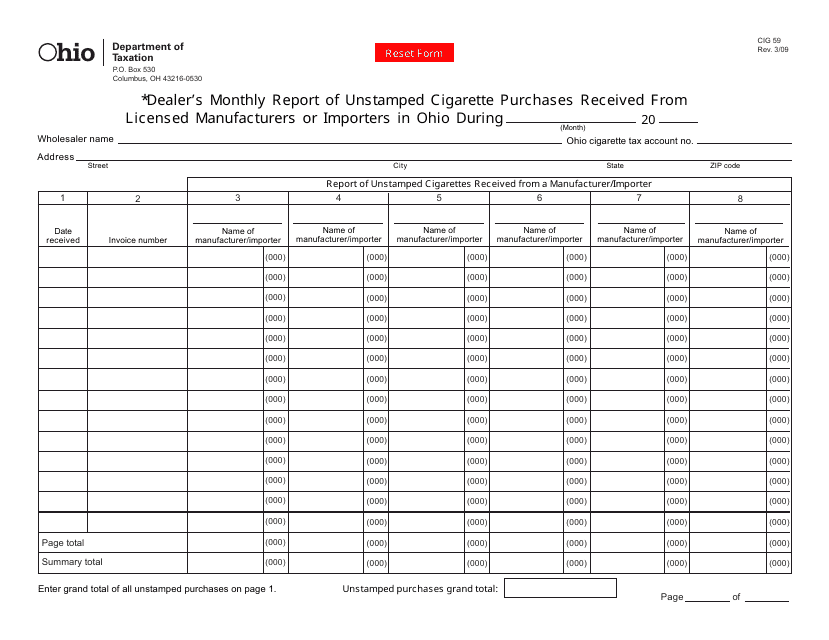

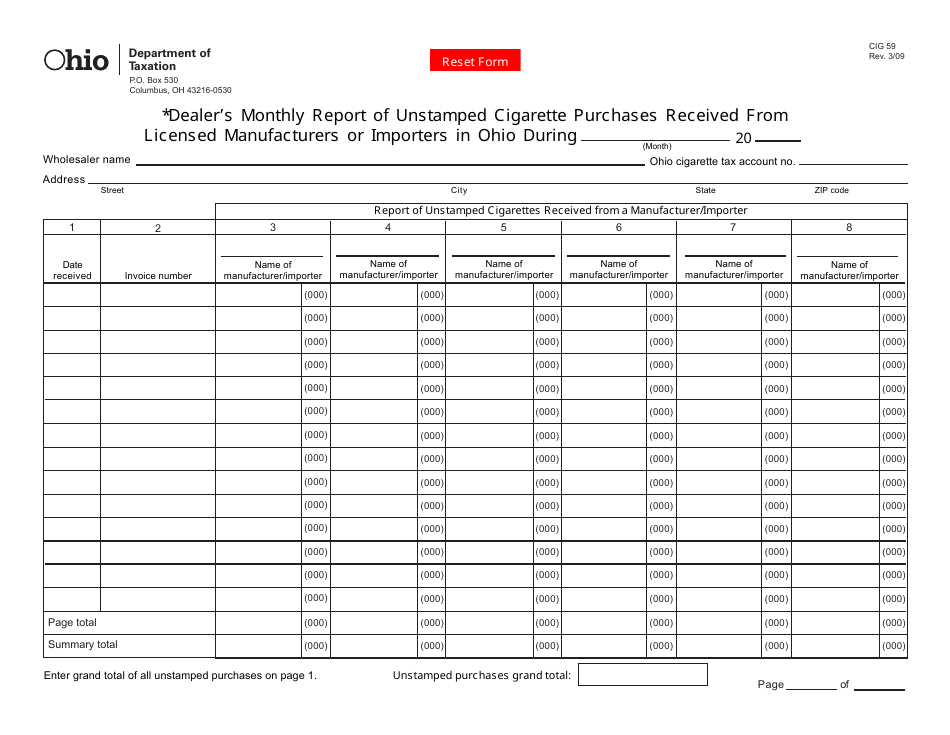

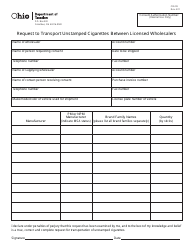

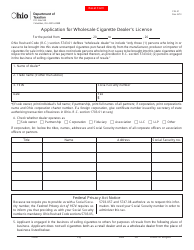

Form CIG59 Dealer's Monthly Report of Unstamped Cigarettes Received in Ohio - Ohio

What Is Form CIG59?

