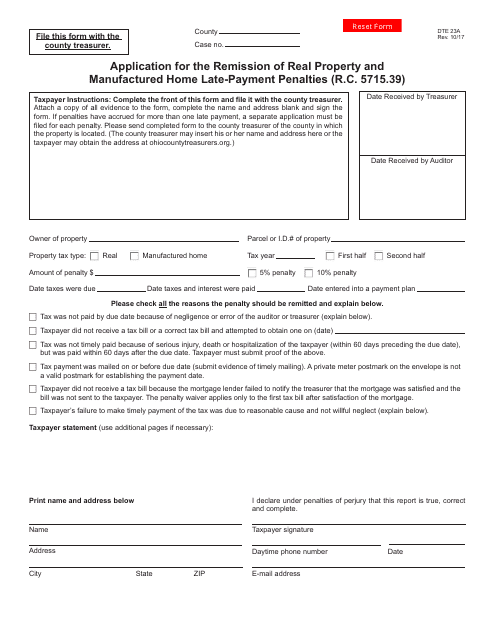

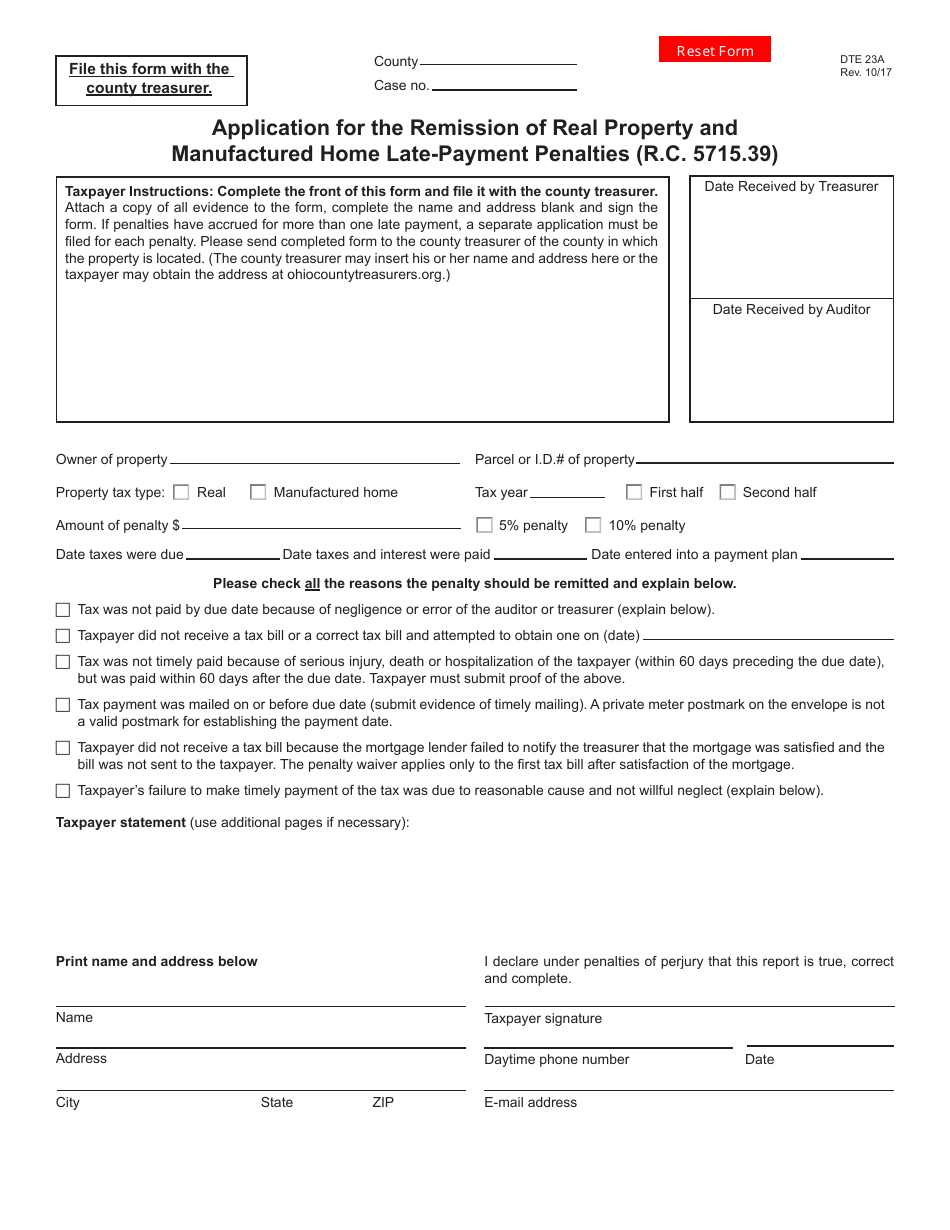

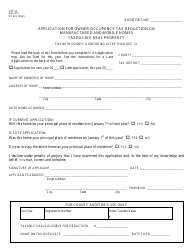

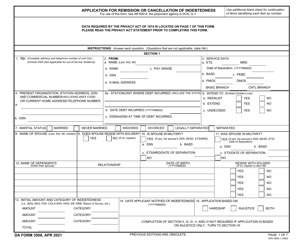

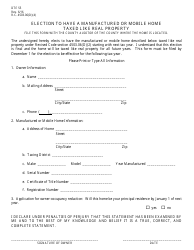

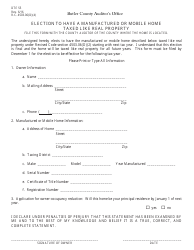

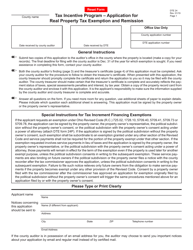

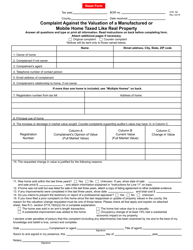

Form DTE23A Application for the Remission of Real Property and Manufactured Home Late-Payment Penalties (R.c. 5715.39) - Ohio

What Is Form DTE23A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE23A?

A: Form DTE23A is an application for the remission of real property and manufactured home late-payment penalties in Ohio.

Q: What does Form DTE23A apply to?

A: Form DTE23A applies to late-payment penalties on real property and manufactured homes in Ohio.

Q: What is the purpose of Form DTE23A?

A: The purpose of Form DTE23A is to request the remission of late-payment penalties for real property and manufactured homes in Ohio.

Q: Who can use Form DTE23A?

A: Anyone who wants to request the remission of real property and manufactured home late-payment penalties in Ohio can use Form DTE23A.

Q: What is R.c. 5715.39?

A: R.c. 5715.39 refers to the specific Ohio Revised Code section that relates to the remission of real property and manufactured home late-payment penalties.

