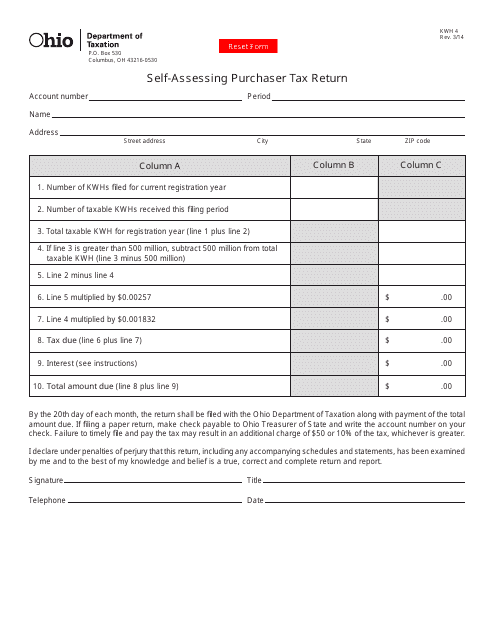

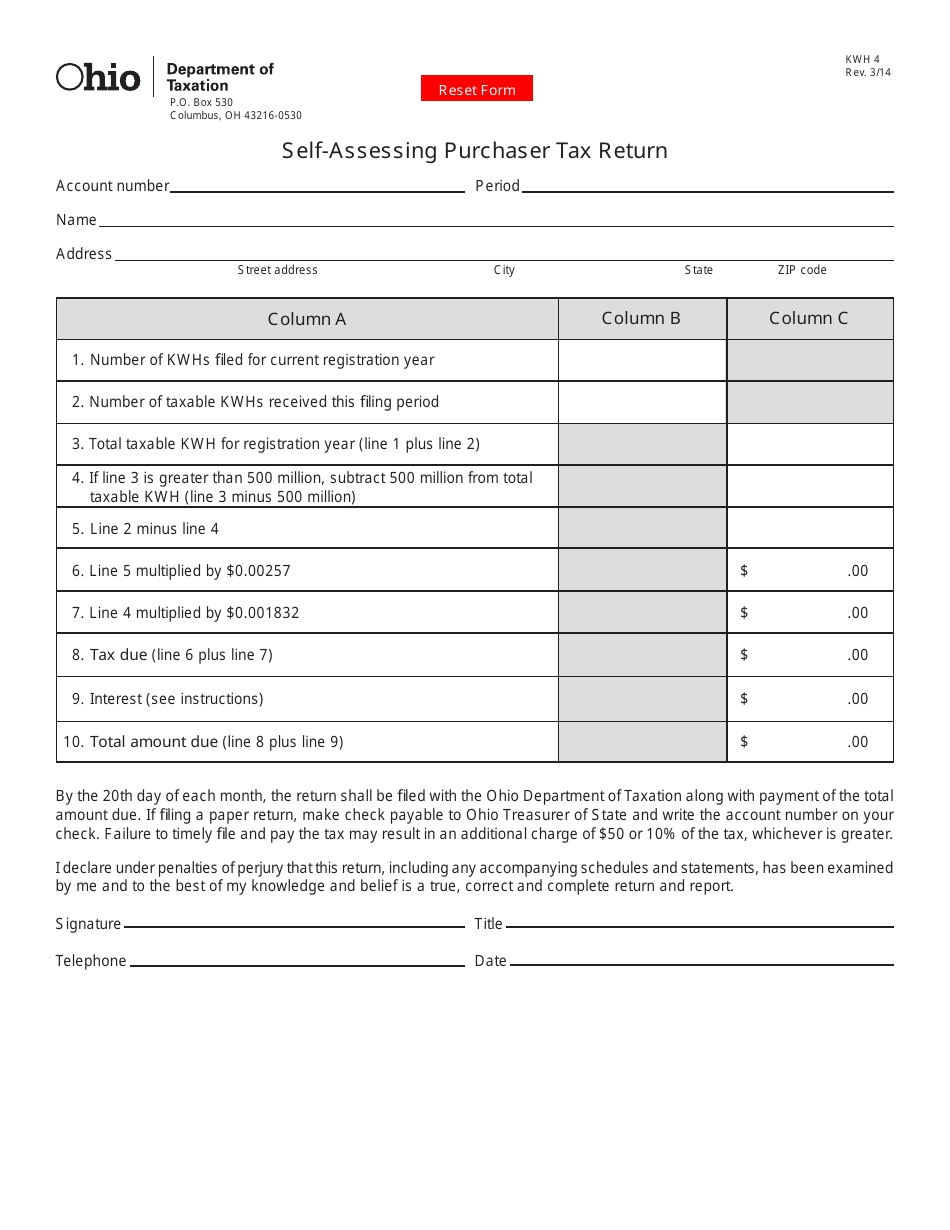

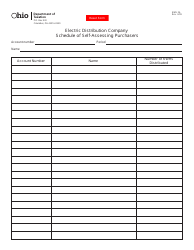

Form KWH4 Self-assessing Purchaser Tax Return - Ohio

What Is Form KWH4?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KWH4?

