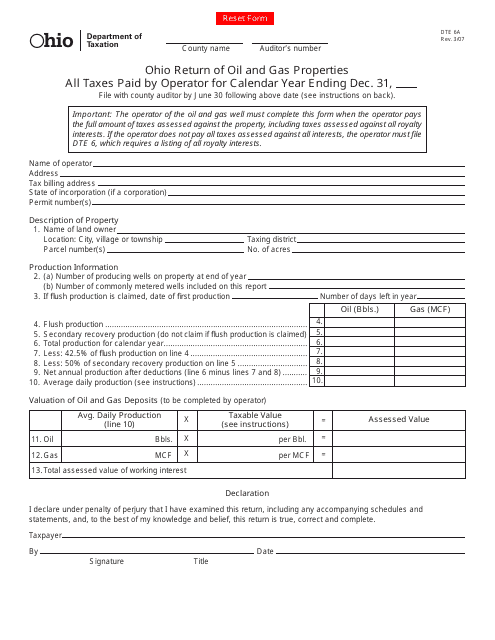

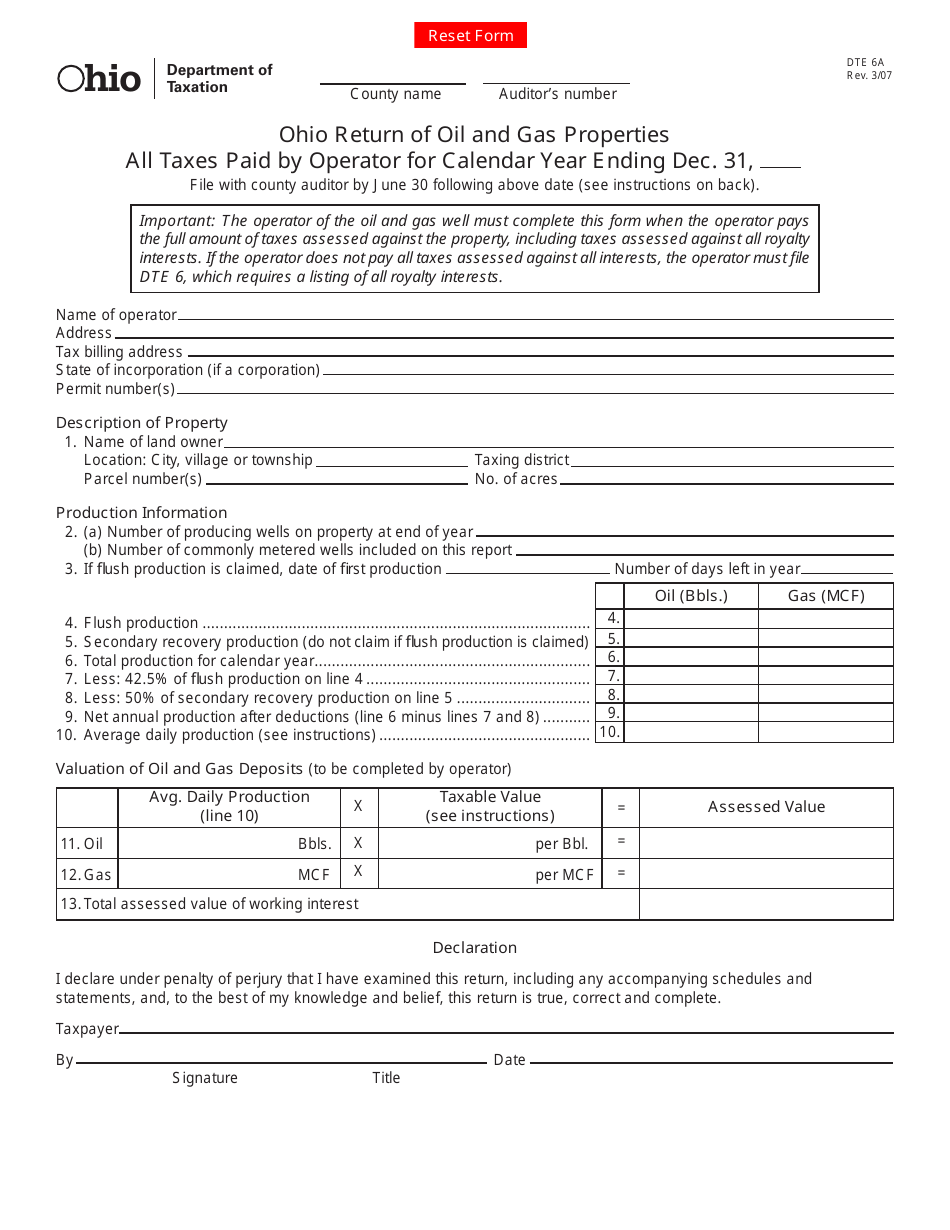

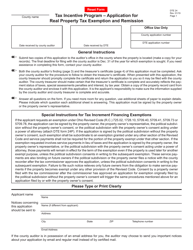

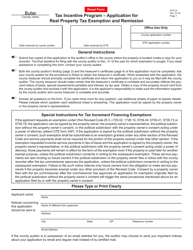

Form DTE6A Ohio Return of Oil and Gas Properties All Taxes Paid by Operator - Ohio

What Is Form DTE6A?

