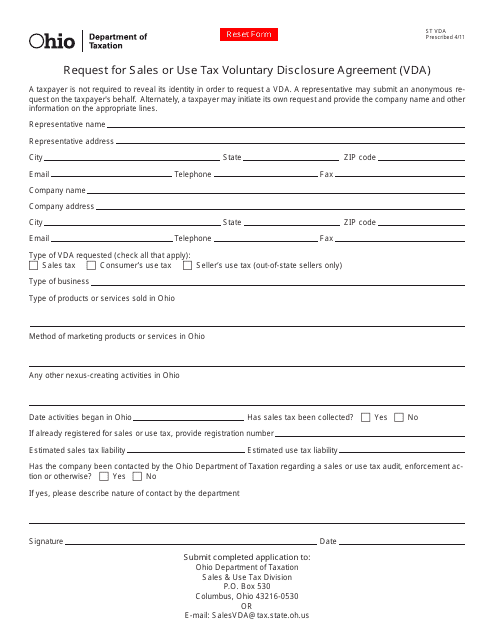

Form ST VDA Request for Sales or Use Tax Voluntary Disclosure Agreement (Vda) - Ohio

What Is Form ST VDA?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

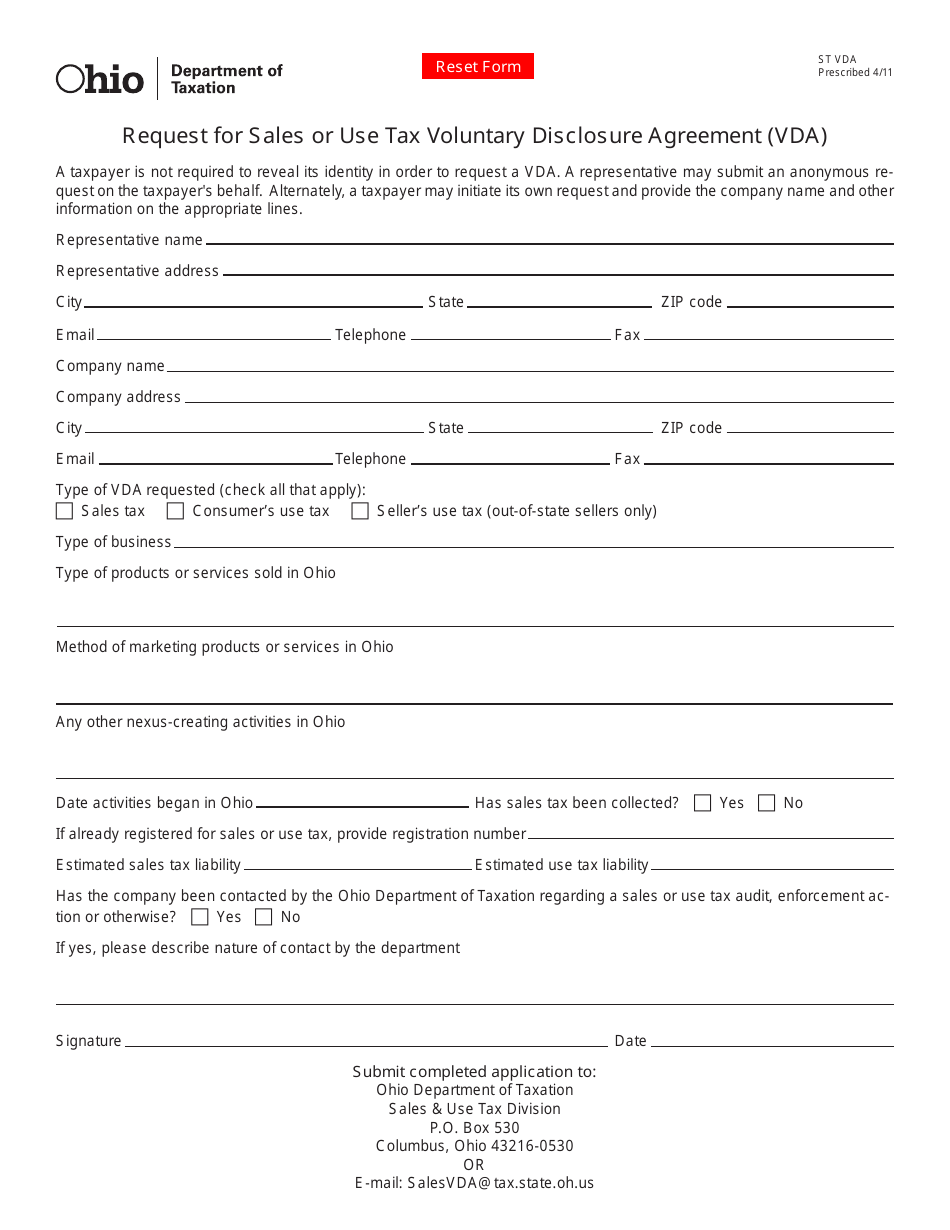

Q: What is a Sales or Use TaxVoluntary Disclosure Agreement (Vda)?

A: A Sales or Use Tax Voluntary Disclosure Agreement (Vda) is a program in Ohio that allows taxpayers to voluntarily come forward and disclose any unpaid sales or use tax liabilities.

Q: Who can request a Sales or Use Tax Voluntary Disclosure Agreement (Vda) in Ohio?

A: Any taxpayer who has not previously been contacted by the Ohio Department of Taxation for sales or use tax liabilities can request a Vda.

Q: What are the benefits of participating in a Sales or Use Tax Voluntary Disclosure Agreement (Vda) in Ohio?

A: By participating in a Vda, taxpayers can avoid penalties and potentially reduce the amount of interest owed on any unpaid sales or use tax liabilities.

Q: How do I request a Sales or Use Tax Voluntary Disclosure Agreement (Vda) in Ohio?

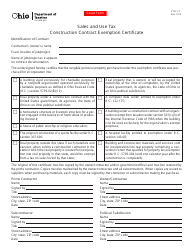

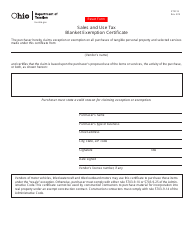

A: To request a Vda in Ohio, taxpayers need to complete and submit Form ST VDA Request for Sales or Use Tax Voluntary Disclosure Agreement (Vda) to the Ohio Department of Taxation.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST VDA by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.