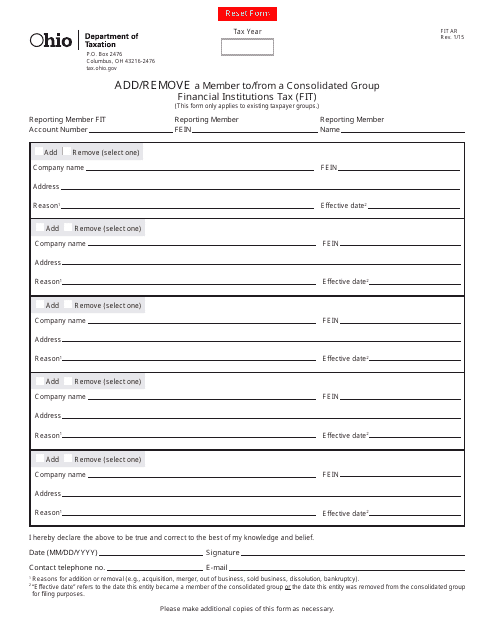

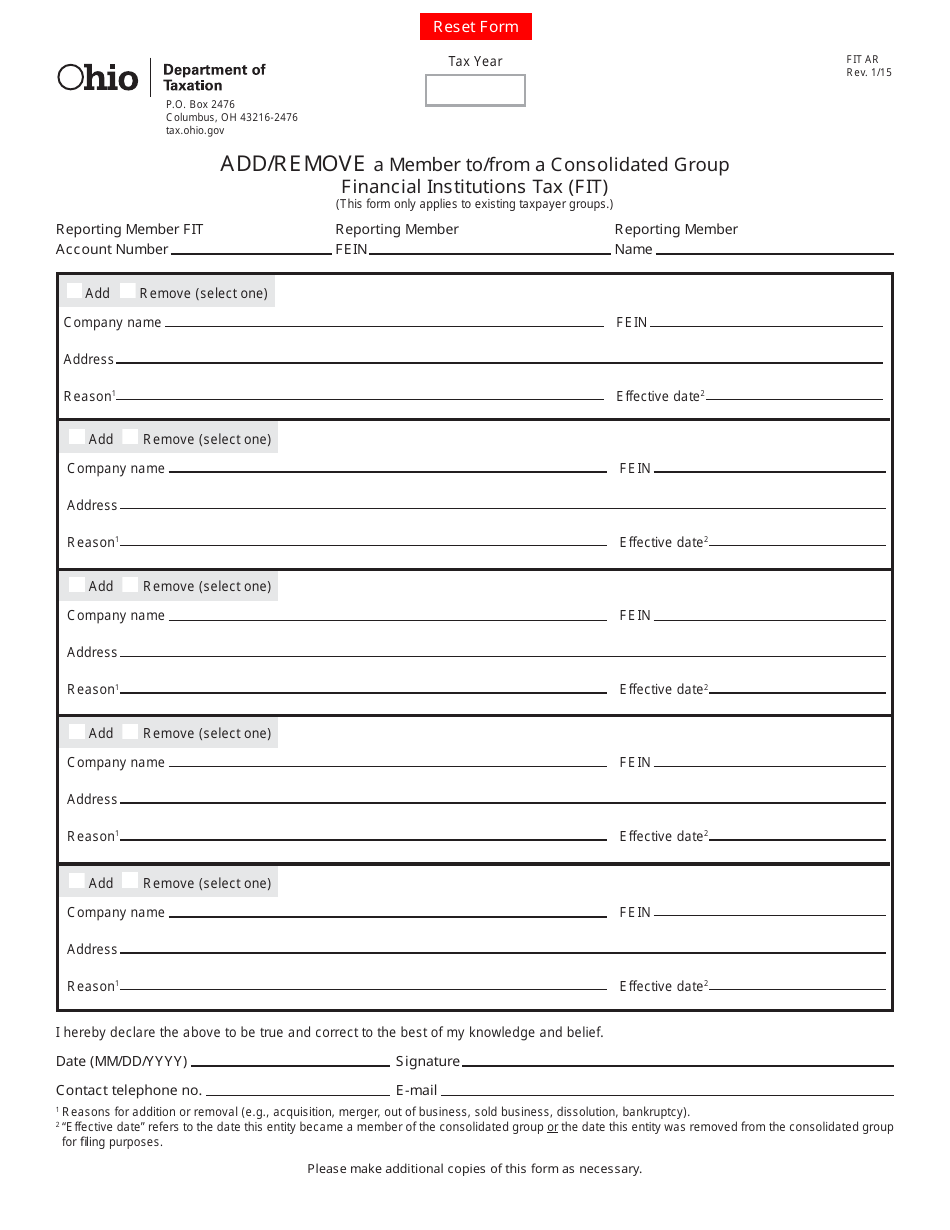

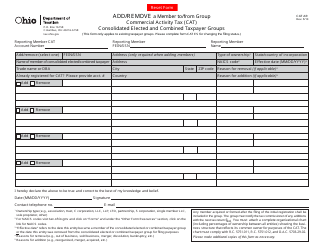

Form FIT AR Add / Remove a Member to / From a Consolidated Group Financial Institutions Tax (Fit) - Ohio

What Is Form FIT AR?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIT AR?

A: Form FIT AR is a form used to add or remove a member to/from a Consolidated Group for Financial Institutions Tax (FIT) in Ohio.

Q: What is Financial Institutions Tax (FIT) in Ohio?

A: Financial Institutions Tax (FIT) is a tax imposed on financial institutions operating in Ohio.

Q: When do I need to use Form FIT AR?

A: You need to use Form FIT AR when you want to add or remove a member from a Consolidated Group for FIT in Ohio.

Q: How do I add a member to a Consolidated Group using Form FIT AR?

A: To add a member to a Consolidated Group, you need to provide the necessary information in Form FIT AR and submit it to the appropriate authority.

Q: How do I remove a member from a Consolidated Group using Form FIT AR?

A: To remove a member from a Consolidated Group, you need to provide the necessary information in Form FIT AR and submit it to the appropriate authority.

Q: Is there a deadline to submit Form FIT AR?

A: Yes, there is a deadline to submit Form FIT AR. The specific deadline can be found on the form or by contacting the Ohio Department of Taxation.

Q: Are there any fees associated with submitting Form FIT AR?

A: There may be filing fees associated with submitting Form FIT AR. The fee amount can be found on the form or by contacting the Ohio Department of Taxation.

Q: What happens after I submit Form FIT AR?

A: After you submit Form FIT AR, the appropriate authority will review your submission and process it accordingly.

Q: Can I make changes to Form FIT AR after submission?

A: It may be possible to make changes to Form FIT AR after submission, but it is best to contact the Ohio Department of Taxation for guidance on this matter.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT AR by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.