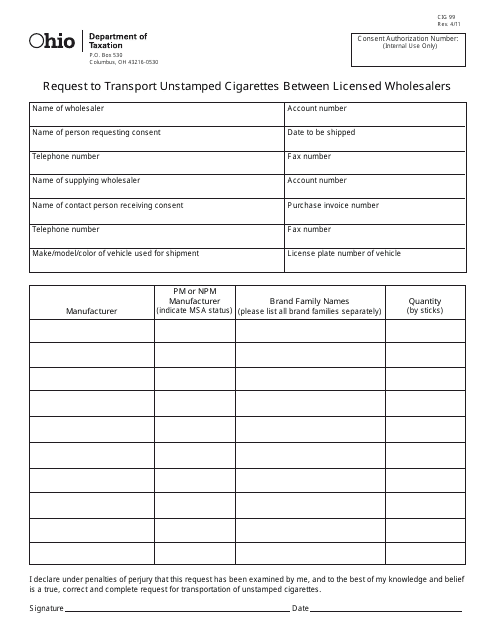

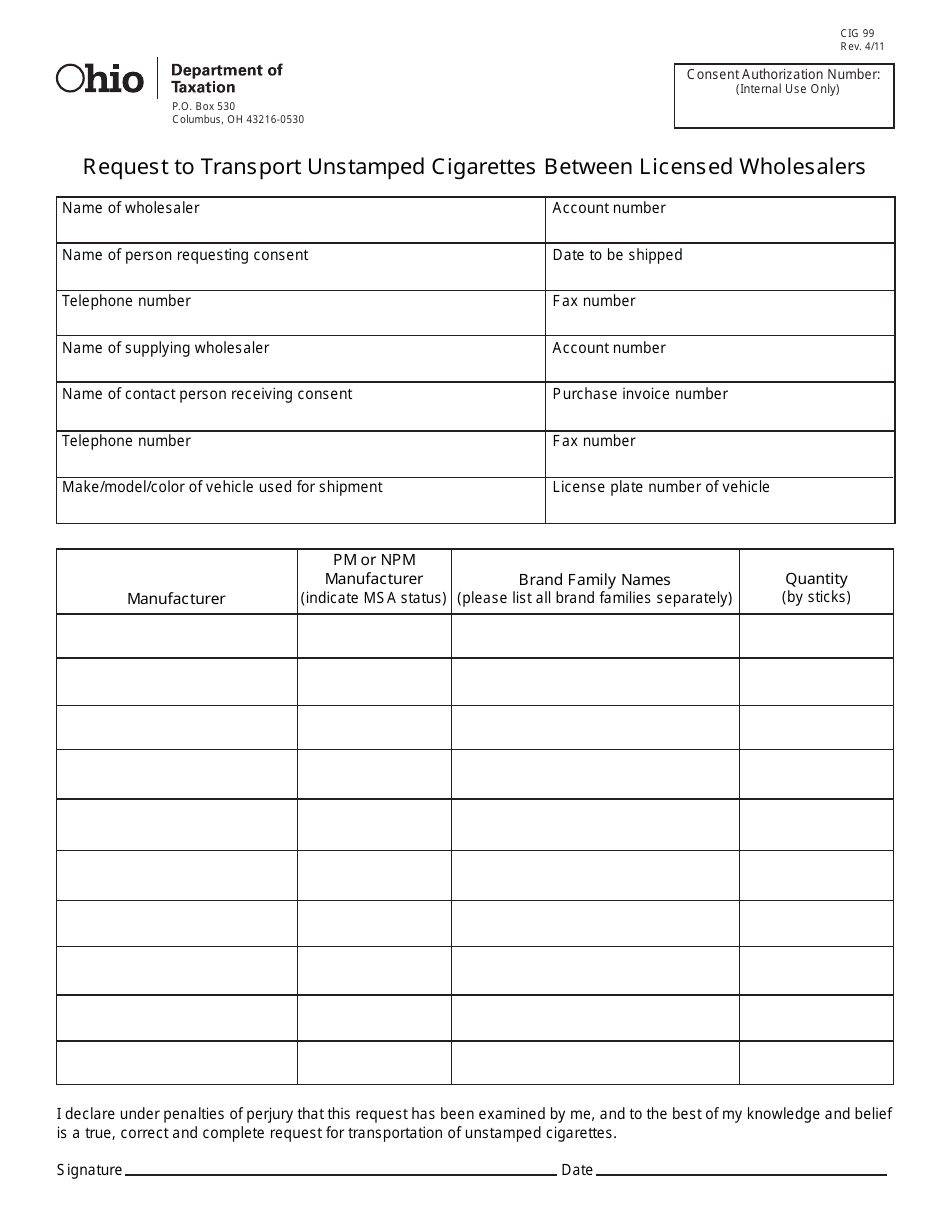

Form CIG99 Request to Transport Unstamped Cigarettes Between Licensed Wholesalers - Ohio

What Is Form CIG99?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CIG99 form?

A: The CIG99 form is a request form to transport unstamped cigarettes between licensed wholesalers in Ohio.

Q: Who needs to use the CIG99 form?

A: Licensed wholesalers in Ohio who want to transport unstamped cigarettes.

Q: What does the CIG99 form allow?

A: The form allows licensed wholesalers to transport unstamped cigarettes between their licensed locations.

Q: Why is the CIG99 form required?

A: The form is required by the Ohio Department of Taxation to ensure compliance with state tobacco tax laws.

Q: Are there any fees associated with the CIG99 form?

A: There are no fees associated with submitting the form.

Q: Can I transport unstamped cigarettes without the CIG99 form?

A: No, transporting unstamped cigarettes without the CIG99 form is illegal in Ohio.

Q: What are the consequences of not using the CIG99 form?

A: Not using the CIG99 form can result in penalties and fines for violating Ohio's tobacco tax laws.

Q: Can I use the CIG99 form to transport cigarettes outside of Ohio?

A: No, the CIG99 form is specific to transporting cigarettes between licensed wholesalers in Ohio only.

Q: How long is the CIG99 form valid for?

A: The form is valid for 15 days from the date of issuance.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIG99 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.