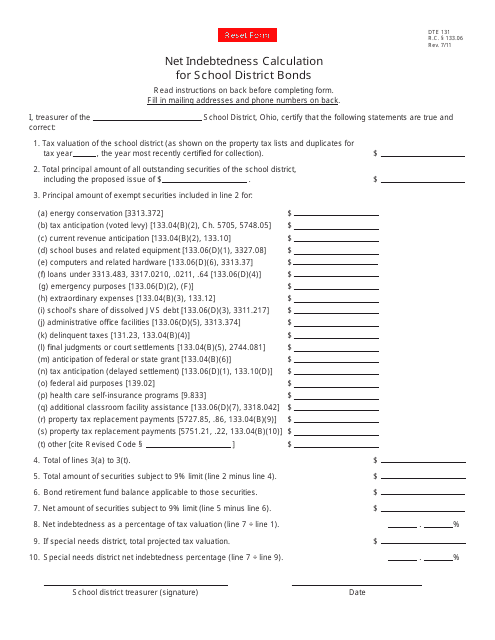

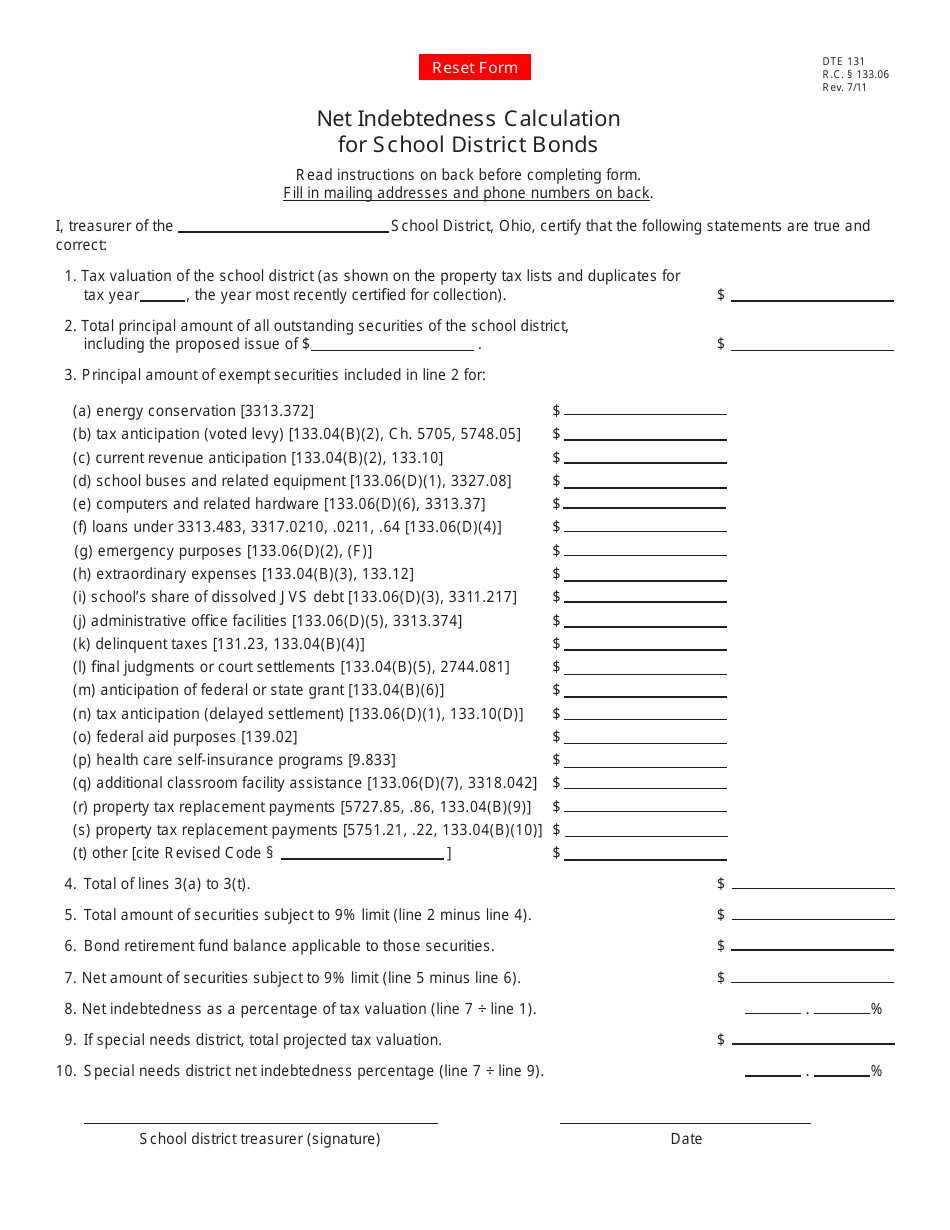

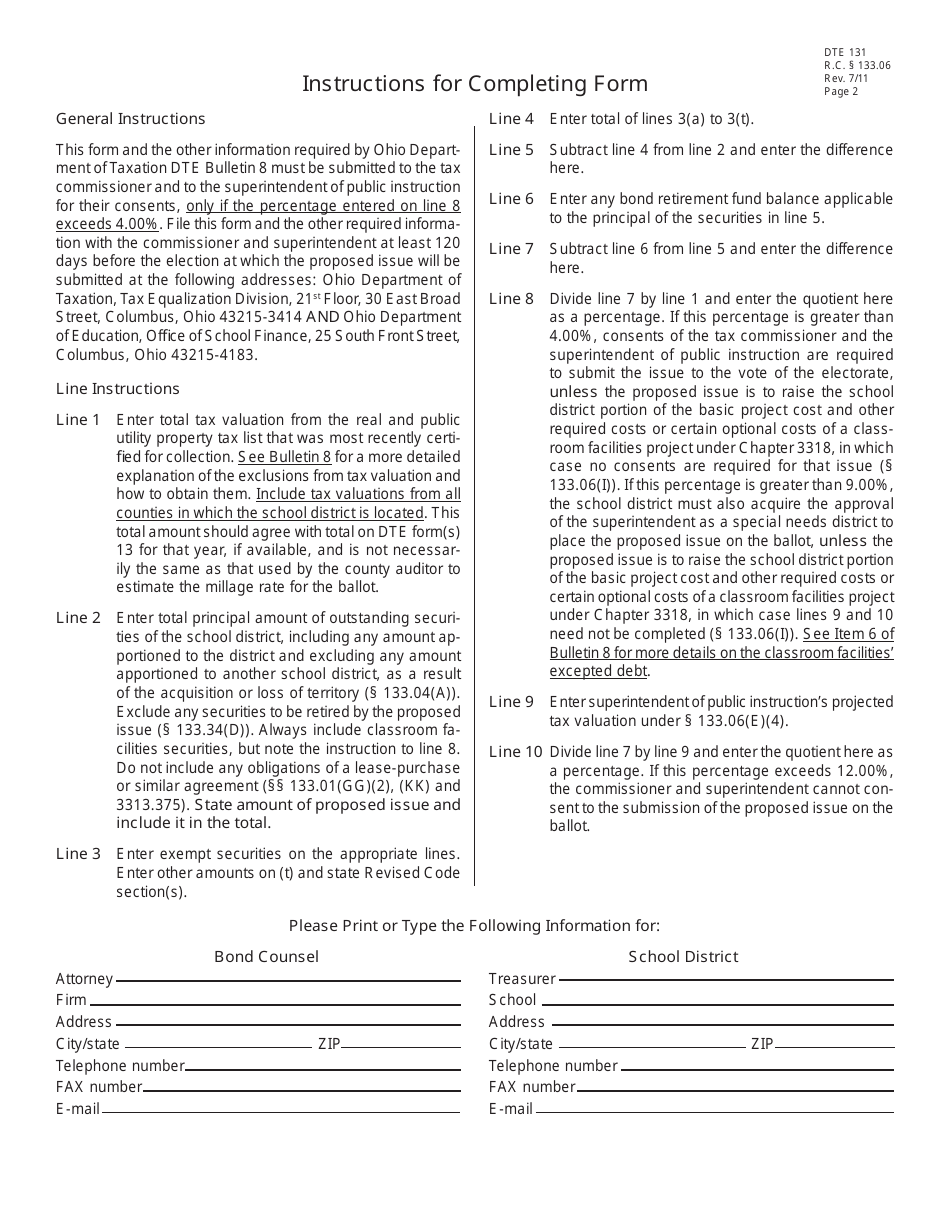

Form DTE131 Net Indebtedness Calculation for School District Bonds - Ohio

What Is Form DTE131?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE131?

A: Form DTE131 is a document used for calculating the net indebtedness of school district bonds in Ohio.

Q: What is net indebtedness?

A: Net indebtedness refers to the total amount of debt that a school district owes after deducting any available resources or assets.

Q: Why is calculating net indebtedness important?

A: Calculating net indebtedness helps determine the financial stability and borrowing capacity of a school district.

Q: Who uses Form DTE131?

A: School districts in Ohio use Form DTE131 to calculate their net indebtedness for the purpose of issuing bonds.

Q: What information is needed to complete Form DTE131?

A: Form DTE131 requires information about the outstanding debt, available assets, and any other financial resources of the school district.

Q: Is Form DTE131 specific to Ohio?

A: Yes, Form DTE131 is specific to school districts in Ohio and is used for compliance with state regulations.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE131 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.