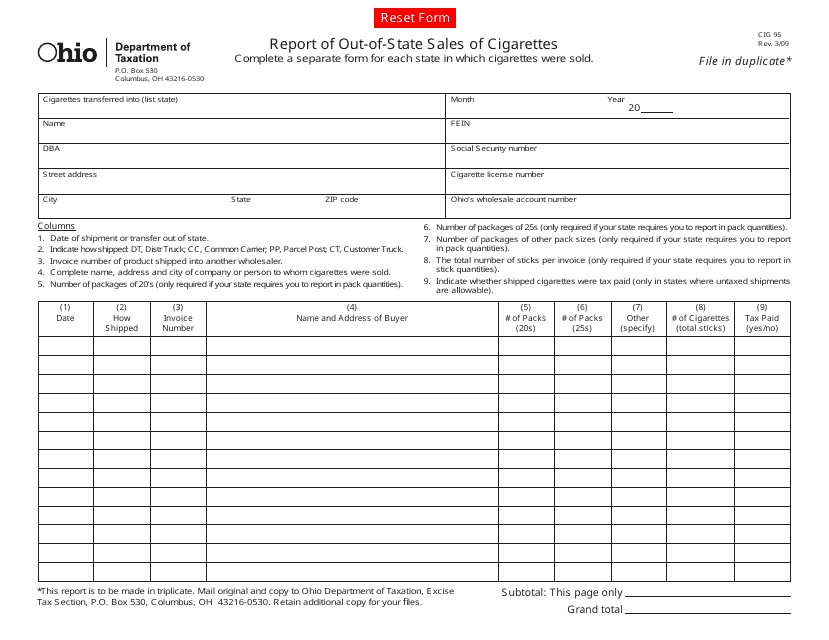

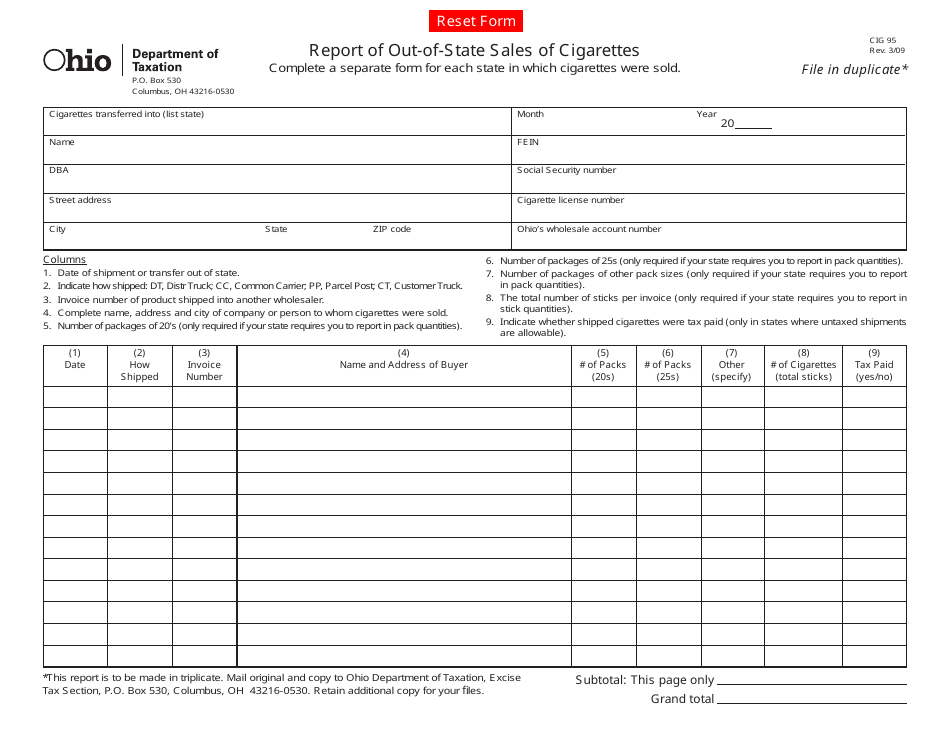

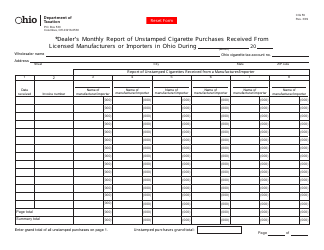

Form CIG95 Report of Out-of-State Sales of Cigarettes - Ohio

What Is Form CIG95?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the CIG95 Report of Out-of-State Sales of Cigarettes in Ohio?

A: The purpose of the CIG95 Report is to track and report out-of-state sales of cigarettes in Ohio.

Q: Who needs to file the CIG95 Report of Out-of-State Sales of Cigarettes in Ohio?

A: Any person or entity engaged in the sale of cigarettes to consumers in Ohio, including those located outside of the state, needs to file the CIG95 Report.

Q: When is the deadline to submit the CIG95 Report of Out-of-State Sales of Cigarettes in Ohio?

A: The CIG95 Report must be filed on or before the 10th day of each month for the previous month's sales.

Q: What information is required to be reported on the CIG95 Report of Out-of-State Sales of Cigarettes in Ohio?

A: The report requires information on the quantity and dollar value of cigarettes sold, as well as the buyer's name, address, and purchase location.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG95 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.