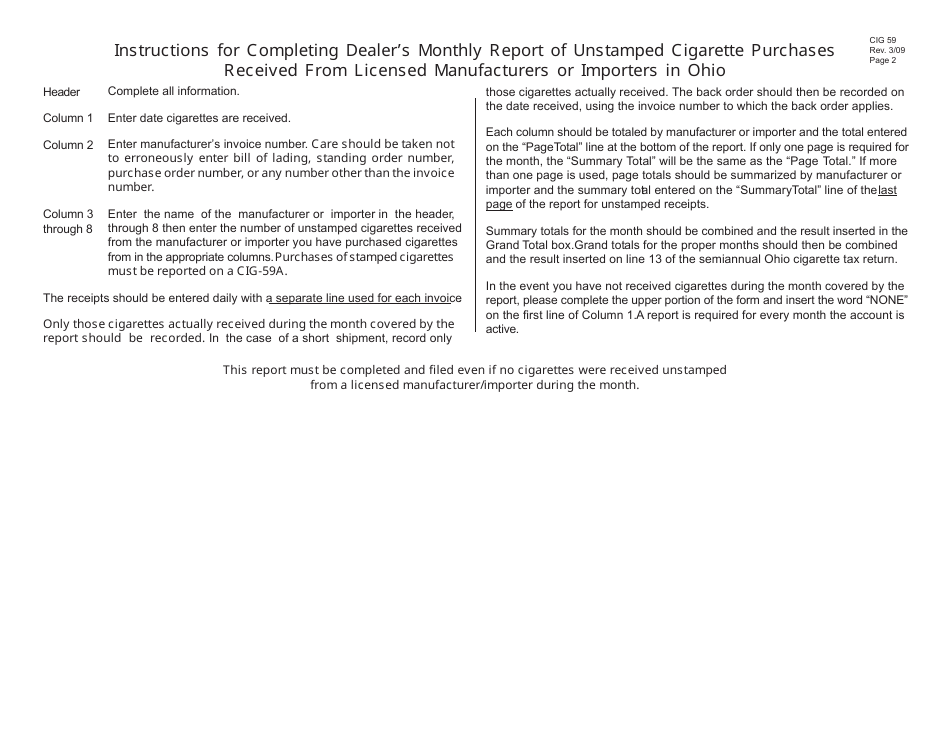

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG59?

A: Form CIG59 is the Dealer's Monthly Report of Unstamped Cigarettes Received in Ohio.

Q: Who needs to fill out Form CIG59?

A: Any dealer in Ohio who receives unstamped cigarettes needs to fill out Form CIG59.

Q: What is the purpose of Form CIG59?

A: Form CIG59 is used to report the quantity of unstamped cigarettes received by dealers in Ohio.

Q: When is Form CIG59 due?

A: Form CIG59 is due on or before the 10th day of the following month.

Q: Are there any penalties for not filing Form CIG59?

A: Yes, failure to file Form CIG59 or providing false information can result in penalties and fines.

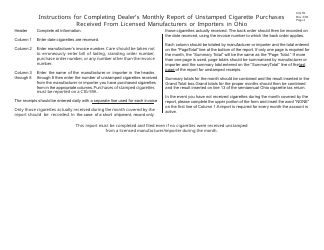

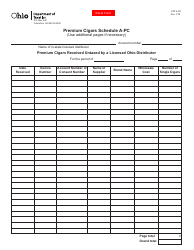

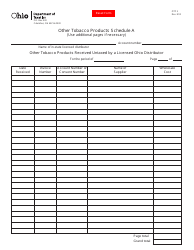

Q: What information needs to be included in Form CIG59?

A: Form CIG59 requires the dealer to provide information on the quantity and source of unstamped cigarettes received.

Q: Is Form CIG59 confidential?

A: The information provided on Form CIG59 may be subject to public disclosure under Ohio's public records laws.

Q: Are there any exemptions to filing Form CIG59?

A: Yes, there are a few exemptions for certain types of dealers. It is best to consult the Ohio Department of Taxation for specific details.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG59 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.