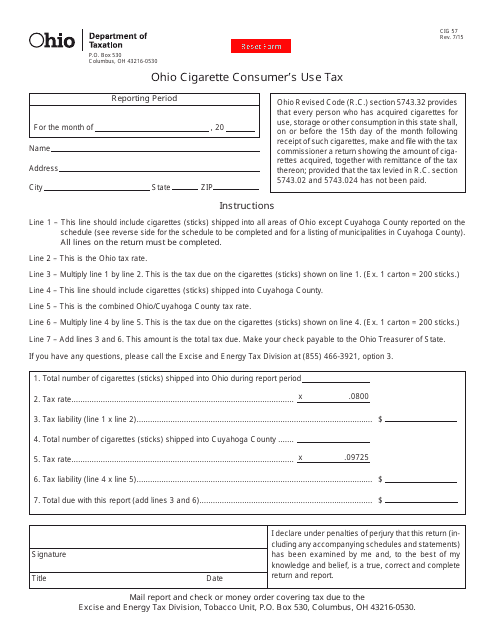

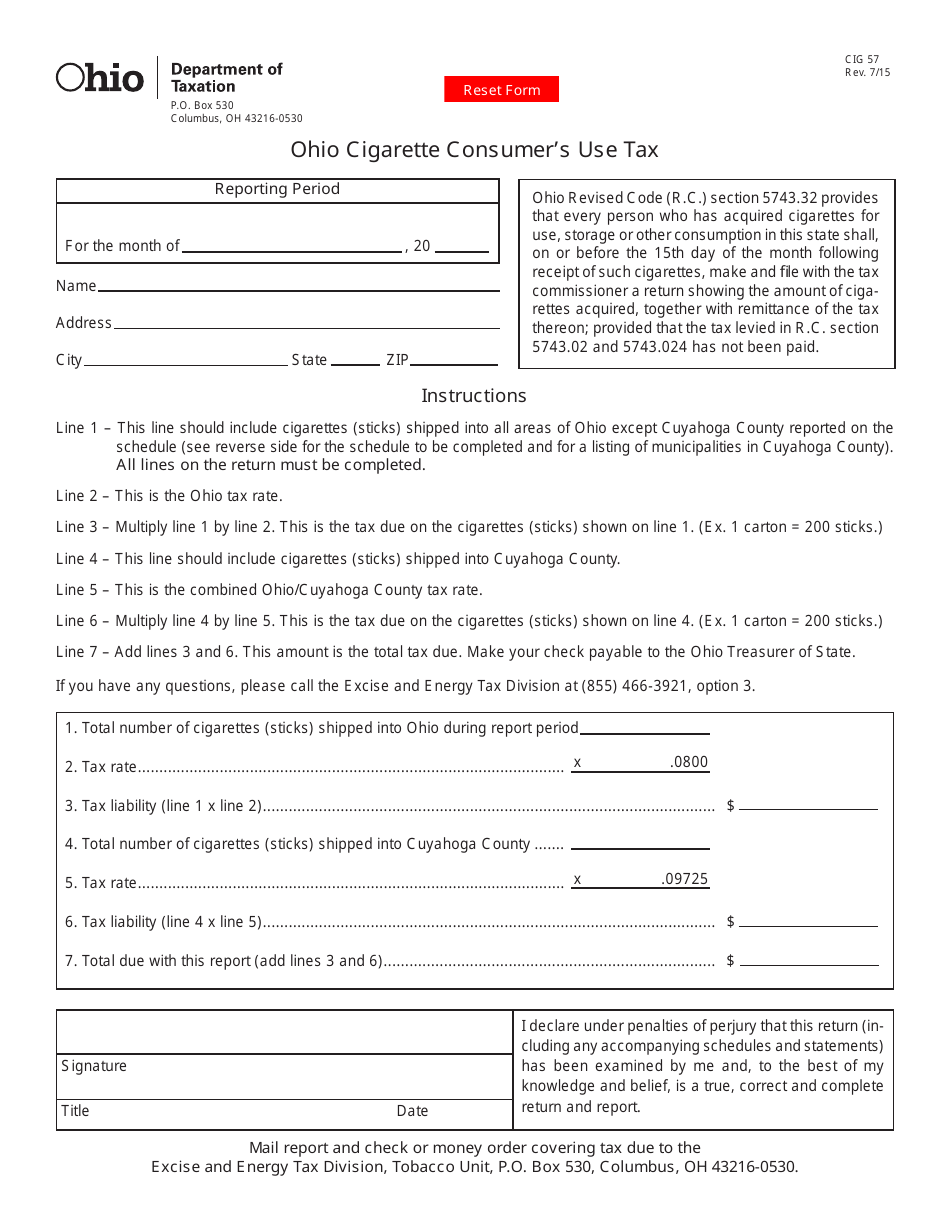

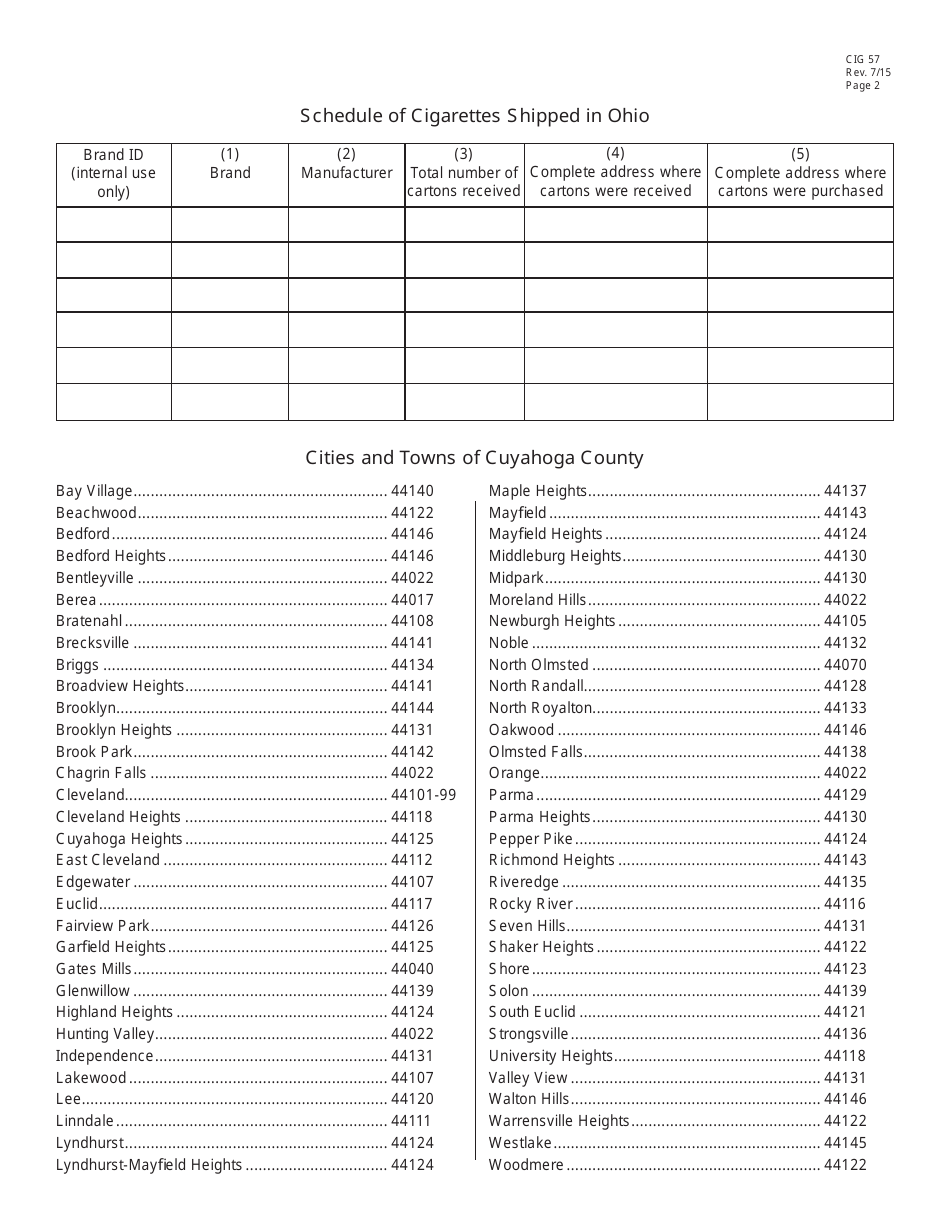

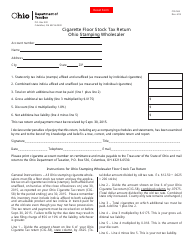

Form CIG57 Ohio Cigarette Consumer's Use Tax - Ohio

What Is Form CIG57?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

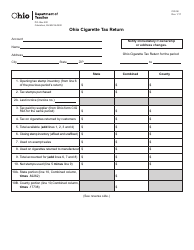

Q: What is CIG57 Ohio Cigarette Consumer's Use Tax?

A: CIG57 Ohio Cigarette Consumer's Use Tax is a tax imposed on cigarettes purchased for personal consumption in Ohio.

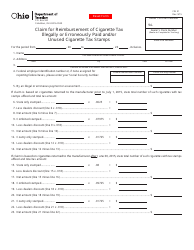

Q: Who needs to pay CIG57 Ohio Cigarette Consumer's Use Tax?

A: Any individual who purchases cigarettes for personal use in Ohio needs to pay CIG57 Ohio Cigarette Consumer's Use Tax.

Q: How is CIG57 Ohio Cigarette Consumer's Use Tax paid?

A: CIG57 Ohio Cigarette Consumer's Use Tax is paid by purchasing and affixing Ohio cigarette tax stamps to the cigarette packages.

Q: What is the rate of CIG57 Ohio Cigarette Consumer's Use Tax?

A: The rate of CIG57 Ohio Cigarette Consumer's Use Tax is $0.55 per pack of 20 cigarettes.

Q: What are the penalties for non-payment of CIG57 Ohio Cigarette Consumer's Use Tax?

A: The penalties for non-payment of CIG57 Ohio Cigarette Consumer's Use Tax include fines and potential criminal charges.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG57 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.