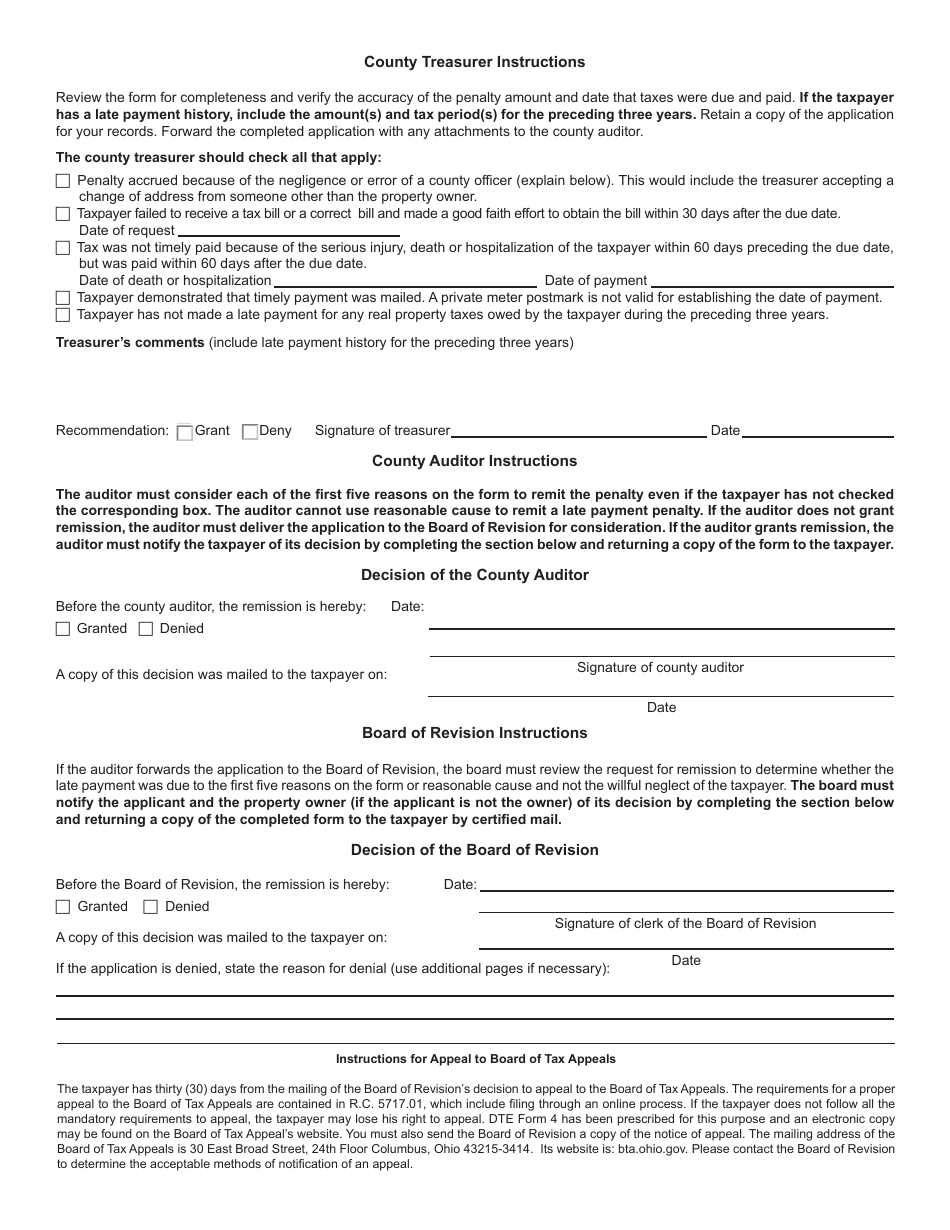

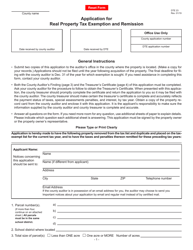

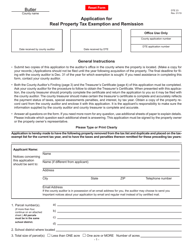

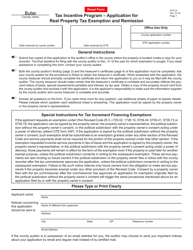

Q: How do I fill out Form DTE23A?

A: To fill out Form DTE23A, you will need to provide your contact information, property details, penalty information, and a statement explaining why the remission should be granted.

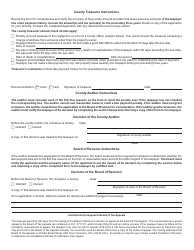

Q: What happens after I submit Form DTE23A?

A: After you submit Form DTE23A, the Ohio Department of Taxation will review your application and determine whether or not to grant the remission of late-payment penalties.

Q: Can I appeal a decision regarding Form DTE23A?

A: Yes, if your application is denied, you have the right to appeal the decision regarding Form DTE23A.

Q: Is there a deadline for submitting Form DTE23A?

A: Yes, there is a deadline for submitting Form DTE23A. It is recommended to check the instructions or contact the Ohio Department of Taxation for the specific deadline.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE23A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.