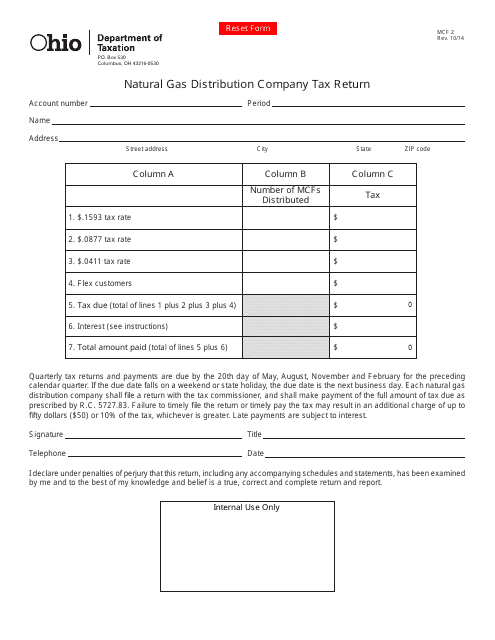

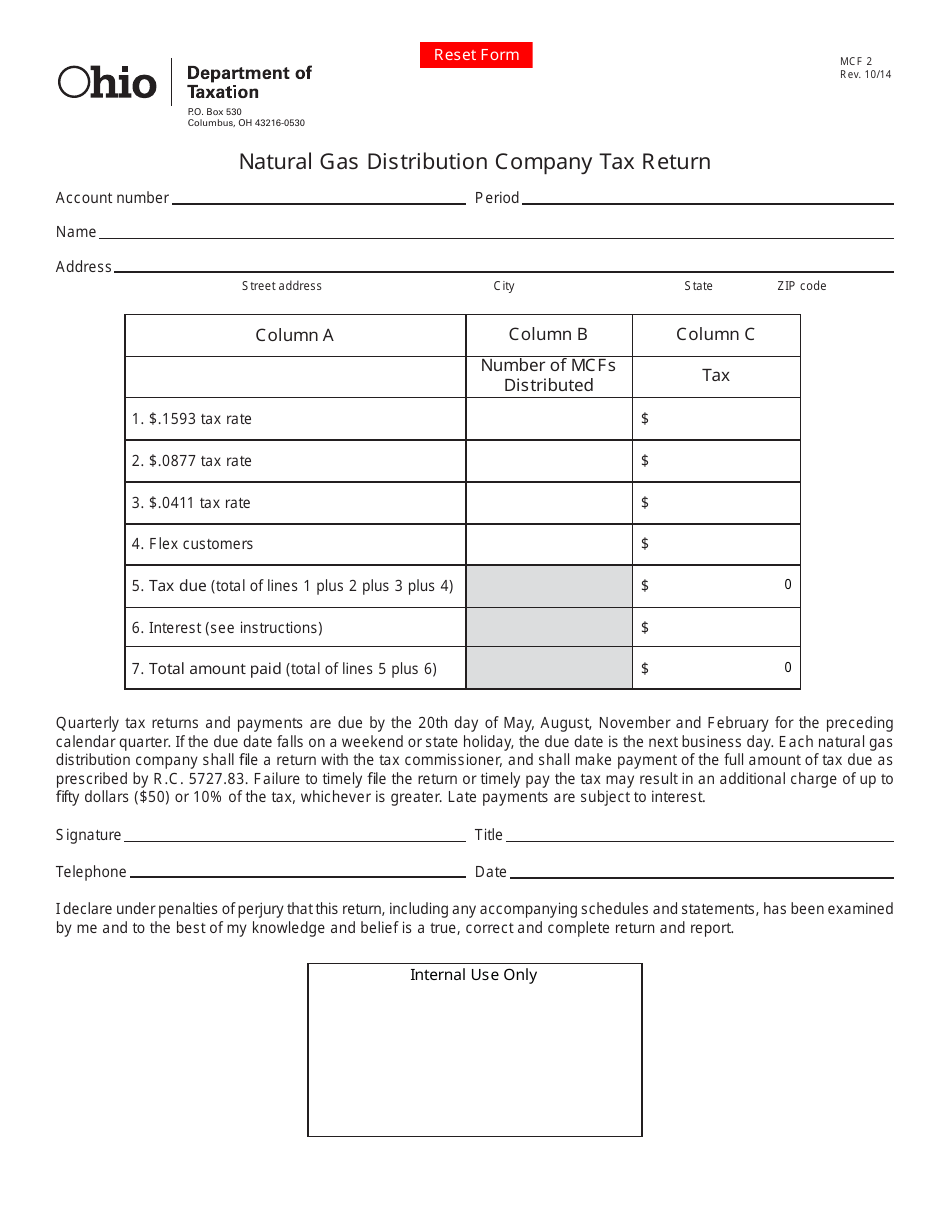

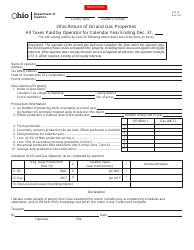

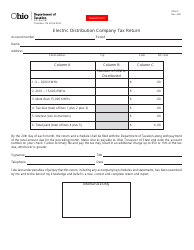

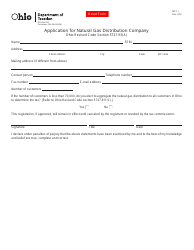

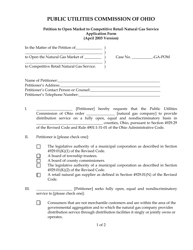

Form MCF2 Natural Gas Distribution Company Tax Return - Ohio

What Is Form MCF2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MCF2?

A: Form MCF2 is a tax return specifically designed for natural gas distribution companies in Ohio.

Q: Who needs to file Form MCF2?

A: Natural gas distribution companies operating in Ohio are required to file Form MCF2.

Q: What is the purpose of Form MCF2?

A: The purpose of Form MCF2 is to report and pay taxes on the distribution of natural gas in Ohio.

Q: When is Form MCF2 due?

A: Form MCF2 is due on or before the last day of the month following the end of the tax period.

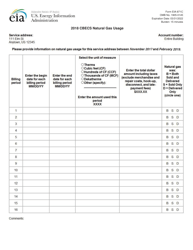

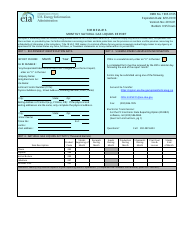

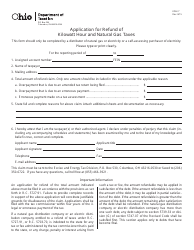

Q: What information do I need to complete Form MCF2?

A: To complete Form MCF2, you will need to provide information such as the total volume of natural gas distributed, taxable sales, and any exemptions or deductions.

Q: Are there any penalties for failure to file Form MCF2?

A: Yes, failure to file Form MCF2 or pay the taxes due may result in penalties and interest charges.

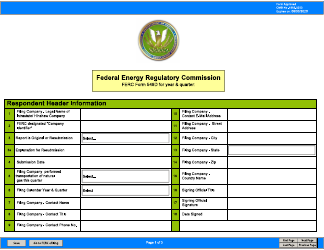

Q: Can Form MCF2 be filed electronically?

A: Yes, you can file Form MCF2 electronically through the Ohio Department of Taxation's e-File system.

Q: Is there a separate form for natural gas distribution companies in Canada?

A: Yes, natural gas distribution companies in Canada have their own specific tax forms.

Q: What other tax obligations do natural gas distribution companies have?

A: In addition to filing Form MCF2, natural gas distribution companies may have other tax obligations, such as federal and state income taxes.

Q: Can I get an extension to file Form MCF2?

A: Yes, you may request an extension to file Form MCF2, but any taxes owed must still be paid by the original due date.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MCF2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.