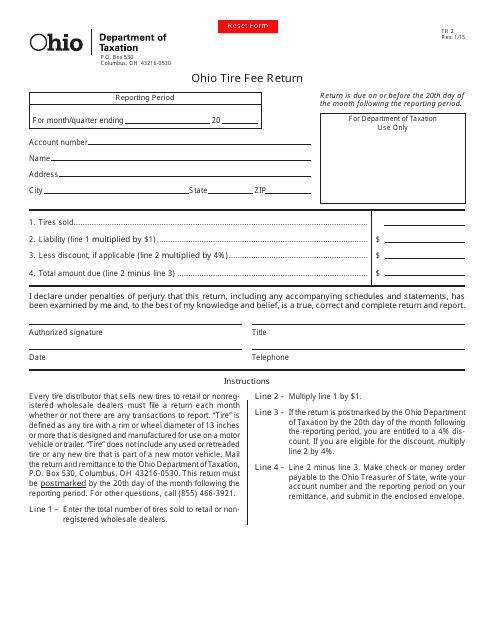

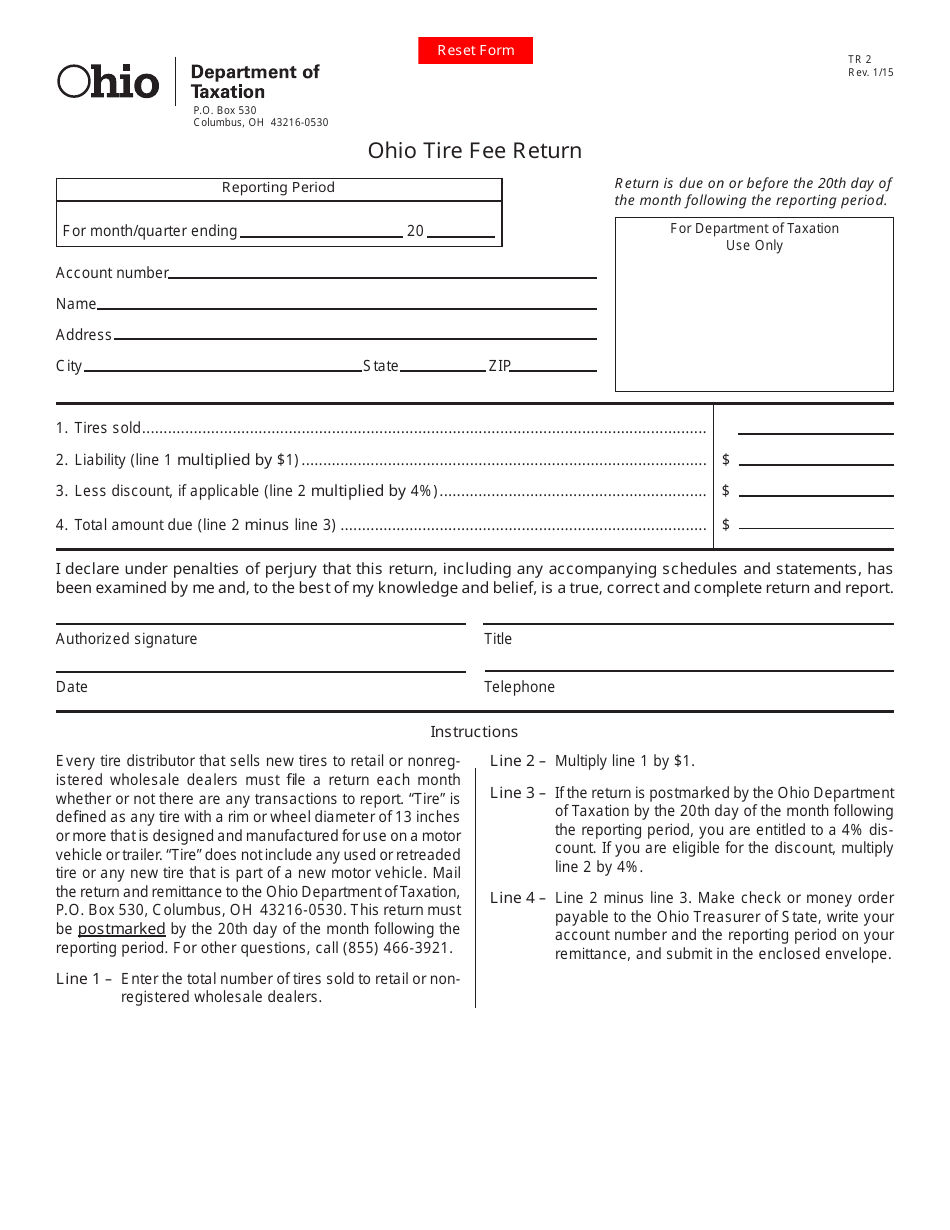

Form TR2 Ohio Tire Fee Return - Ohio

What Is Form TR2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TR2 Ohio Tire Fee Return?

A: Form TR2 Ohio Tire Fee Return is a tax return form used by businesses in Ohio to report and pay the tire fee.

Q: Who needs to file Form TR2 Ohio Tire Fee Return?

A: Businesses in Ohio that sell new tires are required to file Form TR2 Ohio Tire Fee Return.

Q: What is the purpose of the Ohio Tire Fee?

A: The Ohio Tire Fee is used to support the proper disposal and recycling of waste tires in the state.

Q: When is Form TR2 Ohio Tire Fee Return due?

A: Form TR2 Ohio Tire Fee Return is due by the last day of the month following the end of the reporting period.

Q: How do I file Form TR2 Ohio Tire Fee Return?

A: Form TR2 Ohio Tire Fee Return can be filed electronically through the Ohio Business Gateway or by mail.

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment of the Ohio Tire Fee. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.