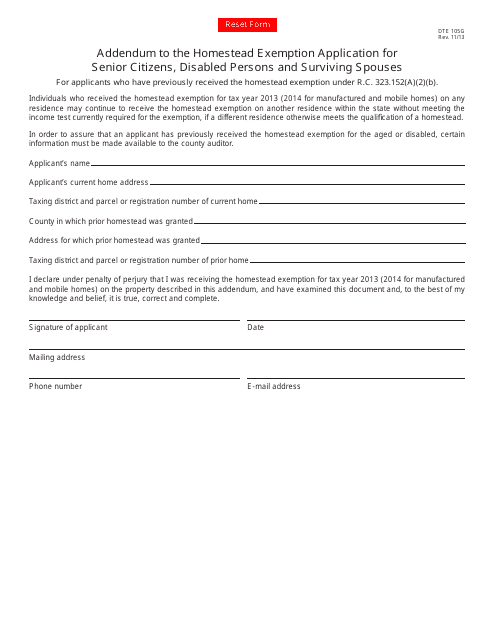

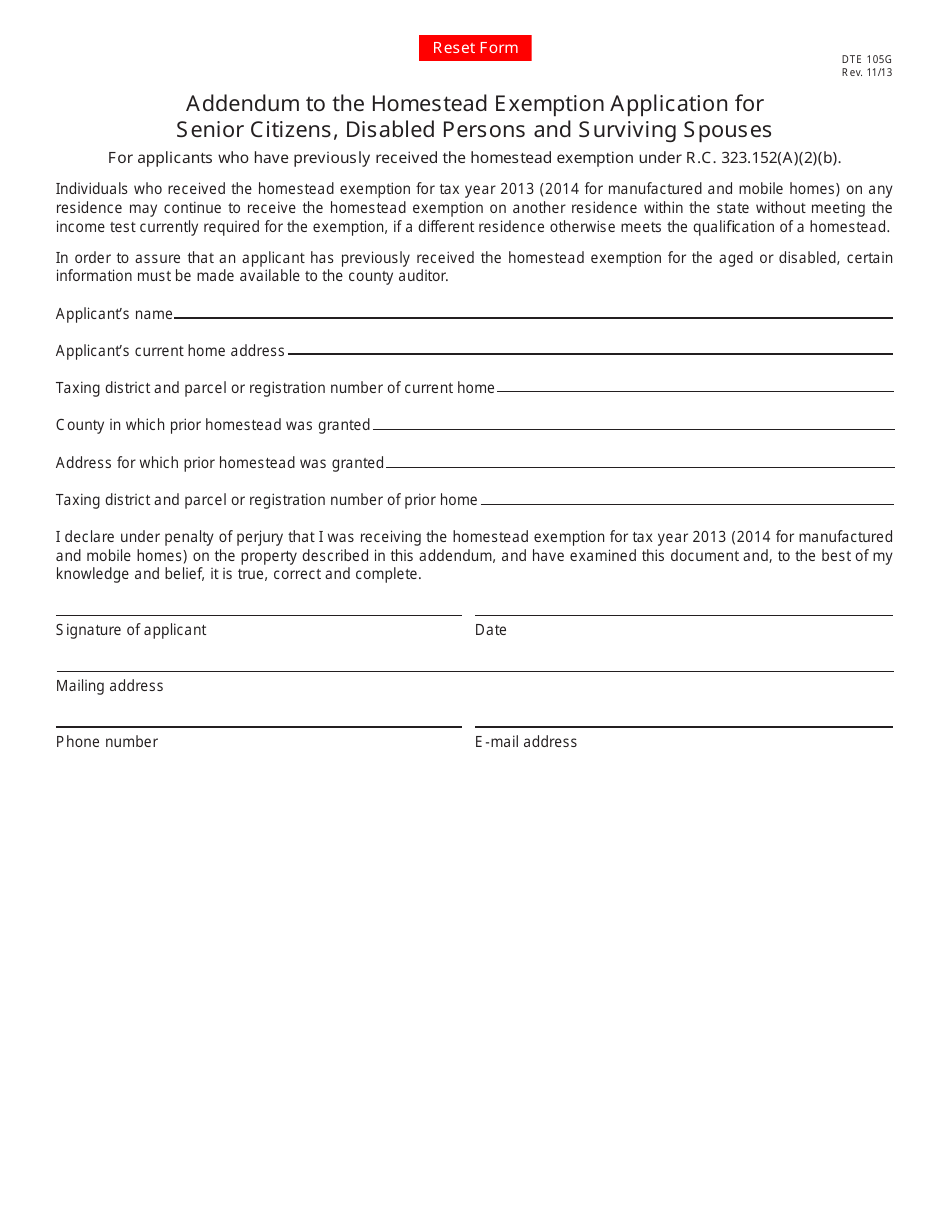

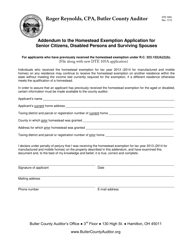

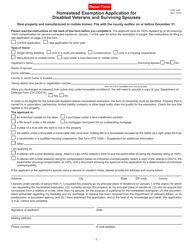

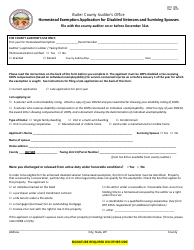

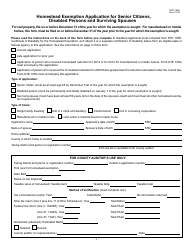

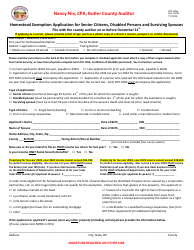

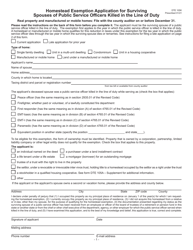

Form DTE105G Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses - Ohio

What Is Form DTE105G?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE105G?

A: Form DTE105G is the Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses in Ohio.

Q: Who is eligible to use Form DTE105G?

A: Senior citizens, disabled persons, and surviving spouses in Ohio who have already applied for the Homestead Exemption may need to use Form DTE105G as an addendum.

Q: What is the purpose of Form DTE105G?

A: Form DTE105G is used to provide additional information and documentation related to eligibility for the Homestead Exemption.

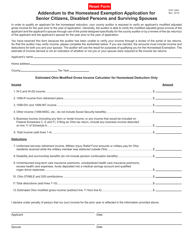

Q: What information is required on Form DTE105G?

A: Form DTE105G requires information such as the applicant's name, address, and Social Security number, as well as documentation related to income, disability, and property ownership.

Q: When should I submit Form DTE105G?

A: Form DTE105G should be submitted as soon as possible after completing the initial Homestead Exemption Application, and any time there are changes in eligibility status or supporting documentation.

Q: Is there a deadline for submitting Form DTE105G?

A: The deadline for submitting Form DTE105G may vary by county, so it is important to check with your county auditor's office for the specific deadline.

Q: What are the benefits of the Homestead Exemption?

A: The Homestead Exemption provides a reduction in the taxable value of a qualified homeowner's property, potentially resulting in lower property taxes.

Q: Are there any income limits or other requirements for the Homestead Exemption?

A: Yes, there are income limits and other requirements for the Homestead Exemption. These limits and requirements can vary by county in Ohio.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105G by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.