A: Form KWH4 is the Self-assessing Purchaser Tax Return for Ohio.

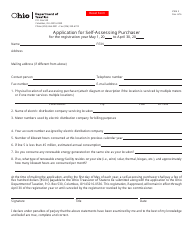

Q: Who needs to file Form KWH4?

A: Anyone who is a self-assessing purchaser and liable for the Ohio sales and use tax should file Form KWH4.

Q: What is the purpose of Form KWH4?

A: The purpose of Form KWH4 is to report and remit the sales and use tax owed by self-assessing purchasers in Ohio.

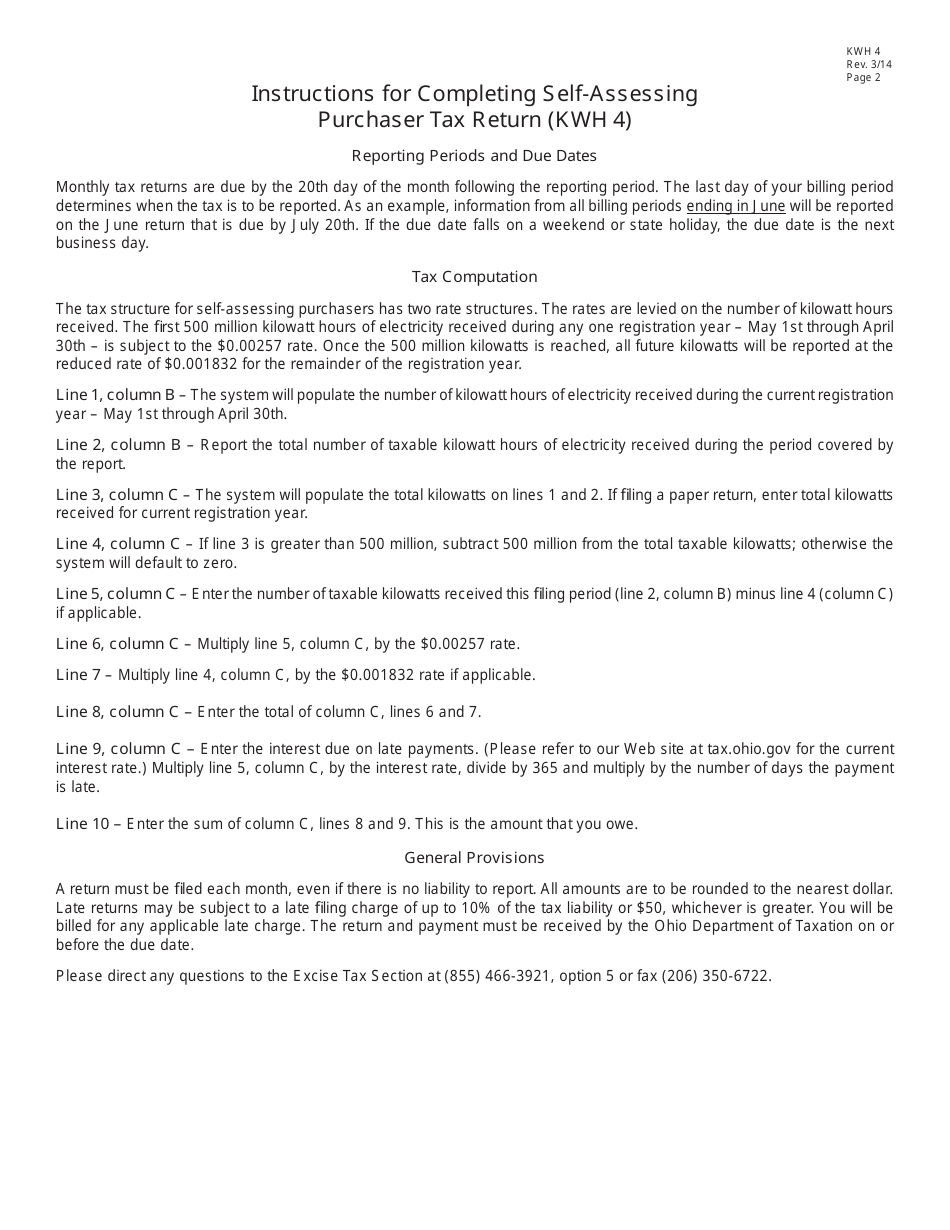

Q: Are there any filing deadlines for Form KWH4?

A: Yes, Form KWH4 must be filed and the tax payment must be remitted by the 23rd day of the month following the end of the reporting period.

Q: What information do I need to complete Form KWH4?

A: You will need to provide your business information, sales and use tax liability details, and calculate the tax due for the reporting period.

Q: Can I file Form KWH4 electronically?

A: Yes, Ohio allows taxpayers to file Form KWH4 electronically through the Ohio Business Gateway.

Q: What happens if I do not file Form KWH4?

A: Failure to file Form KWH4 or pay the tax owed can result in penalties and interest charges.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KWH4 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.