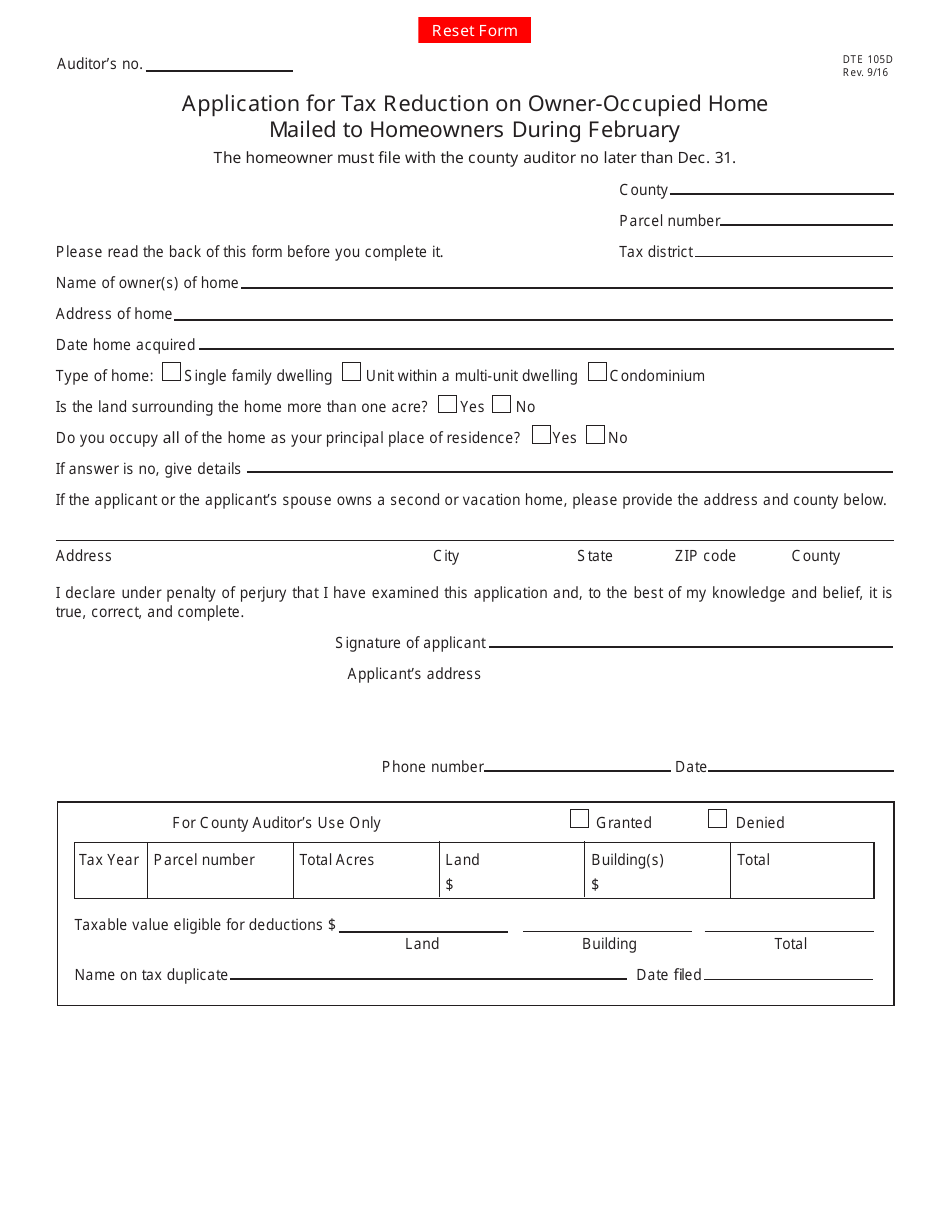

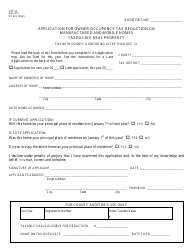

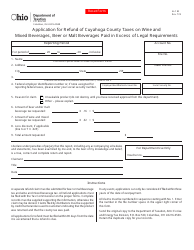

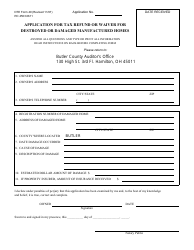

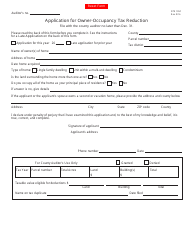

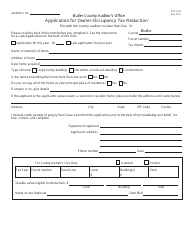

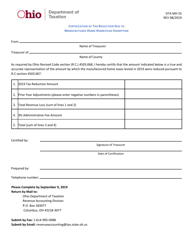

Form DTE105D Application for Tax Reduction on Owner-Occupied Home Mailed to Homeowners During February - Ohio

What Is Form DTE105D?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DTE105D?

A: Form DTE105D is an application for tax reduction on owner-occupied homes.

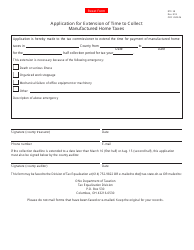

Q: Who receives form DTE105D?

A: Homeowners in Ohio receive form DTE105D.

Q: When is form DTE105D mailed?

A: Form DTE105D is mailed to homeowners during February.

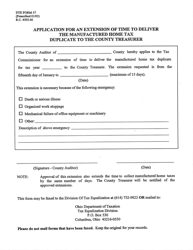

Q: What is the purpose of form DTE105D?

A: The purpose of form DTE105D is to apply for tax reduction on owner-occupied homes in Ohio.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

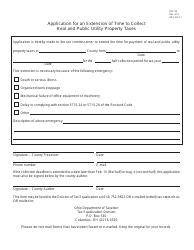

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105D by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.