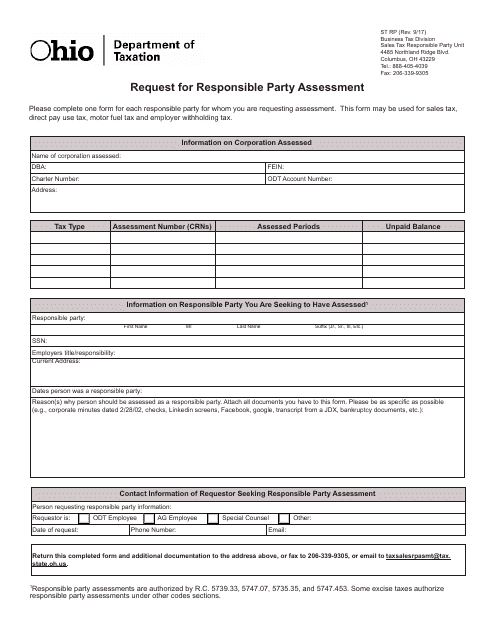

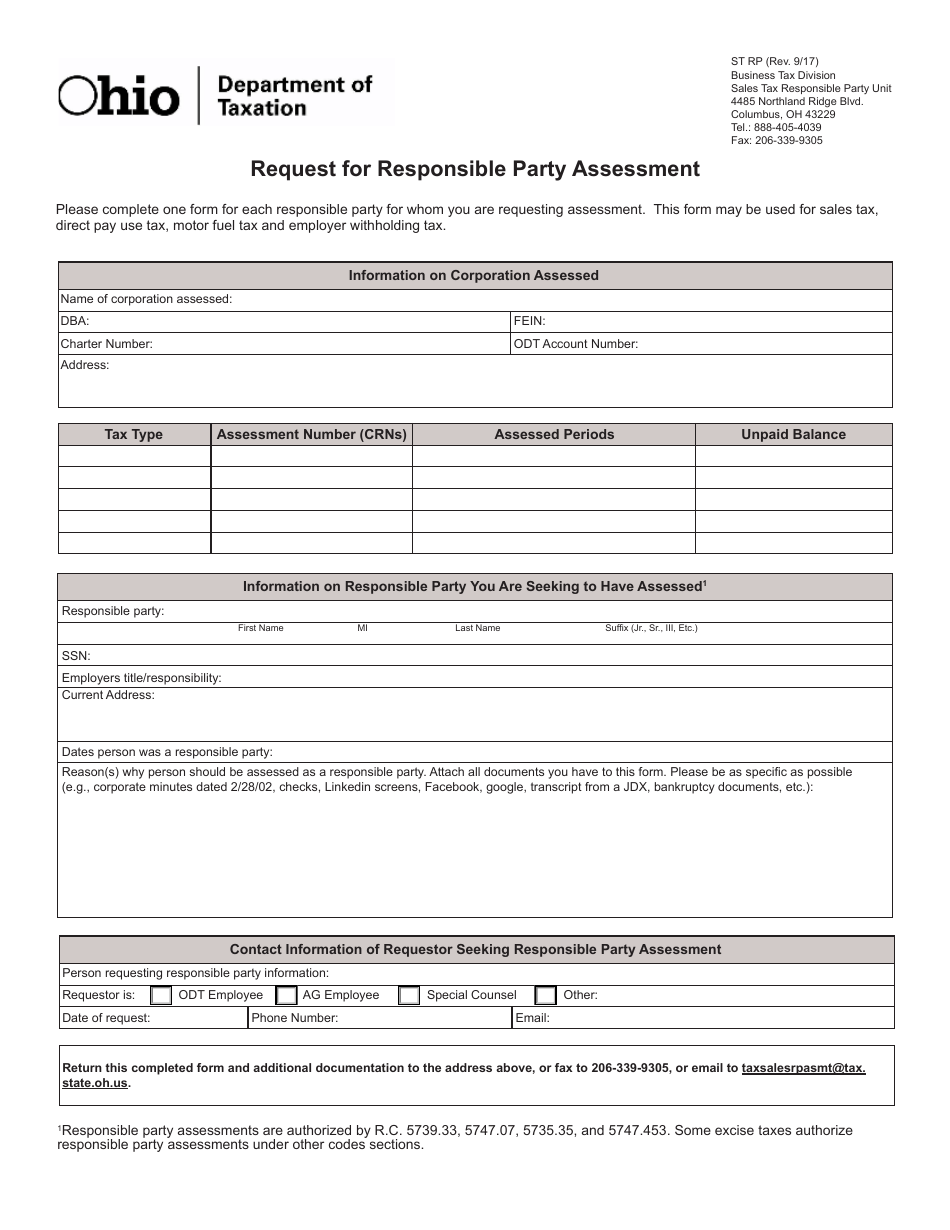

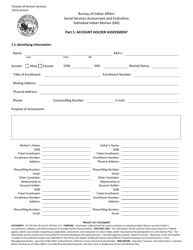

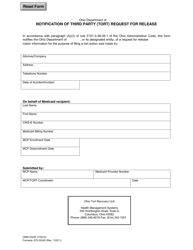

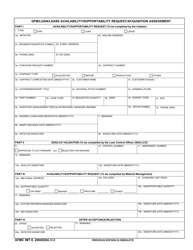

Form ST RP Request for Responsible Party Assessment - Ohio

What Is Form ST RP?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST RP?

A: Form ST RP is the Request for Responsible Party Assessment.

Q: What is the purpose of Form ST RP?

A: The purpose of Form ST RP is to request an assessment of responsible party status in Ohio.

Q: Who needs to fill out Form ST RP?

A: Anyone who wants to request an assessment of responsible party status in Ohio needs to fill out Form ST RP.

Q: Is there a fee for filing Form ST RP?

A: Yes, there is a fee for filing Form ST RP. The current fee is listed on the form itself.

Q: What happens after I submit Form ST RP?

A: After you submit Form ST RP, the Ohio Department of Taxation will review your request and notify you of their decision.

Q: Can I appeal the decision made by the Ohio Department of Taxation?

A: Yes, you can appeal the decision made by the Ohio Department of Taxation if you disagree with their assessment of responsible party status. Instructions forfiling an appeal are included with the decision letter.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST RP by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.