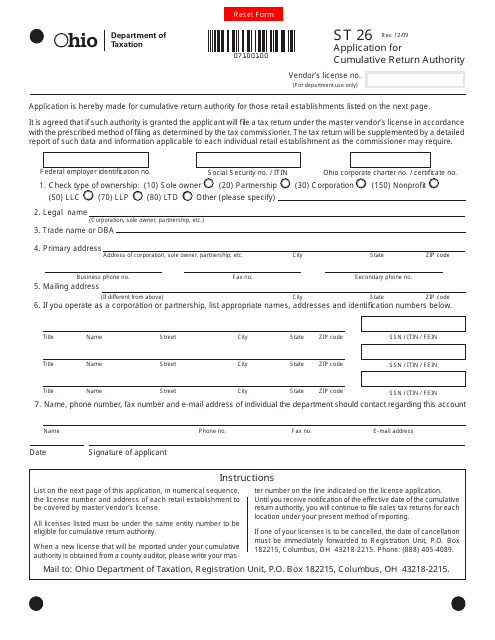

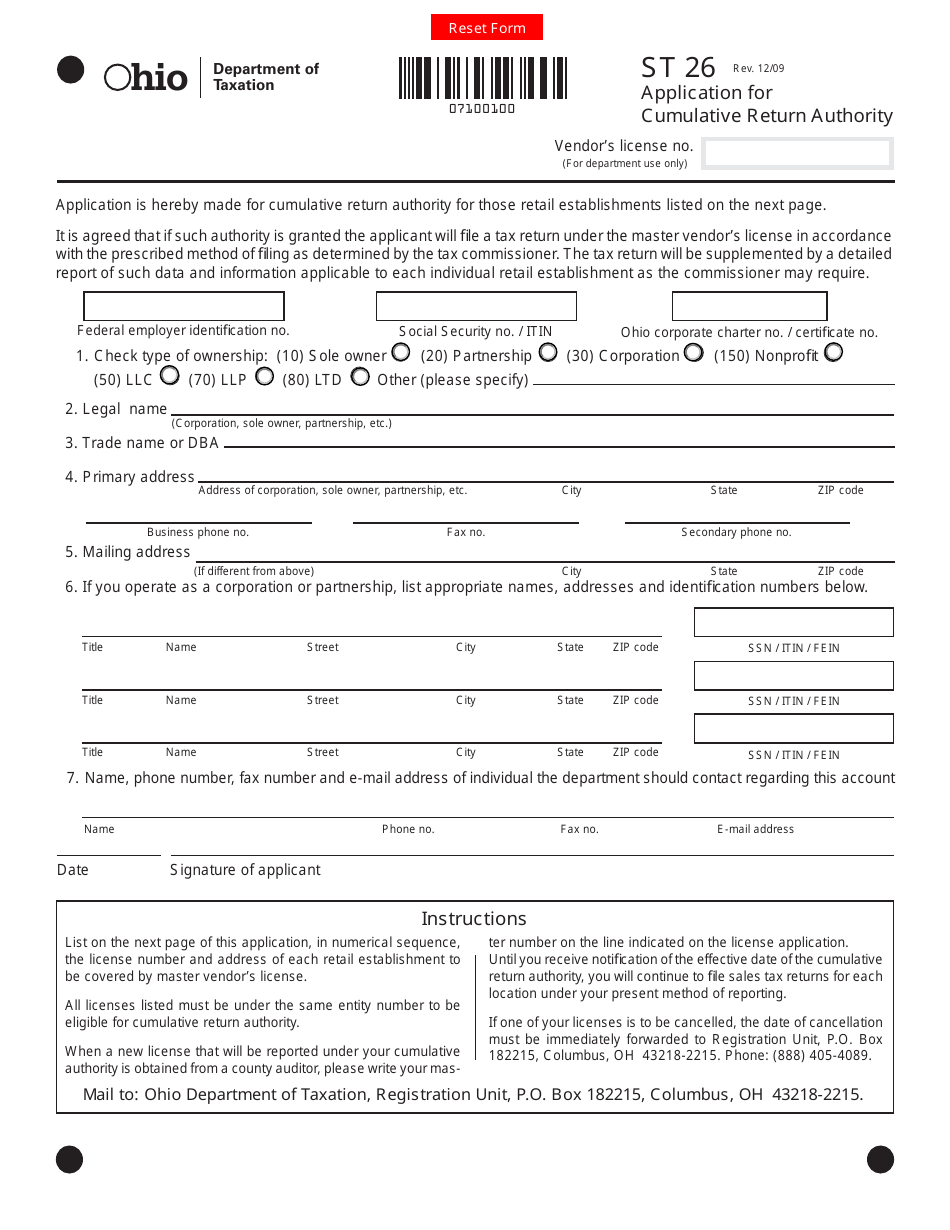

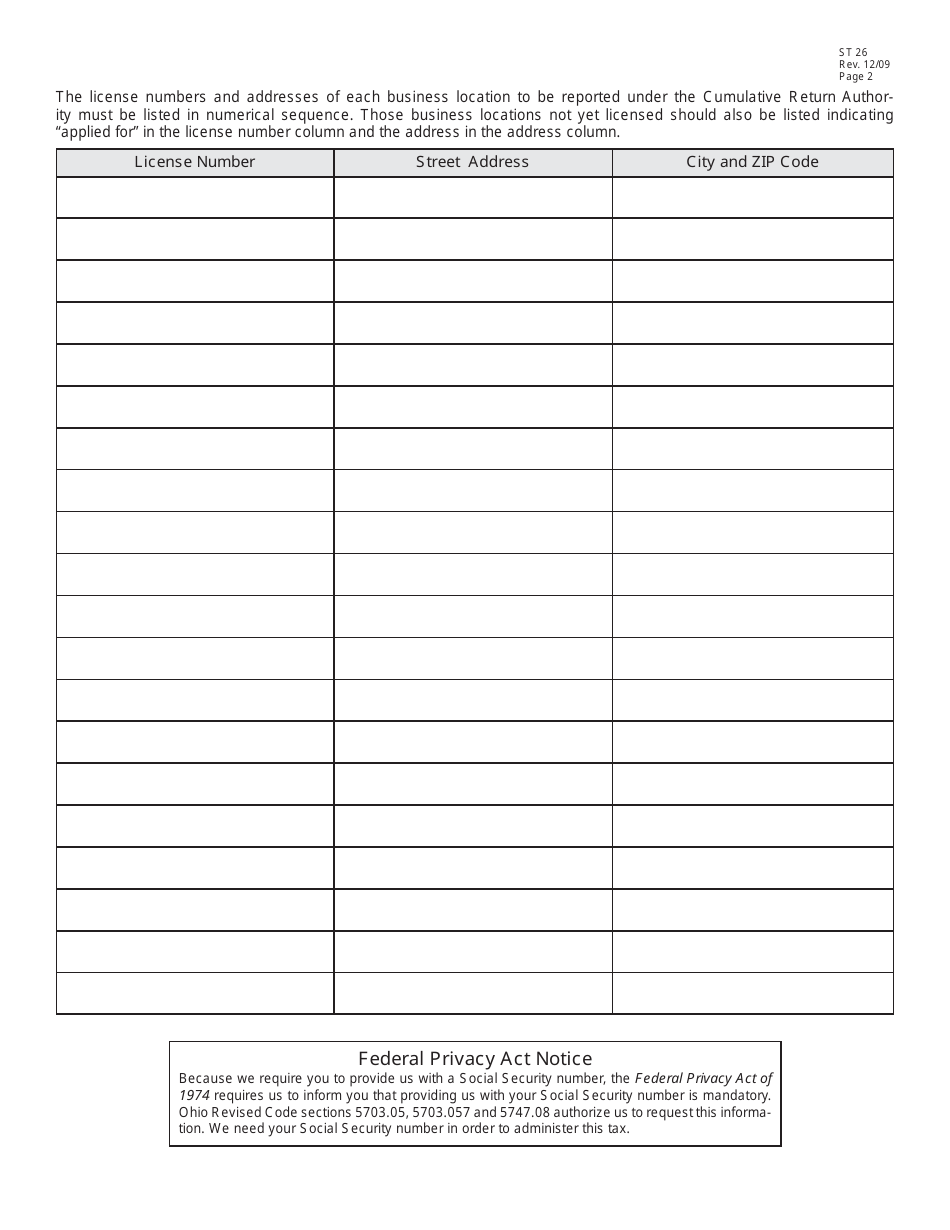

Form ST26 Application for Cumulative Return Authority - Ohio

What Is Form ST26?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST26?

A: Form ST26 is the Application for Cumulative Return Authority in Ohio.

Q: What is the purpose of Form ST26?

A: The purpose of Form ST26 is to apply for Cumulative Return Authority in Ohio.

Q: Who needs to file Form ST26?

A: Any person or entity engaged in selling tangible personal property at retail in Ohio needs to file Form ST26.

Q: What is Cumulative Return Authority?

A: Cumulative Return Authority allows businesses to report sales tax on a monthly basis instead of quarterly in Ohio.

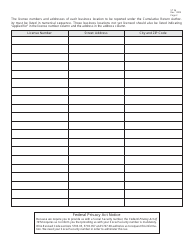

Q: What information is required on Form ST26?

A: Form ST26 requires information about the business, its sales activities, and other related details.

Q: Are there any fees associated with filing Form ST26?

A: No, there are no fees associated with filing Form ST26 in Ohio.

Q: When should Form ST26 be filed?

A: Form ST26 should be filed at least 30 days before the reporting period for which Cumulative Return Authority is requested.

Q: What are the benefits of Cumulative Return Authority?

A: Cumulative Return Authority allows businesses to remit sales tax on a monthly basis, which can help with cash flow management and reduce the potential for penalties or interest.

Q: Can Form ST26 be filed electronically?

A: Yes, Form ST26 can be filed electronically through the Ohio Business Gateway.

Q: Is Form ST26 applicable only to businesses in Ohio?

A: Yes, Form ST26 is specifically for businesses operating in Ohio.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST26 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.