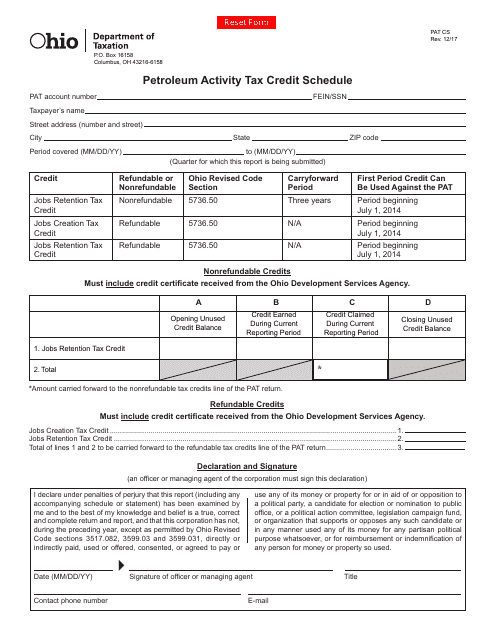

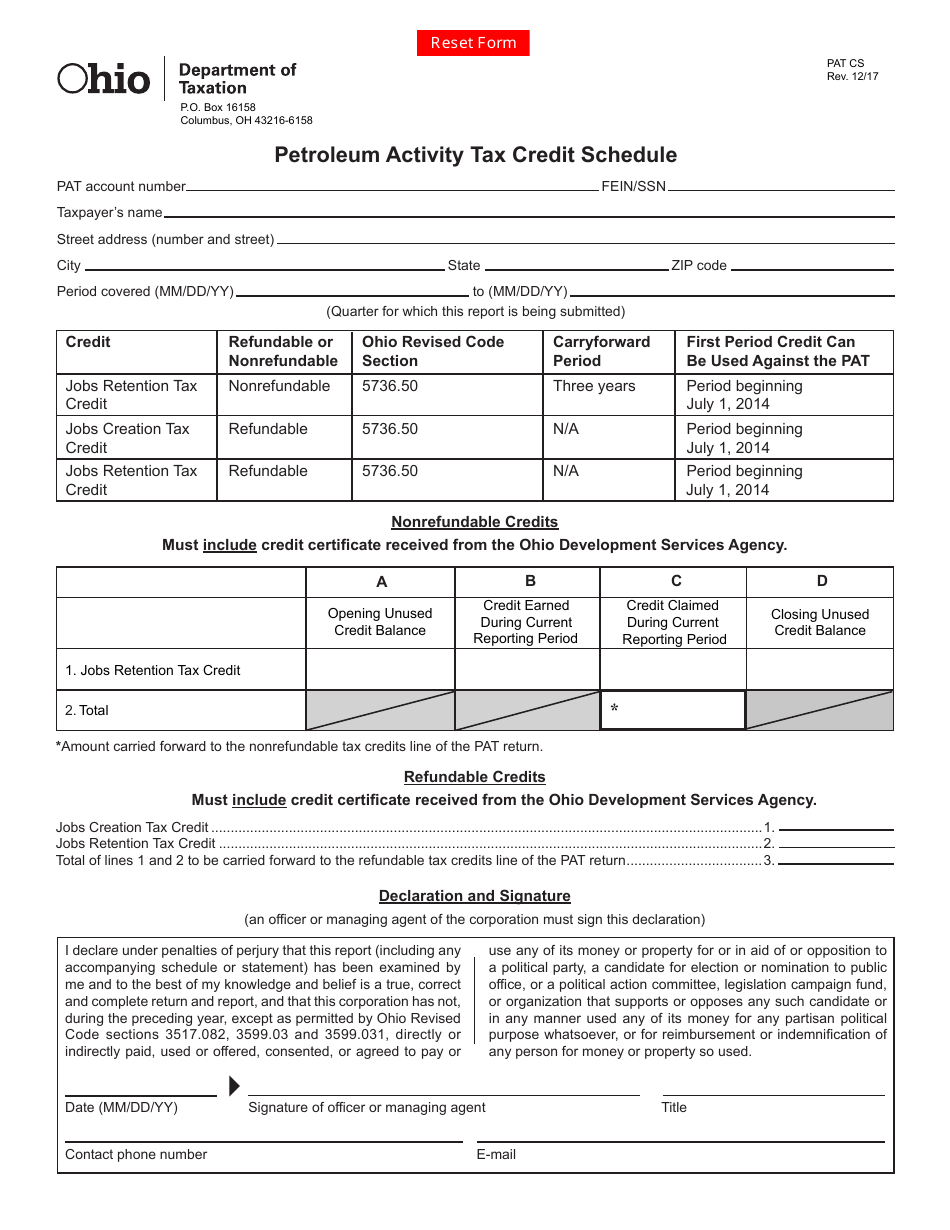

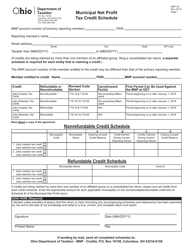

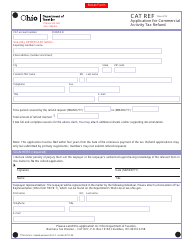

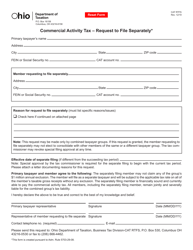

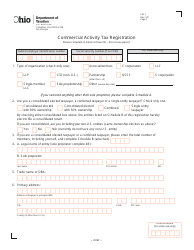

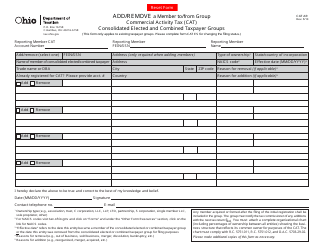

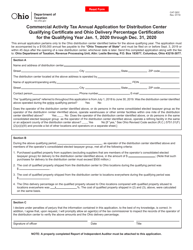

Form PAT CS Petroleum Activity Tax Credit Schedule - Ohio

What Is Form PAT CS?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PAT CS Petroleum Activity Tax Credit Schedule?

A: The PAT CS Petroleum Activity Tax Credit Schedule is a form used in Ohio to claim tax credits related to petroleum activities.

Q: Who needs to file the PAT CS Petroleum Activity Tax Credit Schedule?

A: Individuals and businesses engaged in petroleum activities in Ohio may need to file the PAT CS Petroleum Activity Tax Credit Schedule.

Q: What types of tax credits can be claimed on the PAT CS Petroleum Activity Tax Credit Schedule?

A: The PAT CS Petroleum Activity Tax Credit Schedule allows for the claiming of tax credits related to petroleum activities, such as well drilling and extracting oil and gas.

Q: When is the deadline to file the PAT CS Petroleum Activity Tax Credit Schedule?

A: The deadline to file the PAT CS Petroleum Activity Tax Credit Schedule in Ohio is typically the same as the deadline for filing the annual income tax return, which is April 15th for most individuals.

Q: Are there any specific requirements or qualifications to claim tax credits on the PAT CS Petroleum Activity Tax Credit Schedule?

A: Yes, there may be specific requirements or qualifications to claim tax credits on the PAT CS Petroleum Activity Tax Credit Schedule. It is important to review the instructions and guidelines provided with the form or consult with a tax professional for further guidance.

Q: What should I do if I have questions or need assistance with the PAT CS Petroleum Activity Tax Credit Schedule?

A: If you have questions or need assistance with the PAT CS Petroleum Activity Tax Credit Schedule, you can contact the Ohio Department of Taxation for guidance and support.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PAT CS by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.