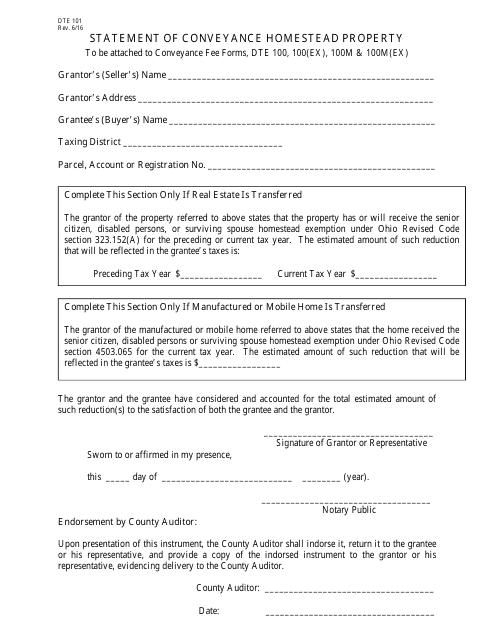

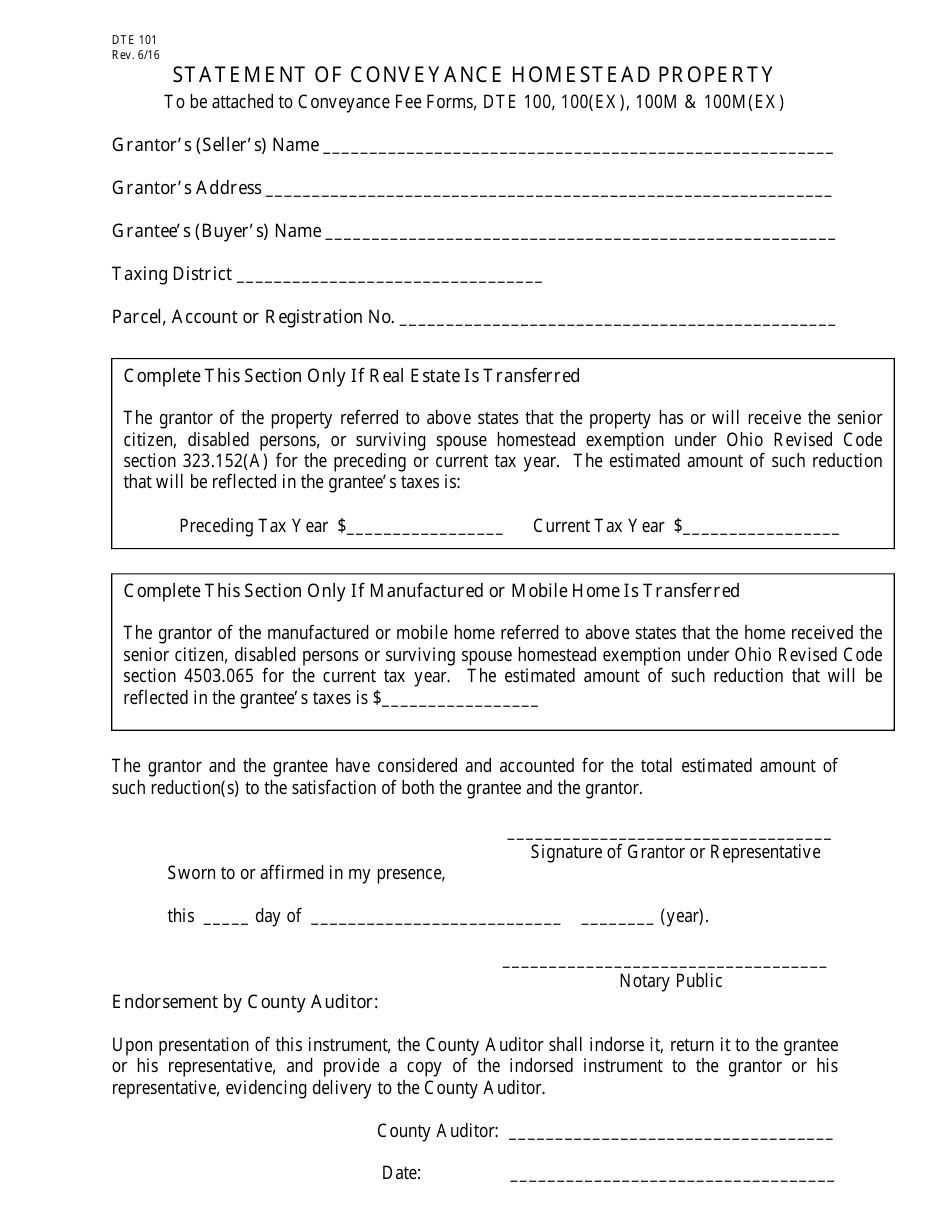

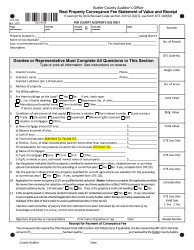

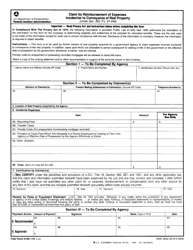

Form DTE101 Statement of Conveyance Homestead Property - Ohio

What Is Form DTE101?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE101?

A: Form DTE101 is the Statement of Conveyance for Homestead Property in Ohio.

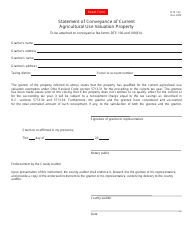

Q: What is the purpose of Form DTE101?

A: The purpose of Form DTE101 is to record the transfer of homestead property in Ohio.

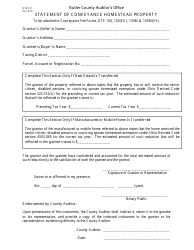

Q: Who needs to fill out Form DTE101?

A: Both the grantor (seller) and grantee (buyer) are required to fill out Form DTE101.

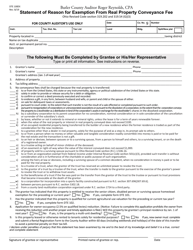

Q: Are there any fees associated with filing Form DTE101?

A: Yes, there may be fees associated with filing Form DTE101. The exact amount varies by county.

Q: What information is required on Form DTE101?

A: Form DTE101 requires information such as the names of the grantor and grantee, property address, and sale price.

Q: When should Form DTE101 be filed?

A: Form DTE101 should be filed within 30 days of the transfer of homestead property.

Q: What happens after Form DTE101 is filed?

A: After Form DTE101 is filed, it will be reviewed by the county auditor and recorded in the public records.

Q: Is Form DTE101 the same as a deed?

A: No, Form DTE101 is not the same as a deed. It is a statement of conveyance for tax purposes.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTE101 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.