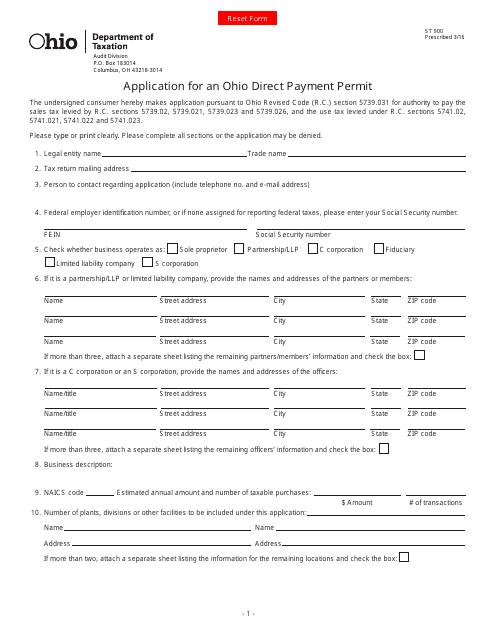

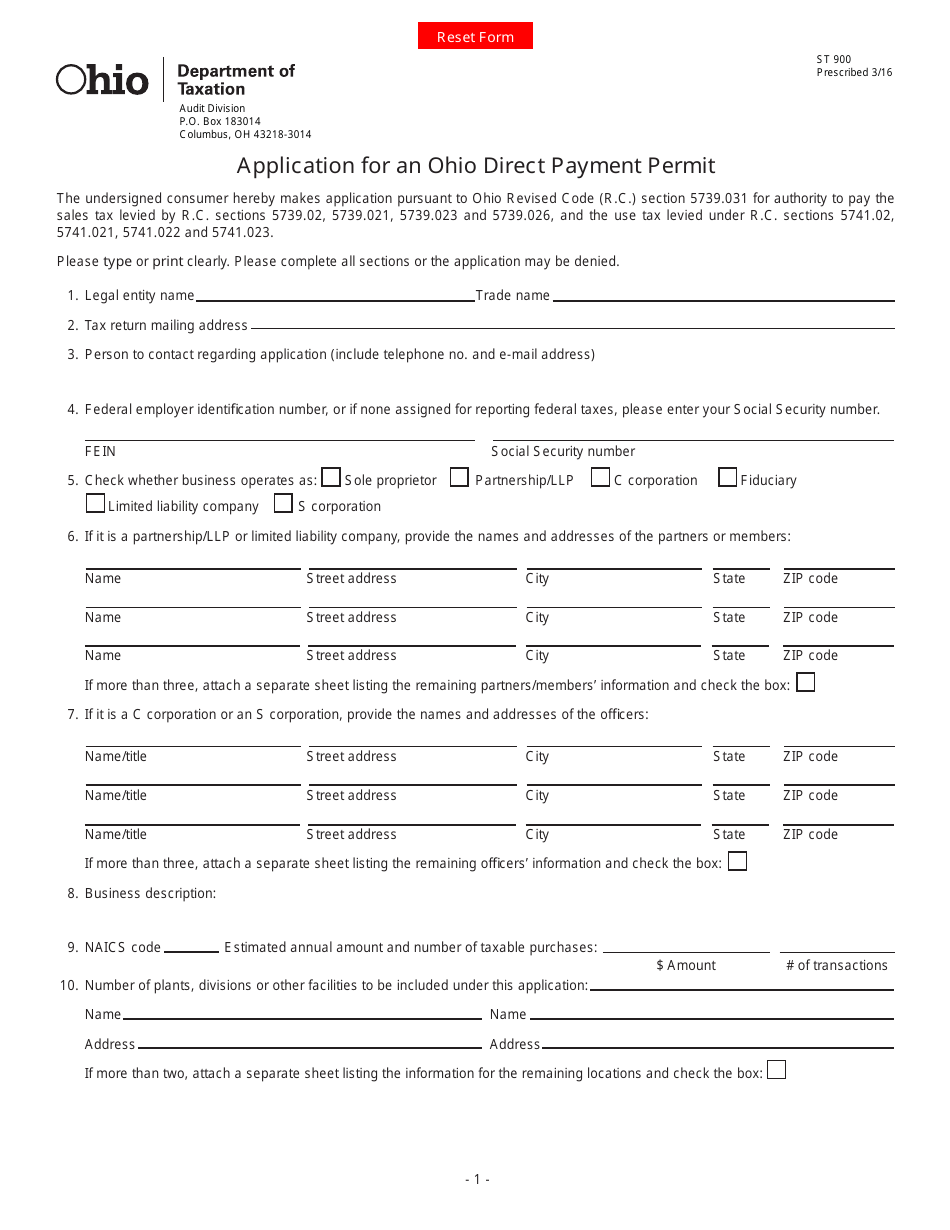

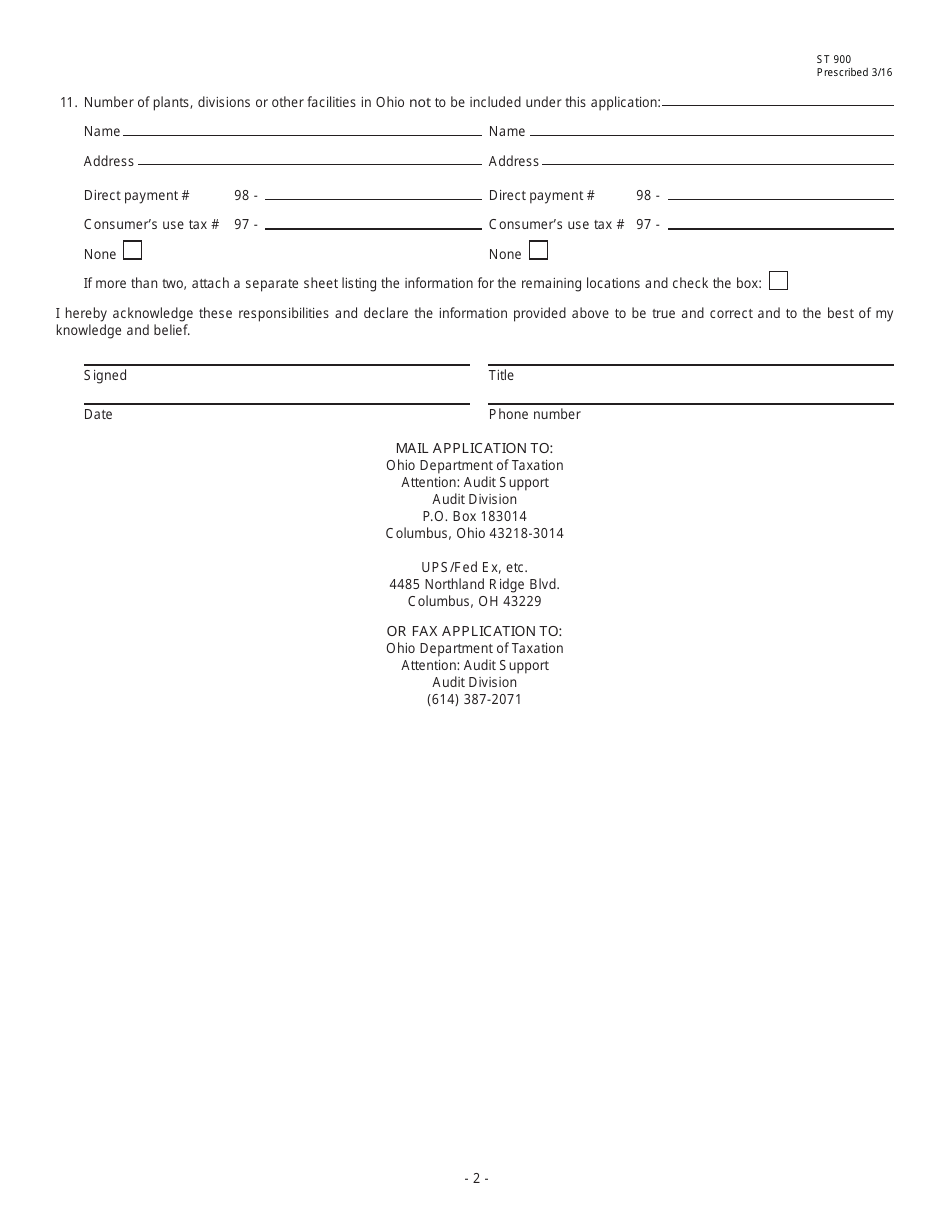

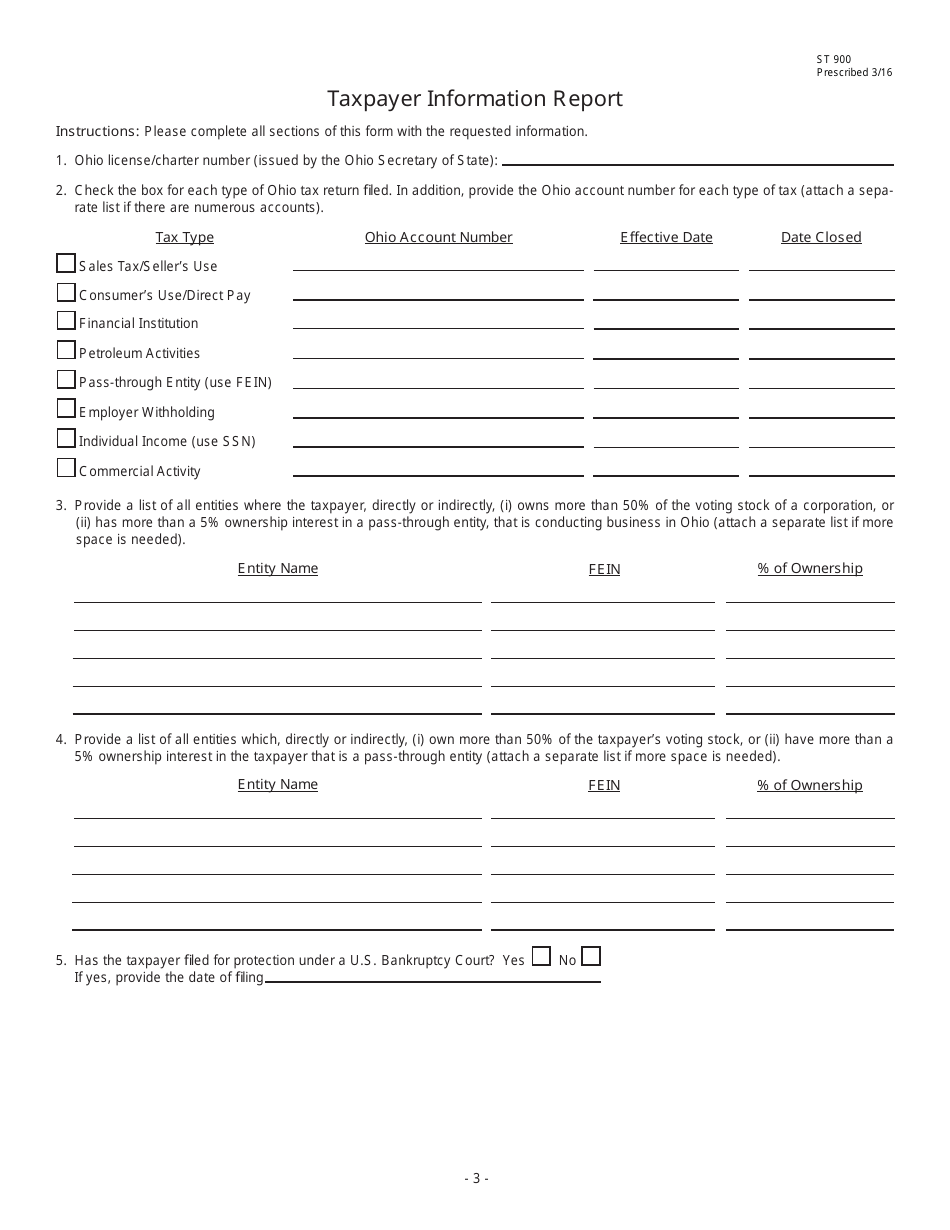

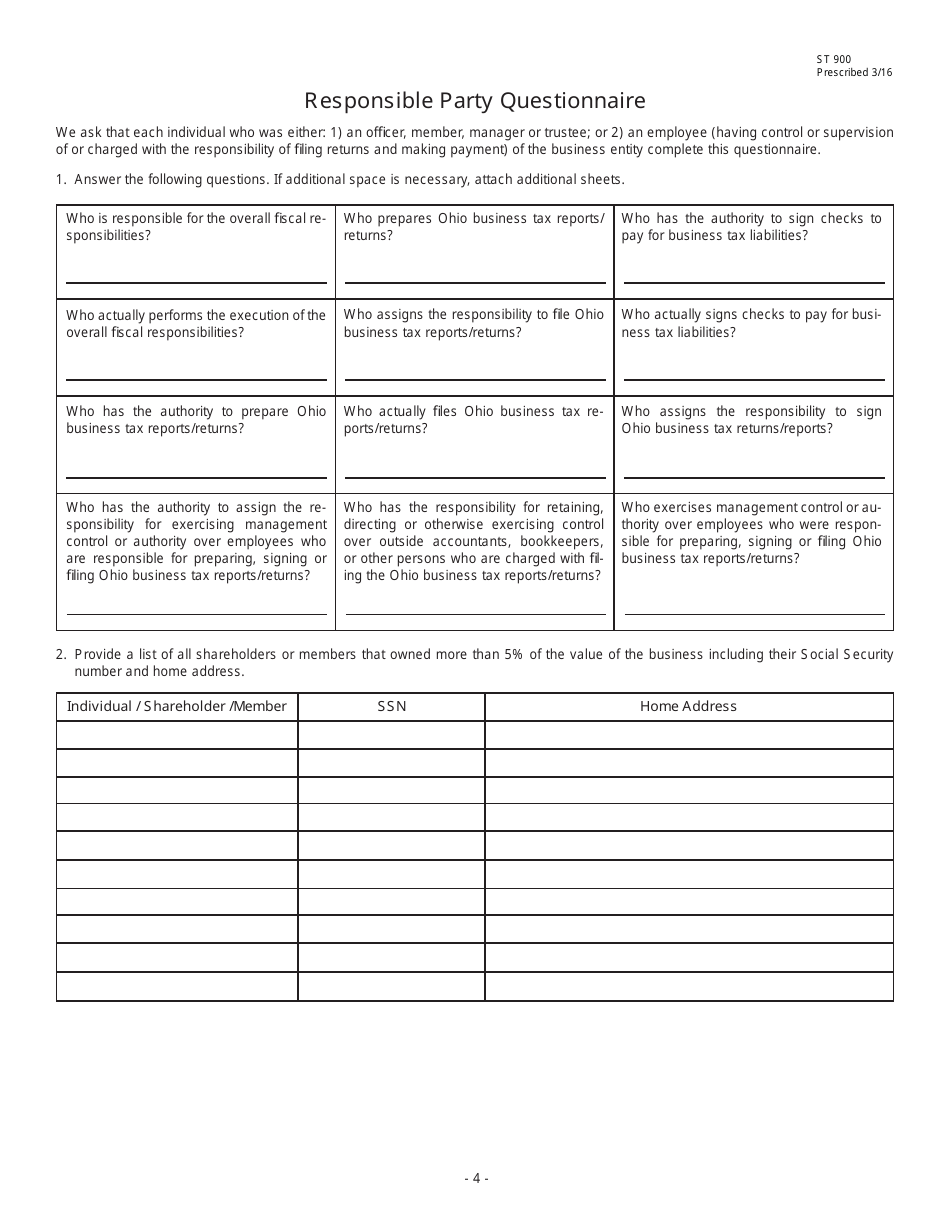

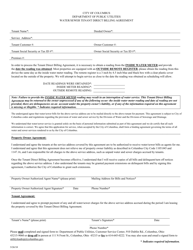

Form ST900 Application for an Ohio Direct Payment Permit - Ohio

What Is Form ST900?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST900?

A: Form ST900 is the application for an Ohio Direct Payment Permit.

Q: What is an Ohio Direct Payment Permit?

A: An Ohio Direct Payment Permit allows businesses to purchase taxable items without paying sales tax at the time of purchase.

Q: Who should use Form ST900?

A: Businesses that want to apply for an Ohio Direct Payment Permit should use Form ST900.

Q: How do I fill out Form ST900?

A: You need to provide your business information, including your name, address, and FEIN (Federal Employer Identification Number), and answer a series of questions about your business activities.

Q: Is there a fee to apply for an Ohio Direct Payment Permit?

A: No, there is no fee to apply for an Ohio Direct Payment Permit.

Q: How long does it take to get an Ohio Direct Payment Permit?

A: It typically takes 4-6 weeks for the Ohio Department of Taxation to process an application for an Ohio Direct Payment Permit.

Q: How often do I need to renew my Ohio Direct Payment Permit?

A: Ohio Direct Payment Permits are valid for two years and need to be renewed before they expire.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST900 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.