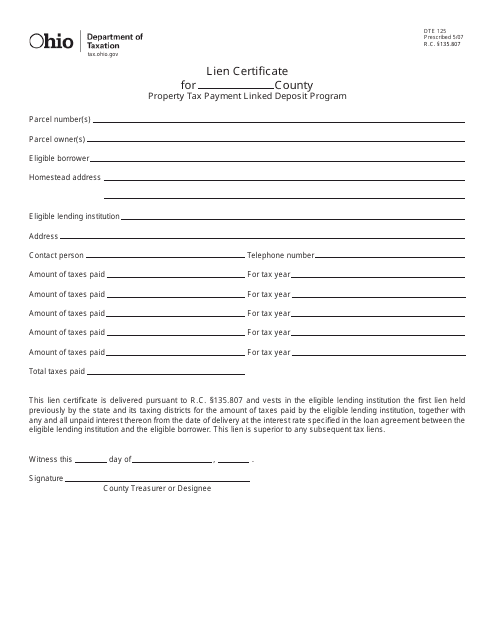

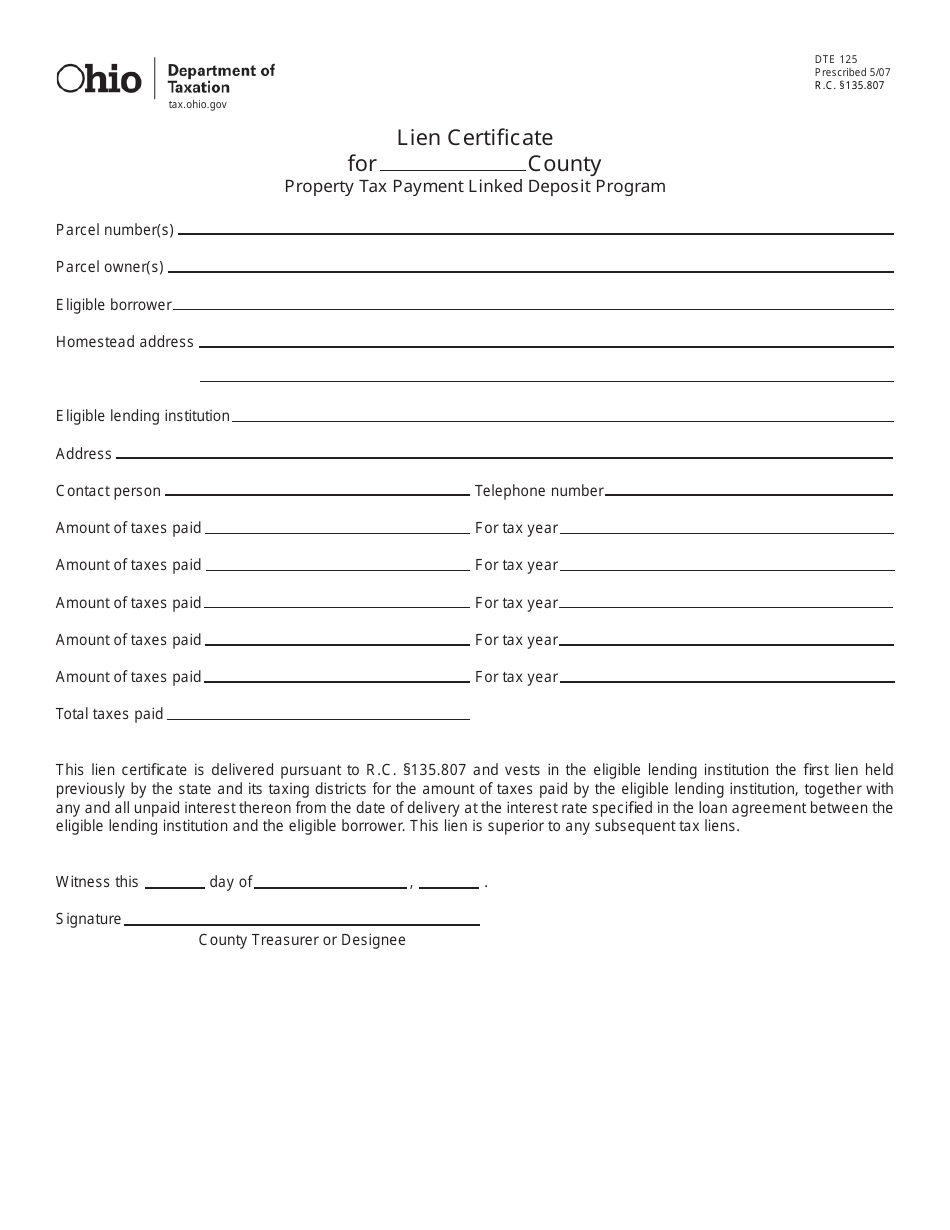

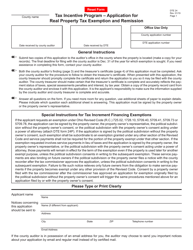

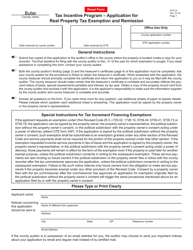

Form DTE125 Lien Certificate for Property Tax Payment Linked Deposit Program - Ohio

What Is Form DTE125?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

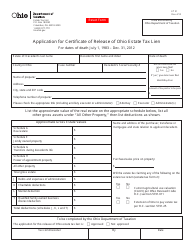

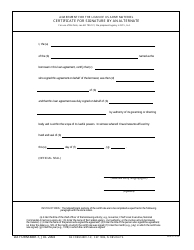

Q: What is a DTE125 Lien Certificate?

A: A DTE125 Lien Certificate is a document issued by the county auditor's office in Ohio that certifies the amount of property taxes owed on a specific property.

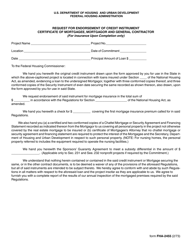

Q: What is the Property Tax Payment Linked Deposit Program in Ohio?

A: The Property Tax Payment Linked Deposit Program is a program in Ohio that provides qualifying property owners with low-interest loans to help them pay their property taxes.

Q: How does the Property Tax Payment Linked Deposit Program work?

A: Under the program, property owners can apply for a loan to pay their property taxes. If approved, the loan amount is deposited directly with the county treasurer's office and is used to pay the property taxes.

Q: Who is eligible for the Property Tax Payment Linked Deposit Program?

A: Eligibility requirements for the program vary by county in Ohio. Generally, property owners who are current on their property taxes and meet certain income and credit criteria may be eligible.

Q: What is the purpose of the DTE125 Lien Certificate?

A: The purpose of the DTE125 Lien Certificate is to provide proof to the lender that there are no outstanding property tax liens on the property, ensuring the loan is secured.

Q: Do I need a DTE125 Lien Certificate to apply for the Property Tax Payment Linked Deposit Program?

A: Yes, most lenders require a DTE125 Lien Certificate as part of the application process for the Property Tax Payment Linked Deposit Program.

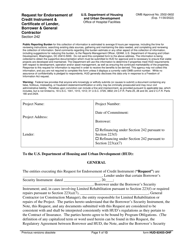

Q: Is the Property Tax Payment Linked Deposit Program available statewide in Ohio?

A: The program is available in select counties in Ohio. Each county determines whether or not to participate in the program.

Q: How can I find out if my county participates in the Property Tax Payment Linked Deposit Program?

A: You can contact your county auditor's office to inquire about the availability of the program in your county.

Q: Are there any fees associated with the Property Tax Payment Linked Deposit Program?

A: Fees and interest rates may vary depending on the lender and the county where the property is located. It is advisable to check with the lender for specific details regarding fees and interest rates for the program.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTE125 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.