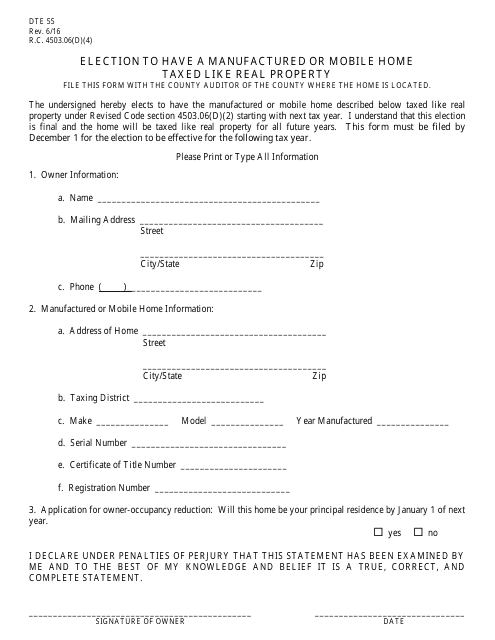

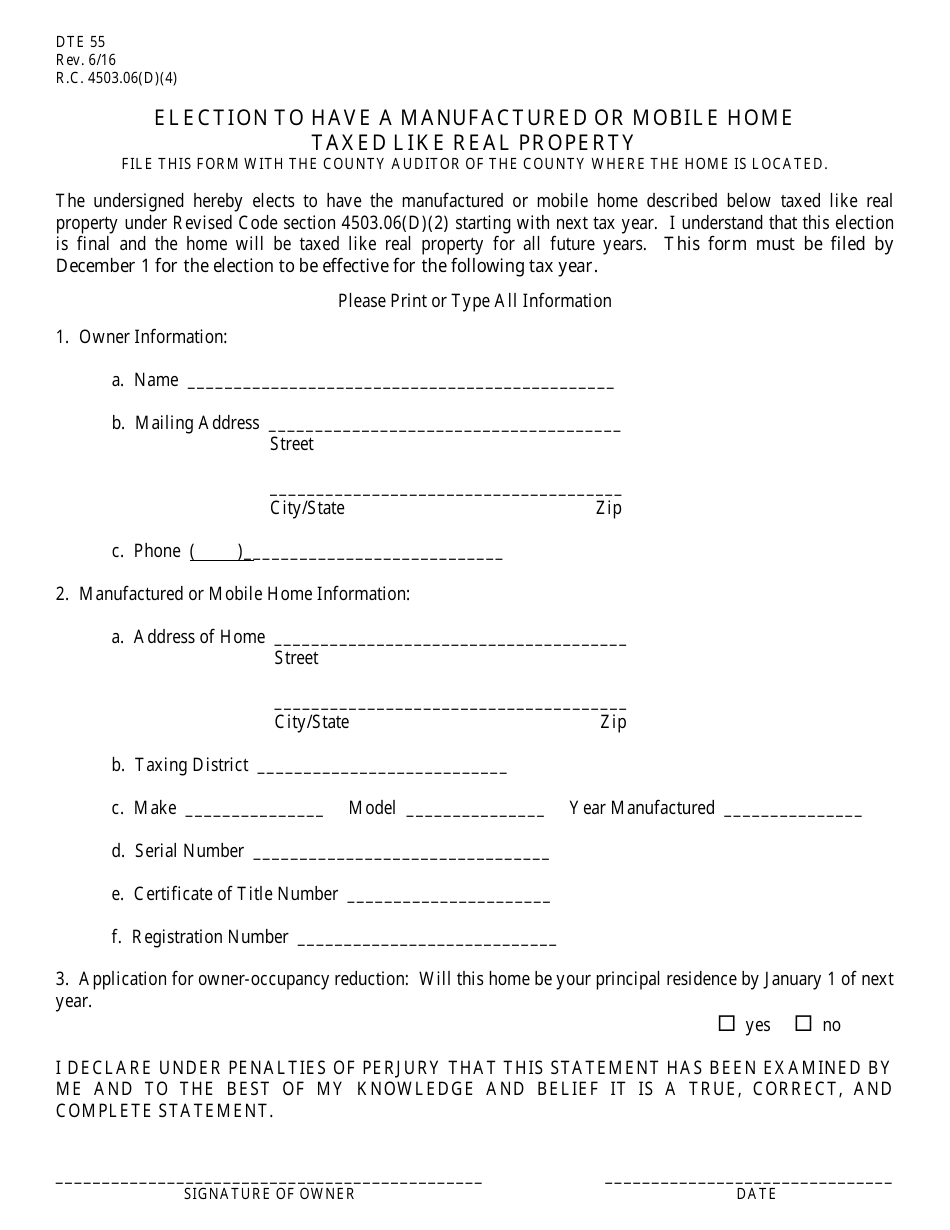

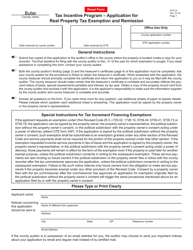

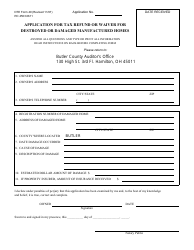

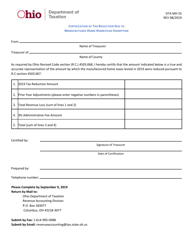

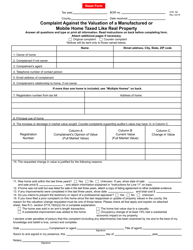

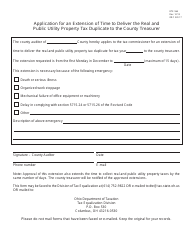

Form DTE55 Election to Have a Manufactured or Mobile Home Taxed Like Real Property - Ohio

What Is Form DTE55?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE55?

A: Form DTE55 is the Election to Have a Manufactured or Mobile Home Taxed Like Real Property form in Ohio.

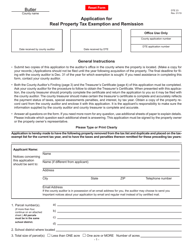

Q: What is the purpose of Form DTE55?

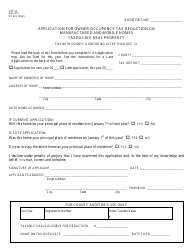

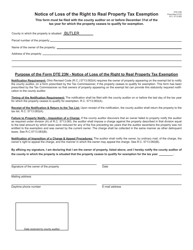

A: The purpose of Form DTE55 is to allow owners of manufactured or mobile homes in Ohio to choose to have their homes taxed like real property.

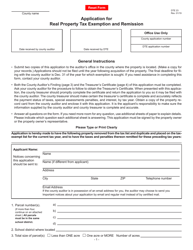

Q: How do I use Form DTE55?

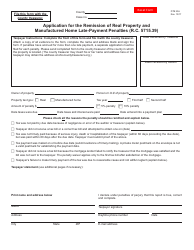

A: To use Form DTE55, you need to complete the form with your personal information and submit it to the local county auditor's office.

Q: Who is eligible to use Form DTE55?

A: Manufactured or mobile home owners in Ohio are eligible to use Form DTE55.

Q: What are the benefits of using Form DTE55?

A: Using Form DTE55 allows manufactured or mobile home owners to have a lower tax rate and qualify for certain exemptions available to real property owners.

Q: Are there any limitations or requirements for using Form DTE55?

A: Yes, there are certain limitations and requirements that must be met, such as the home must be permanently attached to a foundation and meet other specific criteria.

Q: What is the deadline for submitting Form DTE55?

A: The deadline for submitting Form DTE55 is the first day of January of the year for which you want the manufactured or mobile home to be taxed like real property.

Q: What should I do if I have additional questions about Form DTE55?

A: If you have additional questions about Form DTE55, you should contact your local county auditor's office or the Ohio Department of Taxation for assistance.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTE55 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.