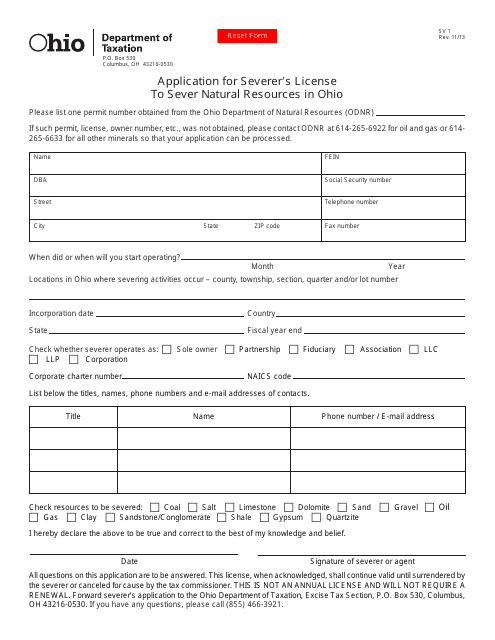

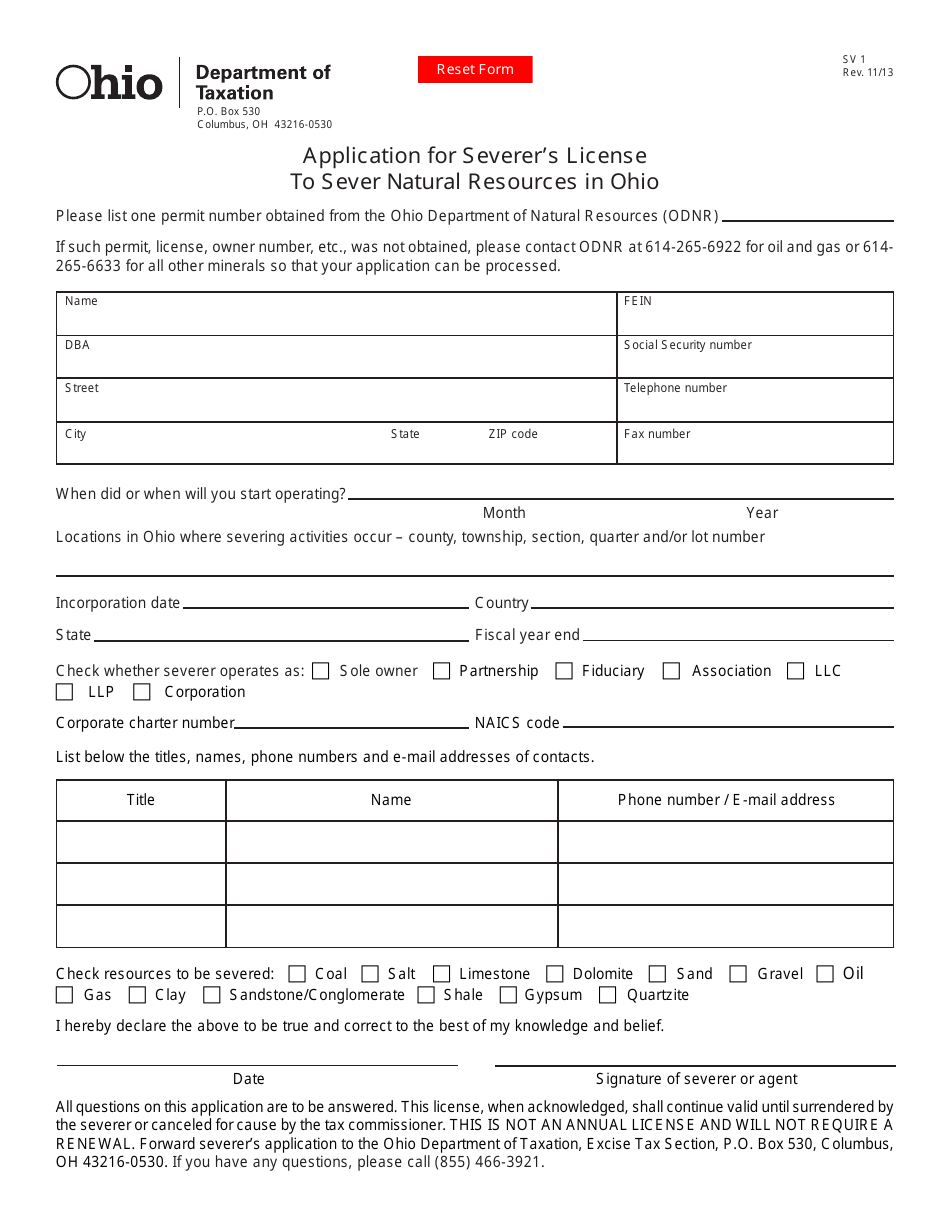

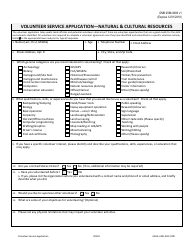

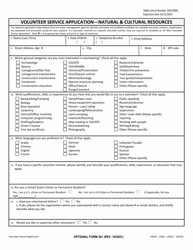

Form SV1 Application for Severer's License to Sever Natural Resources in Ohio - Ohio

What Is Form SV1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SV1 Application?

A: The SV1 Application is a form used to apply for a Severer's License to sever natural resources in Ohio.

Q: What does it mean to sever natural resources?

A: Severing natural resources refers to the extraction or removal of resources such as oil, gas, coal, timber, or other minerals from the earth.

Q: Who needs to fill out the SV1 Application?

A: Anyone who wishes to sever natural resources in Ohio needs to fill out the SV1 Application.

Q: What information is required on the SV1 Application?

A: The SV1 Application requires information such as the applicant's name, contact information, description of the resource to be severed, location of the severing operation, and supporting documentation.

Q: Are there any fees associated with the SV1 Application?

A: Yes, there are fees associated with the SV1 Application. The specific fees depend on the type and size of the severing operation.

Q: How long does it take to process the SV1 Application?

A: The processing time for the SV1 Application varies depending on the complexity of the application and the workload of the Division of Oil and Gas Resources Management.

Q: Are there any regulations or requirements for severing natural resources in Ohio?

A: Yes, there are regulations and requirements for severing natural resources in Ohio. These include compliance with environmental regulations, obtaining necessary permits, and following best practices for resource extraction.

Q: Can I appeal if my SV1 Application is denied?

A: Yes, you have the right to appeal if your SV1 Application is denied. The process for appeal may vary, so it's best to consult with the Division of Oil and Gas Resources Management for specific instructions.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SV1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.