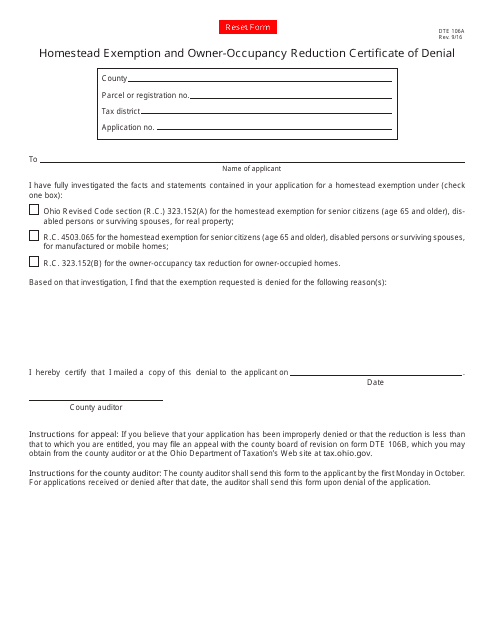

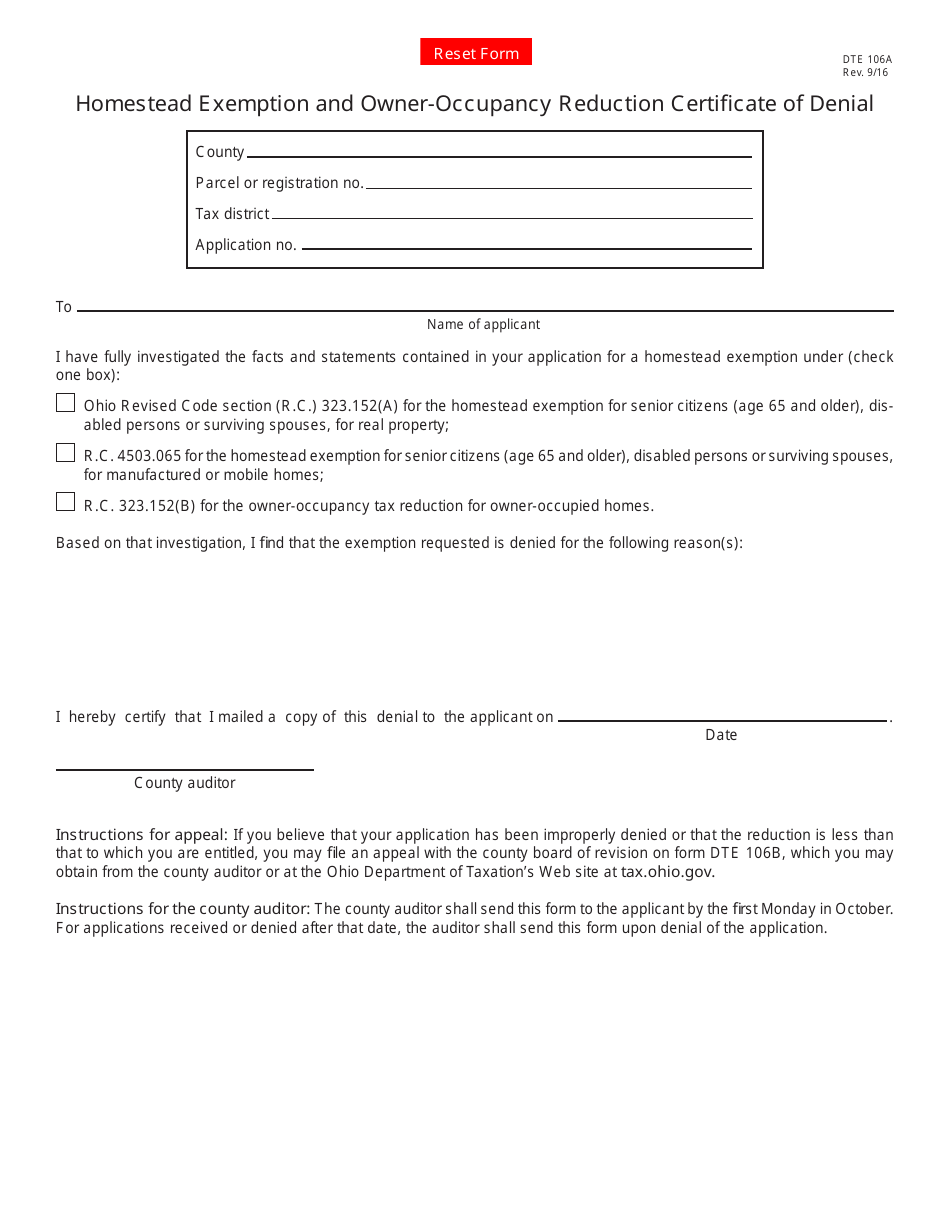

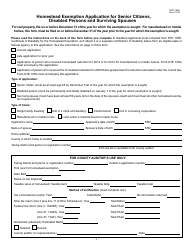

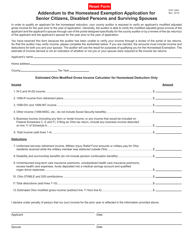

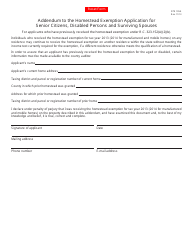

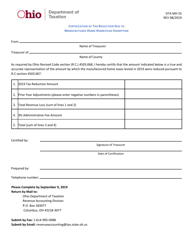

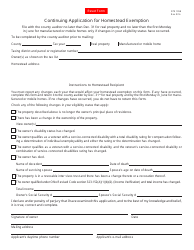

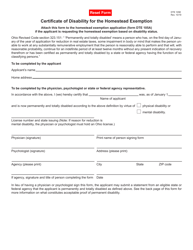

Form DTE106A Homestead Exemption and Owner-Occupancy Reduction Certifi Cate of Denial - Ohio

What Is Form DTE106A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE106A?

A: Form DTE106A is the Homestead Exemption and Owner-Occupancy Reduction Certificate of Denial in Ohio.

Q: What is the purpose of Form DTE106A?

A: The purpose of Form DTE106A is to request a denial certificate for the Homestead Exemption and Owner-Occupancy Reduction in Ohio.

Q: Who needs to fill out Form DTE106A?

A: Form DTE106A needs to be filled out by individuals who have applied for the Homestead Exemption and Owner-Occupancy Reduction in Ohio and have been denied.

Q: Is there a fee for filing Form DTE106A?

A: No, there is no fee for filing Form DTE106A.

Q: What information is required on Form DTE106A?

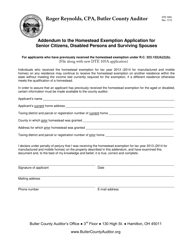

A: Form DTE106A requires information such as the applicant's name, address, county of residence, reason for denial, and signature.

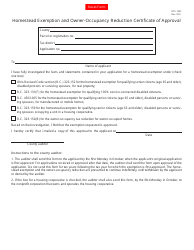

Q: What should I do if my Form DTE106A is approved?

A: If your Form DTE106A is approved, you may be eligible for the Homestead Exemption and Owner-Occupancy Reduction in Ohio.

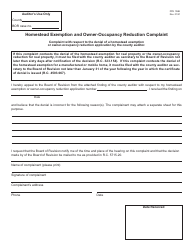

Q: What should I do if my Form DTE106A is denied?

A: If your Form DTE106A is denied, you may need to provide additional documentation or information to support your application for the Homestead Exemption and Owner-Occupancy Reduction in Ohio.

Q: Are there any deadlines for filing Form DTE106A?

A: There may be specific deadlines for filing Form DTE106A, so it is important to check with your local county auditor's office for more information.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE106A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.