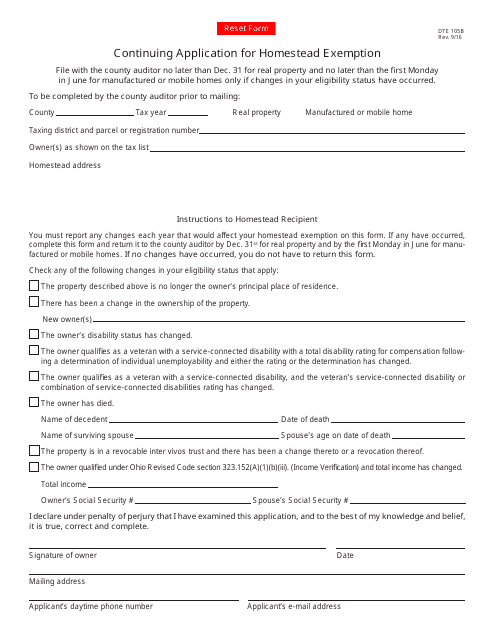

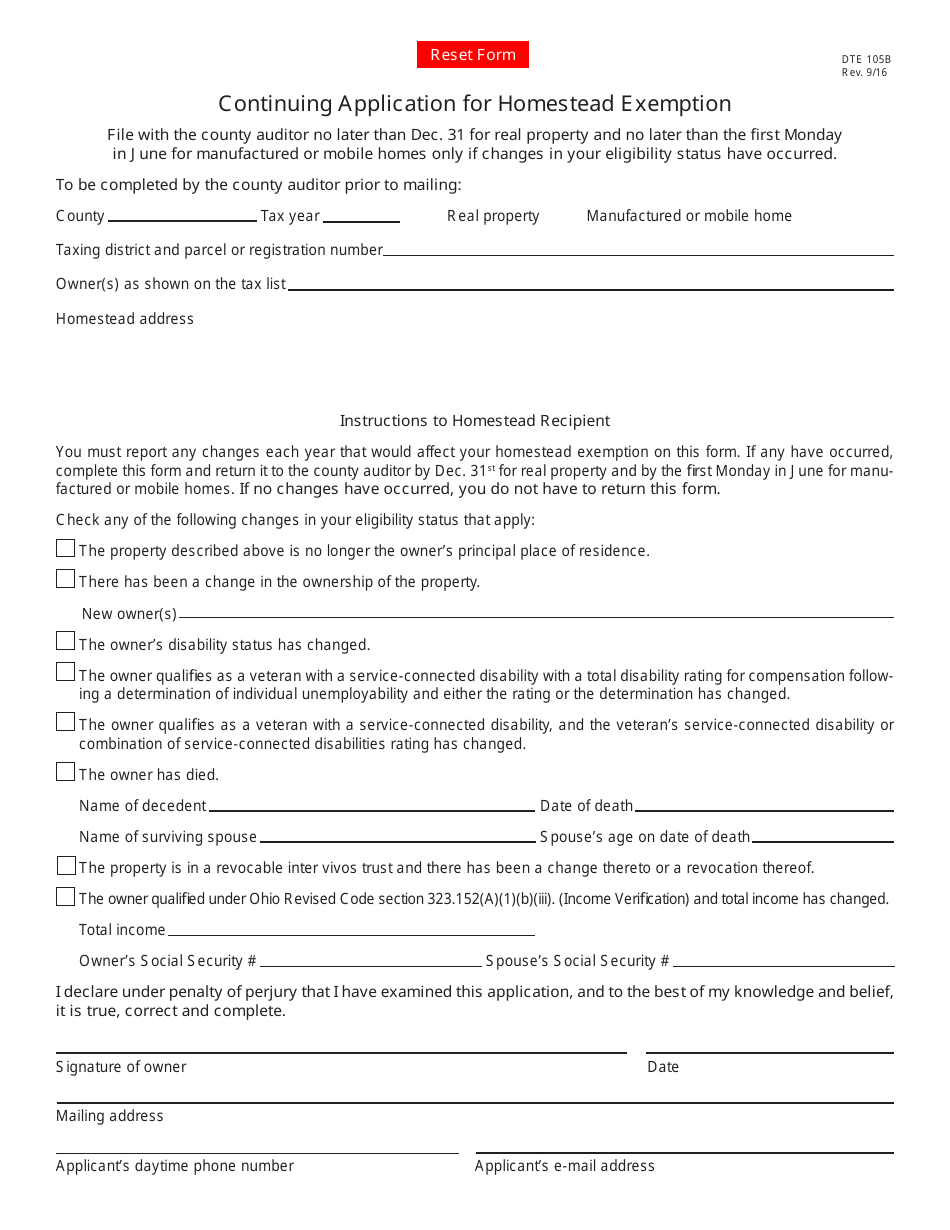

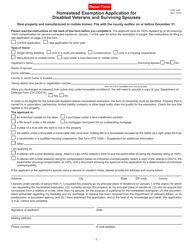

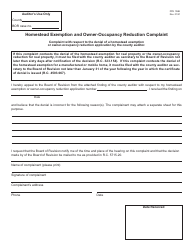

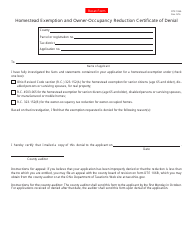

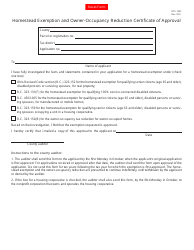

Form DTE105B Continuing Application for Homestead Exemption - Ohio

What Is Form DTE105B?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE105B?

A: Form DTE105B is the Continuing Application for Homestead Exemption in Ohio.

Q: What is the Homestead Exemption in Ohio?

A: The Homestead Exemption is a program that provides a reduction in property taxes for eligible Ohio residents.

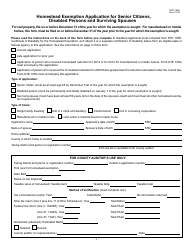

Q: Who is eligible for the Homestead Exemption in Ohio?

A: To be eligible for the Homestead Exemption in Ohio, you must be at least 65 years old or totally and permanently disabled.

Q: What is the purpose of the Continuing Application for Homestead Exemption?

A: The Continuing Application is used to verify that you still qualify for the Homestead Exemption each year.

Q: When is the deadline to submit Form DTE105B?

A: The deadline to submit the Continuing Application for Homestead Exemption is the first Monday in June each year.

Q: What documents do I need to submit with Form DTE105B?

A: You may be required to provide proof of age or disability, such as a driver's license or a statement from a physician.

Q: What happens if I don't submit the Continuing Application for Homestead Exemption?

A: If you don't submit the application, you may lose your eligibility for the Homestead Exemption and your property taxes may increase.

Q: Can I apply for the Homestead Exemption if I rent my home?

A: No, the Homestead Exemption is only available to homeowners.

Q: Is there an income limit for the Homestead Exemption in Ohio?

A: Yes, there is an income limit for the Homestead Exemption. As of 2021, the income limit is $32,800 for a single individual and $42,950 for a married couple.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105B by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.