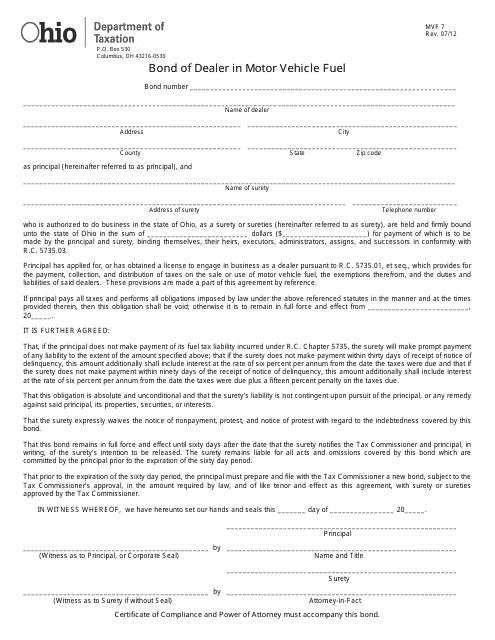

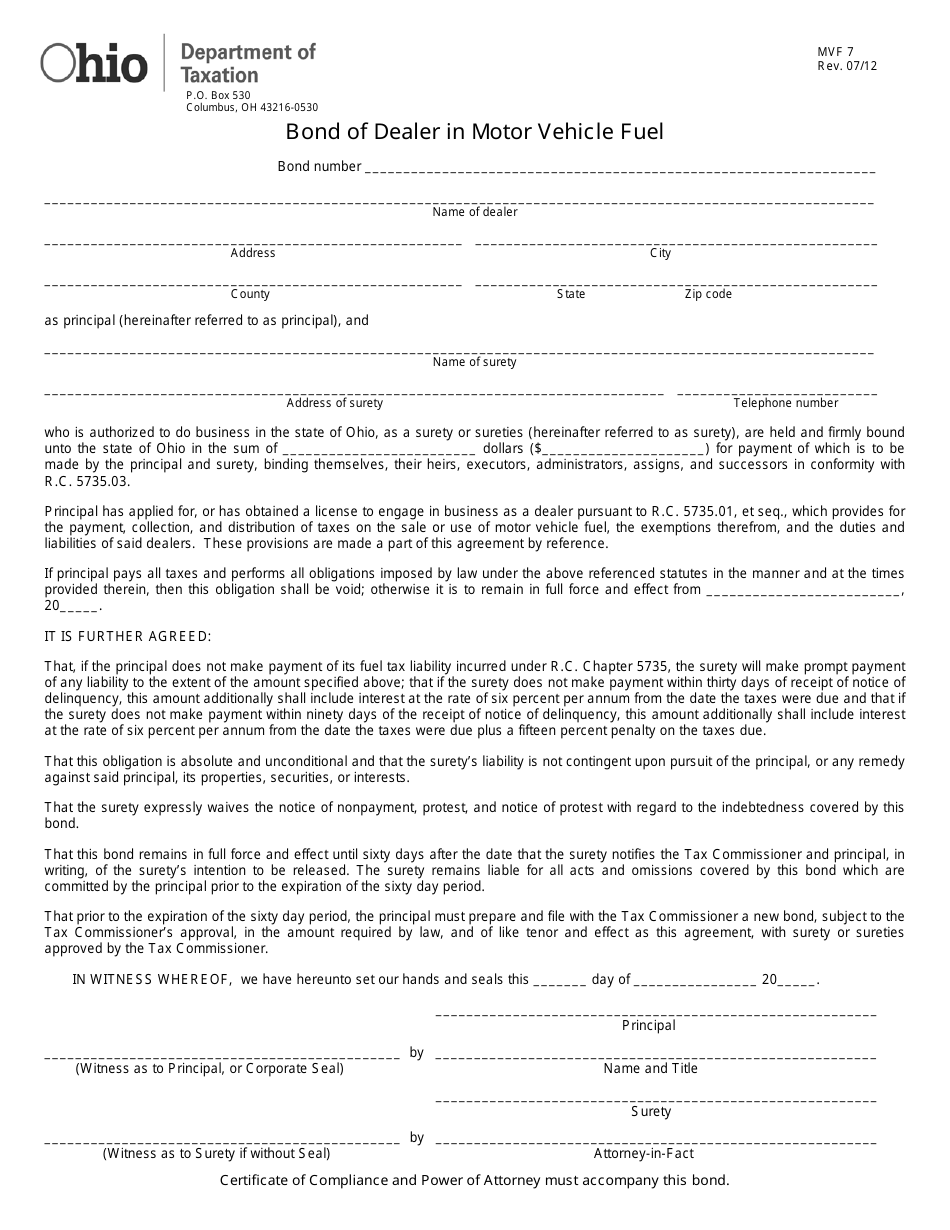

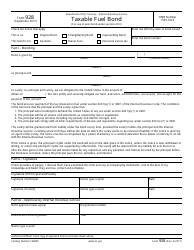

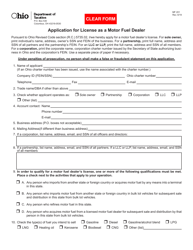

Form MVF7 Bond of Dealer in Motor Vehicle Fuel - Ohio

What Is Form MVF7?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an MVF7 bond?

A: An MVF7 bond is a type of bond required for motor vehicle fuel dealers in Ohio.

Q: Who needs an MVF7 bond?

A: Motor vehicle fuel dealers in Ohio need an MVF7 bond.

Q: What is the purpose of an MVF7 bond?

A: The purpose of an MVF7 bond is to provide financial protection to the state and consumers in case the motor vehicle fuel dealer does not fulfill their obligations.

Q: How does an MVF7 bond work?

A: An MVF7 bond works as a guarantee that the motor vehicle fuel dealer will comply with all applicable laws and regulations.

Q: How much does an MVF7 bond cost?

A: The cost of an MVF7 bond varies depending on the creditworthiness of the dealer, but typically ranges from 1-5% of the bond amount.

Q: How long does an MVF7 bond need to be maintained?

A: An MVF7 bond needs to be maintained for as long as the motor vehicle fuel dealer is in operation.

Q: What happens if a motor vehicle fuel dealer does not have an MVF7 bond?

A: Failure to have an MVF7 bond can result in penalties, fines, and even suspension or revocation of the dealer's license.

Q: Can an MVF7 bond be canceled?

A: An MVF7 bond can be cancelled by the surety company or the dealer with proper notice.

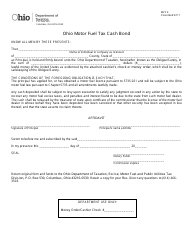

Q: Are there alternatives to an MVF7 bond?

A: In some cases, an escrow account may be used as an alternative to an MVF7 bond.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MVF7 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.