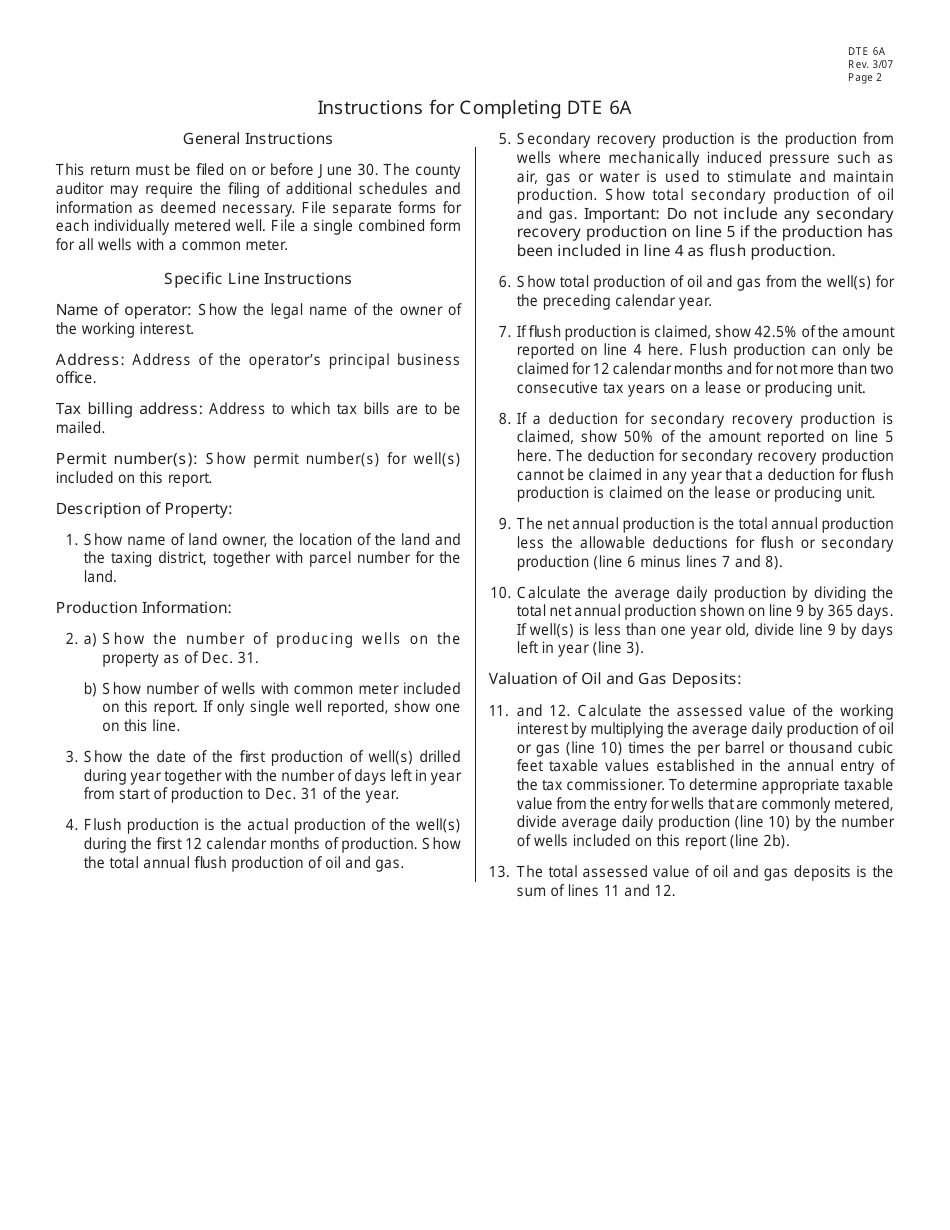

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE6A?

A: Form DTE6A is the Ohio Return of Oil and Gas Properties All Taxes Paid by Operator.

Q: Who needs to file Form DTE6A?

A: Operators of oil and gas properties in Ohio need to file Form DTE6A.

Q: What is the purpose of Form DTE6A?

A: Form DTE6A is used to report and pay taxes on oil and gas properties in Ohio.

Q: What taxes are paid on Form DTE6A?

A: Form DTE6A is used to report and pay all taxes related to oil and gas properties in Ohio.

Q: When is Form DTE6A due?

A: Form DTE6A is due on or before the last day of the month following the end of the calendar quarter.

Form Details:

- Released on March 1, 2007;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE6A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.