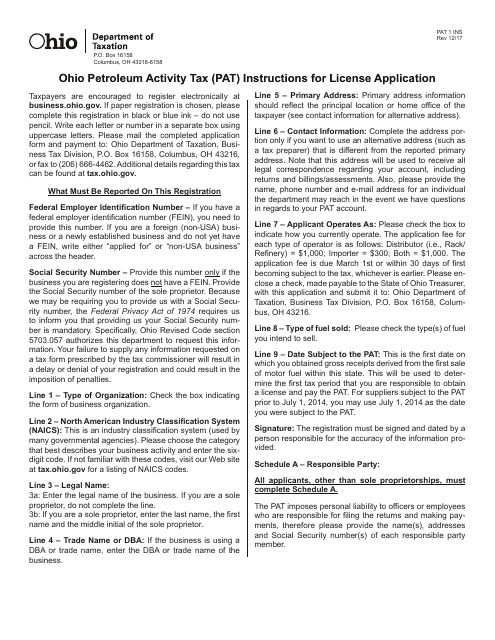

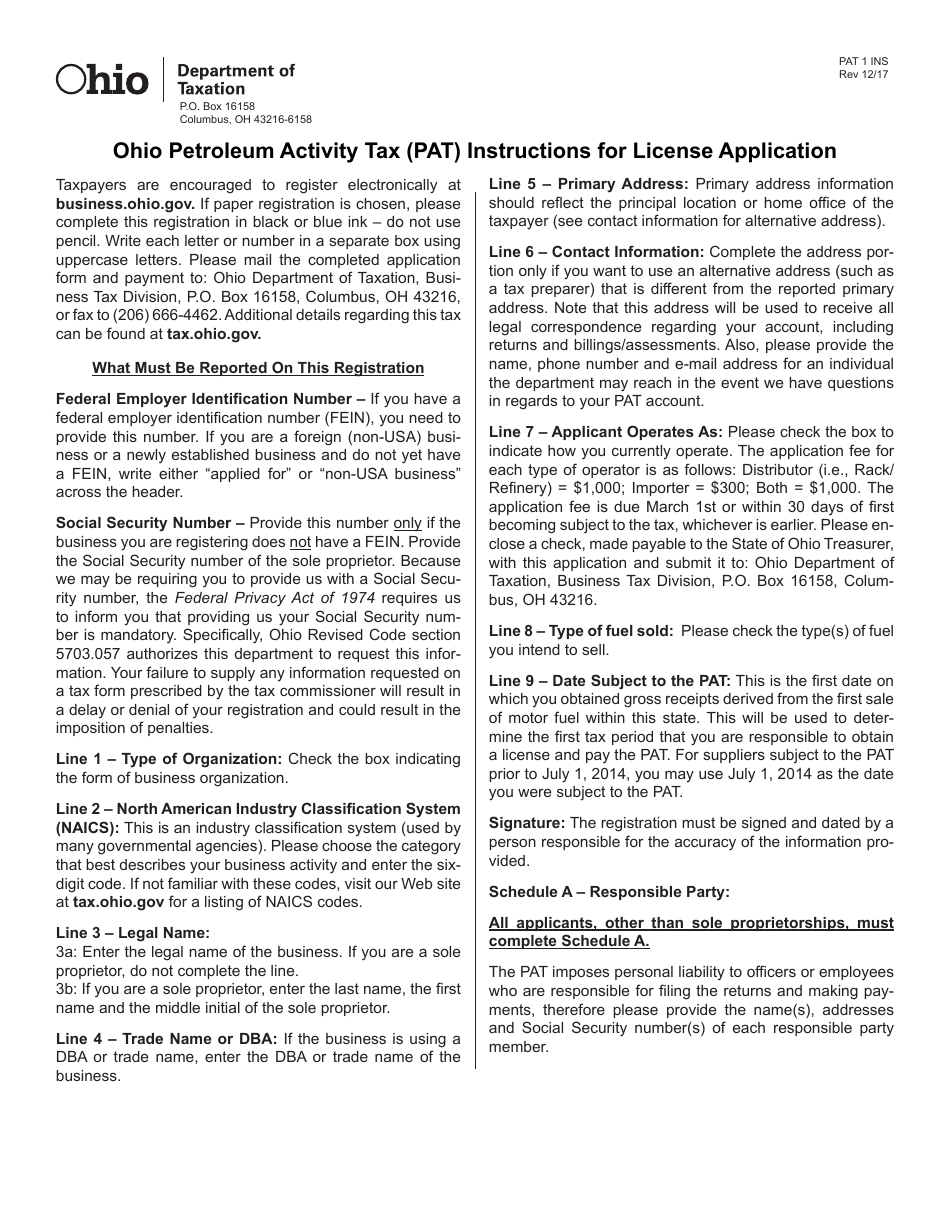

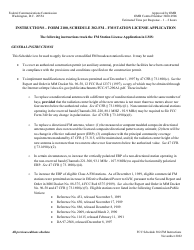

Instructions for Form PAT1 Petroleum Activity Tax Supplier's License Application - Ohio

This document contains official instructions for Form PAT1 , Petroleum Activity Tax Supplier's License Application - a form released and collected by the Ohio Department of Taxation.

FAQ

Q: What is Form PAT1?

A: Form PAT1 is the Petroleum Activity Tax Supplier's License Application for Ohio.

Q: Who needs to fill out Form PAT1?

A: Anyone applying for a Petroleum Activity Tax Supplier's License in Ohio needs to fill out Form PAT1.

Q: What is the purpose of Form PAT1?

A: The purpose of Form PAT1 is to apply for a Petroleum Activity Tax Supplier's License in Ohio.

Q: What information do I need to provide on Form PAT1?

A: You will need to provide basic information about your business, such as its name, address, and federal employer identification number (FEIN). You will also need to provide details about your petroleum activity in Ohio.

Q: When should I submit Form PAT1?

A: Form PAT1 should be submitted prior to engaging in any petroleum activity in Ohio. It is recommended to submit the application well in advance to allow for processing time.

Q: Are there any penalties for not submitting Form PAT1?

A: Yes, failure to submit Form PAT1 or engage in petroleum activity without a valid license may result in penalties, including fines and legal repercussions.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.