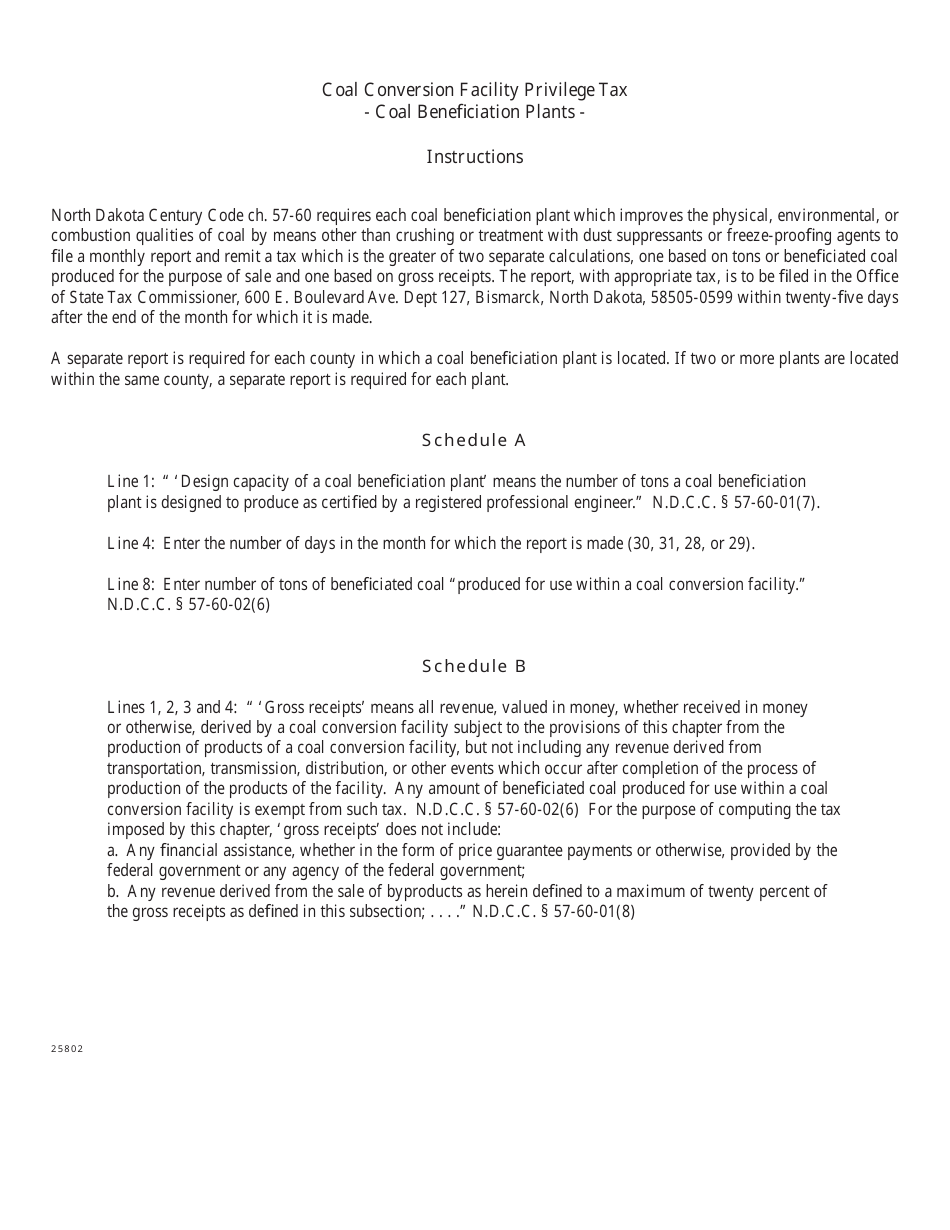

Q: What is Form 25802 Coal Conversion Facility Privilege Tax?

A: Form 25802 is a tax form used by coal conversion facilities in North Dakota to report and pay privilege tax.

Q: Who needs to file Form 25802?

A: Coal conversion facilities in North Dakota are required to file Form 25802 and pay privilege tax.

Q: What is privilege tax?

A: Privilege tax is a tax levied on the privilege of operating a coal conversion facility in North Dakota.

