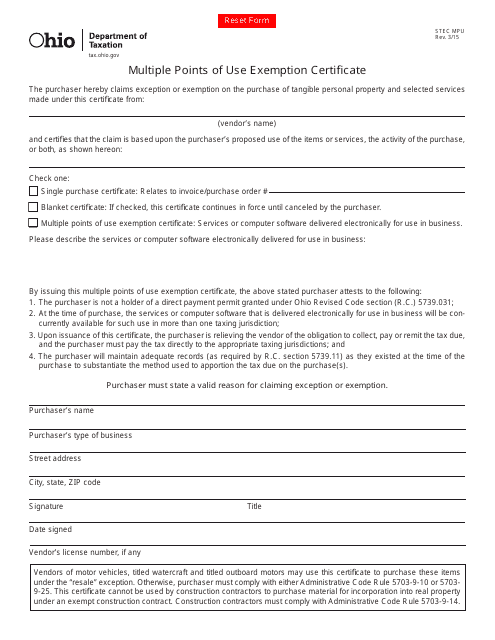

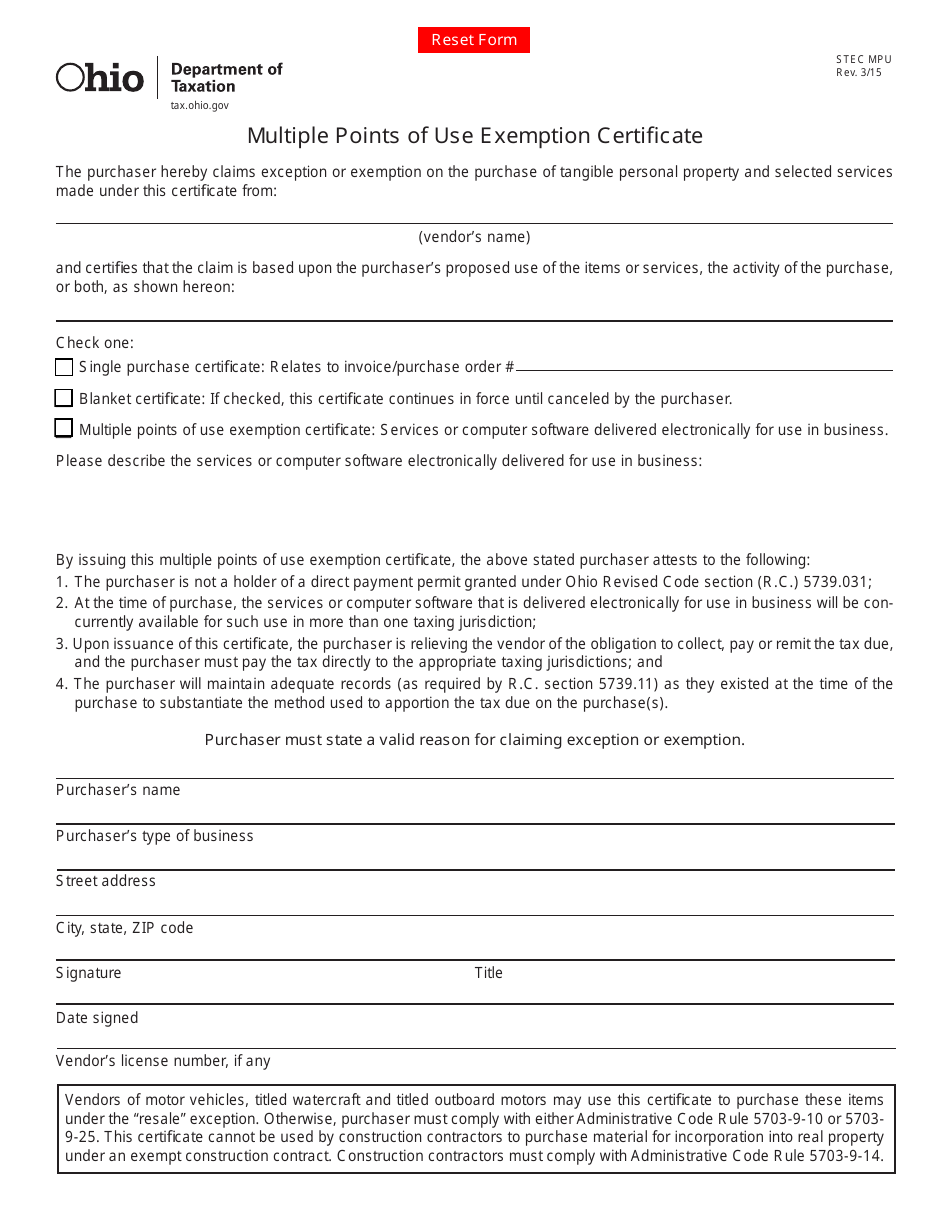

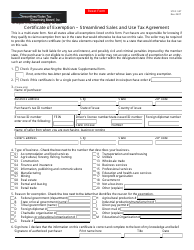

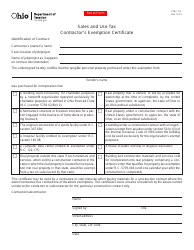

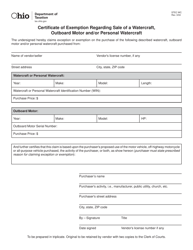

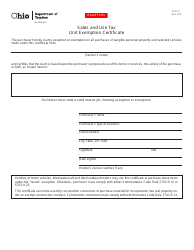

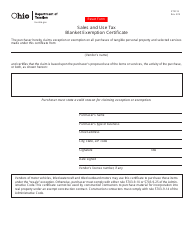

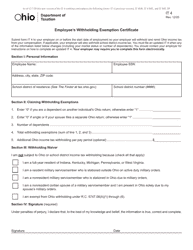

Form STEC MPU Multiple Points of Use Exemption Certificate - Ohio

What Is Form STEC MPU?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a STEC MPU Multiple Points of Use Exemption Certificate?

A: The STEC MPU Multiple Points of Use Exemption Certificate is a form used in Ohio to claim exemptions from state sales tax for purchases made for multiple points of use.

Q: Who can use the STEC MPU Multiple Points of Use Exemption Certificate?

A: Businesses and individuals who are registered vendors in Ohio can use this form to claim sales tax exemptions.

Q: What is the purpose of the STEC MPU Multiple Points of Use Exemption Certificate?

A: The purpose of this form is to allow businesses and individuals to claim sales tax exemptions on purchases made for multiple points of use.

Q: What is an exemption from state sales tax?

A: An exemption from state sales tax means that a particular purchase is not subject to the usual sales tax rate.

Q: How do I fill out the STEC MPU Multiple Points of Use Exemption Certificate?

A: To fill out this form, you will need to provide your business information, purchase information, and details of the intended multiple points of use.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STEC MPU by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.