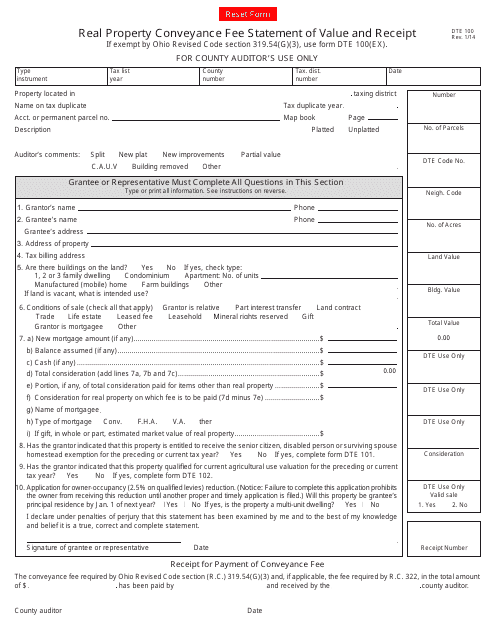

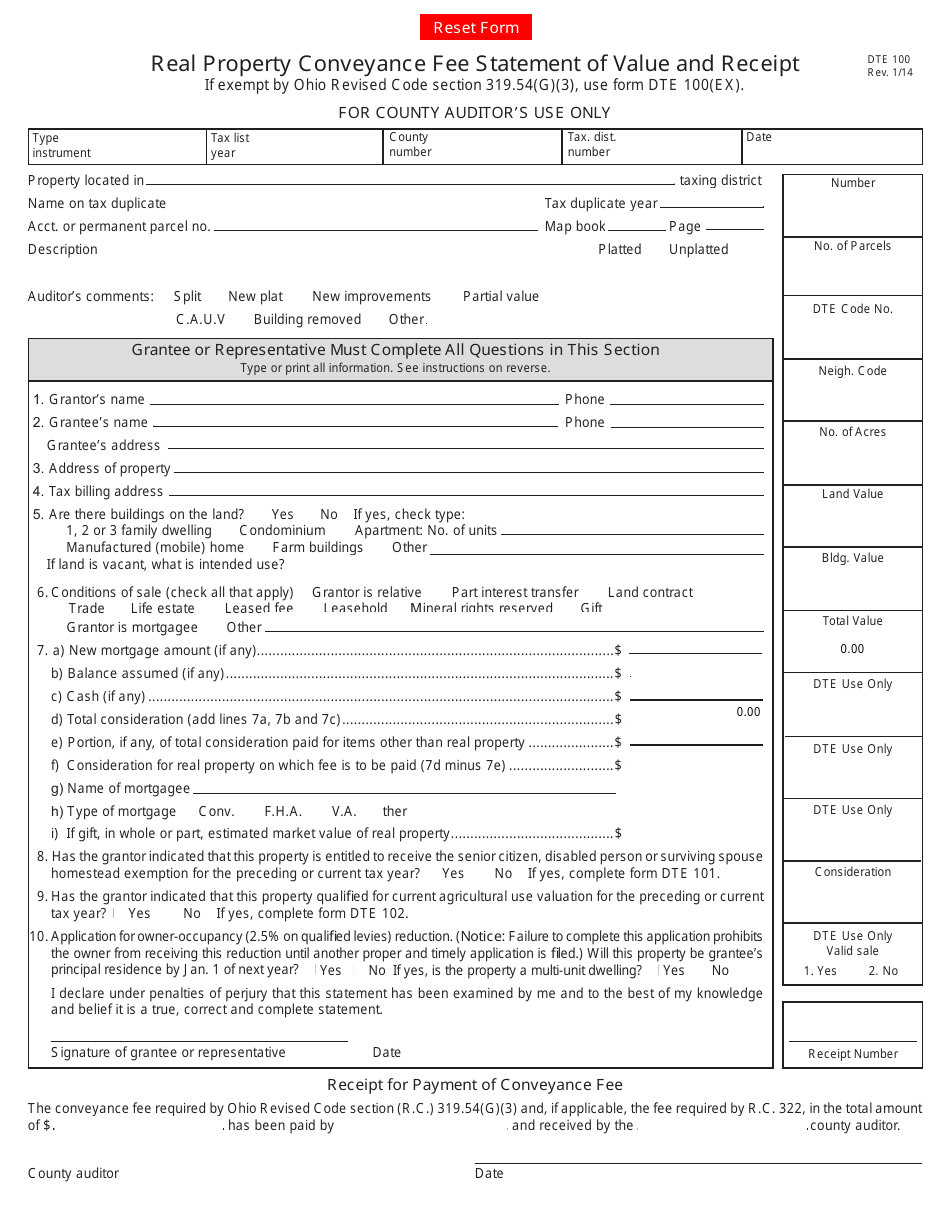

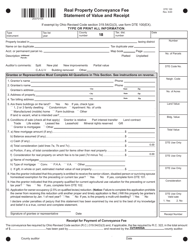

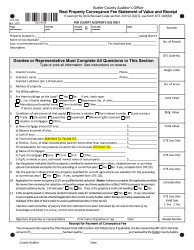

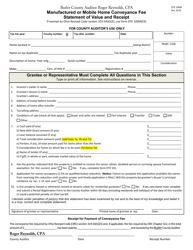

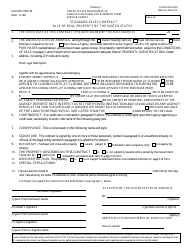

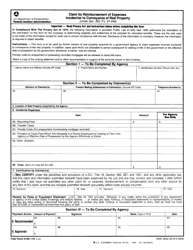

Form DTE100 Real Property Conveyance Fee Statement of Value and Receipt - Ohio

What Is Form DTE100?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a DTE100 form?