Q: How often is Form 25802 filed?

A: Form 25802 is filed annually by coal conversion facilities in North Dakota.

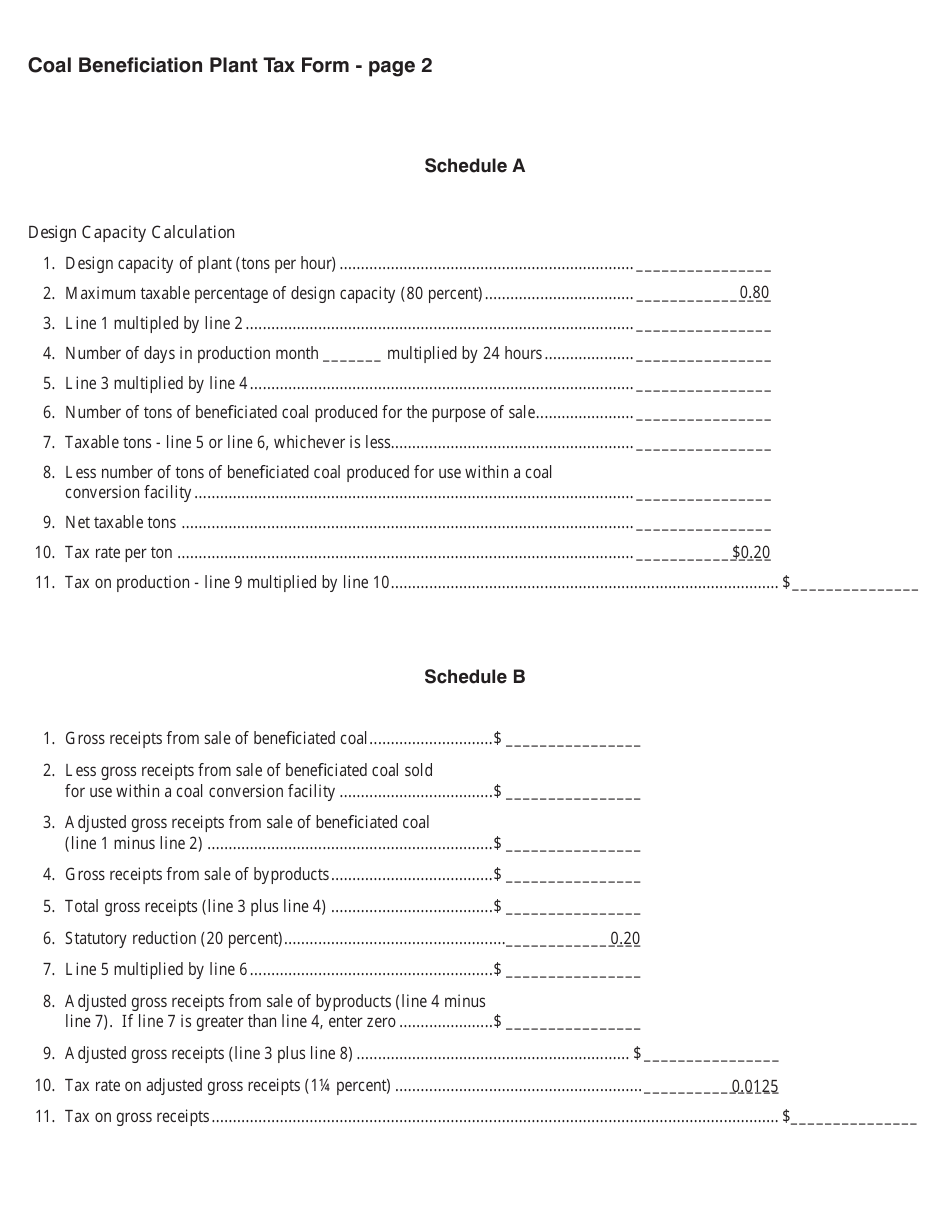

Q: How is the privilege tax calculated?

A: The privilege tax is calculated based on the coal conversion facility's gross receipts from the sale or use of converted coal.

Q: Are there any exemptions or deductions available?

A: There may be certain exemptions or deductions available for coal conversion facilities, which can be found in the instructions for Form 25802.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25802 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.