A: The DTE100 form is the Real PropertyConveyance Fee Statement of Value and Receipt in Ohio.

Q: What is the purpose of the DTE100 form?

A: The purpose of the DTE100 form is to report the sale or transfer of real property and pay the required conveyance fee.

Q: Who needs to file the DTE100 form?

A: The seller or transferor of real property in Ohio needs to file the DTE100 form.

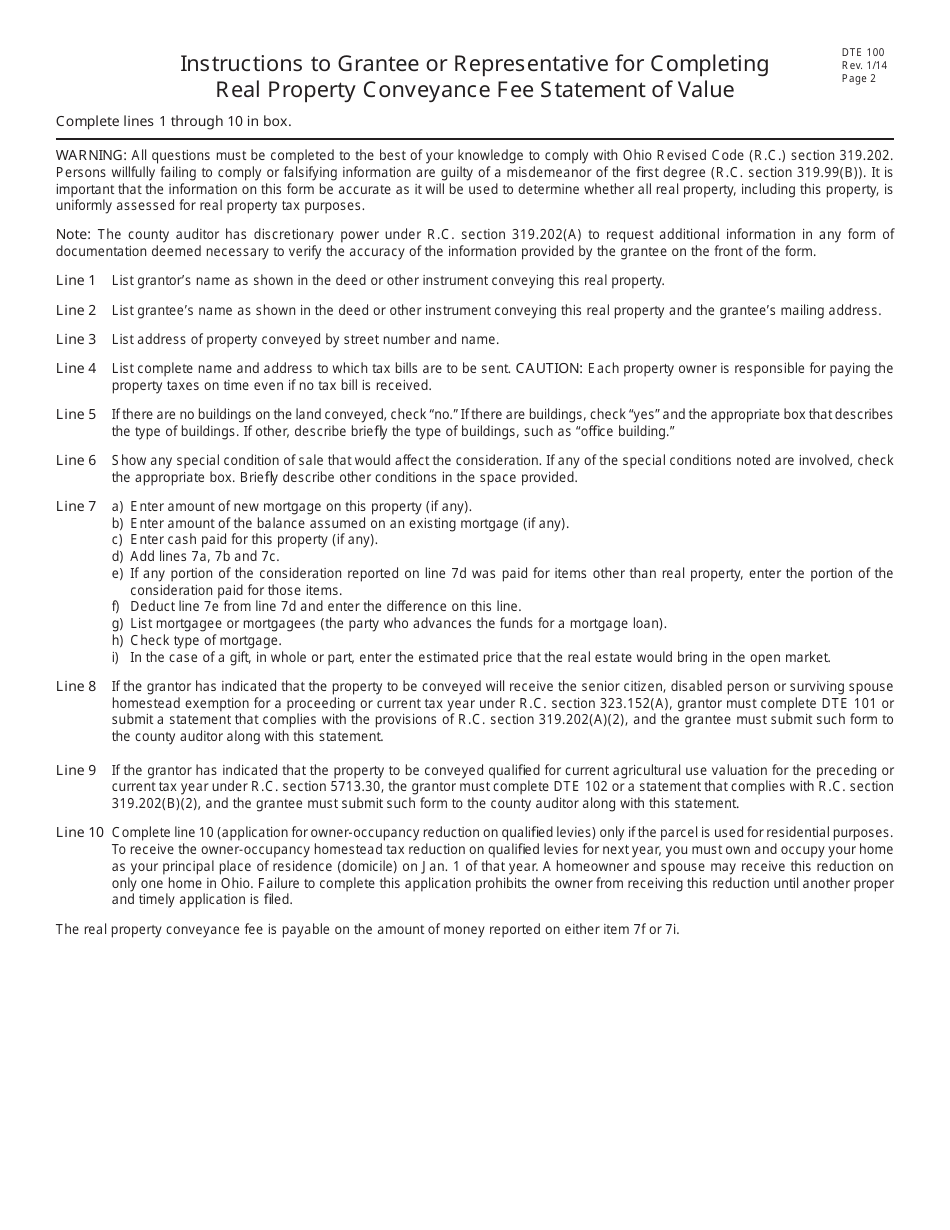

Q: What information is required on the DTE100 form?

A: The DTE100 form requires information such as the property address, sale price, and buyer information.

Q: How is the conveyance fee calculated?

A: The conveyance fee is calculated based on the sale price or value of the property being transferred.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE100 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.