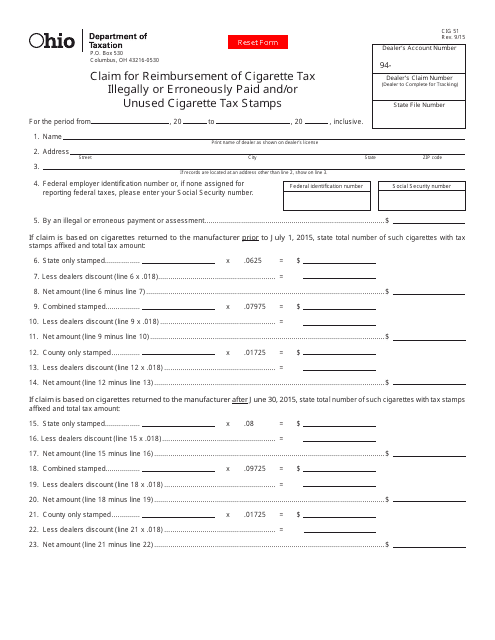

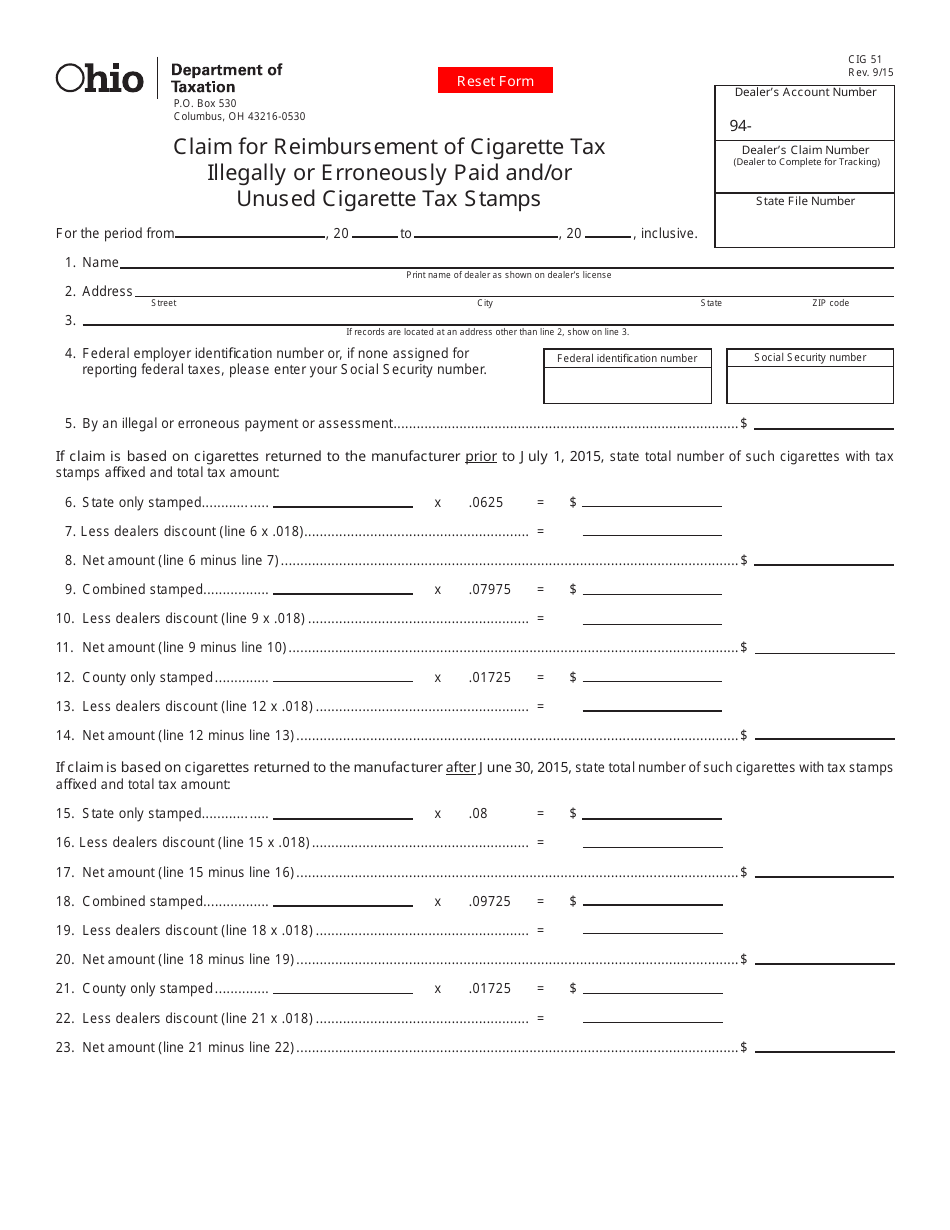

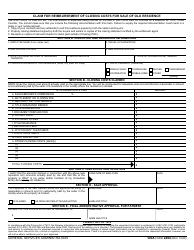

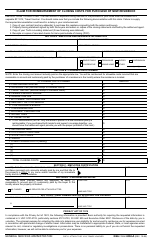

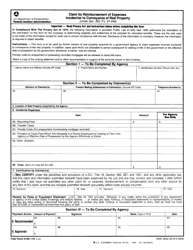

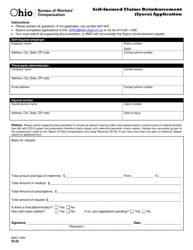

Form CIG51 Claim for Reimbursement of Cigarette Tax Illegally or Erroneously Paid and / or Unused Cigarette Tax Stamps - Ohio

What Is Form CIG51?

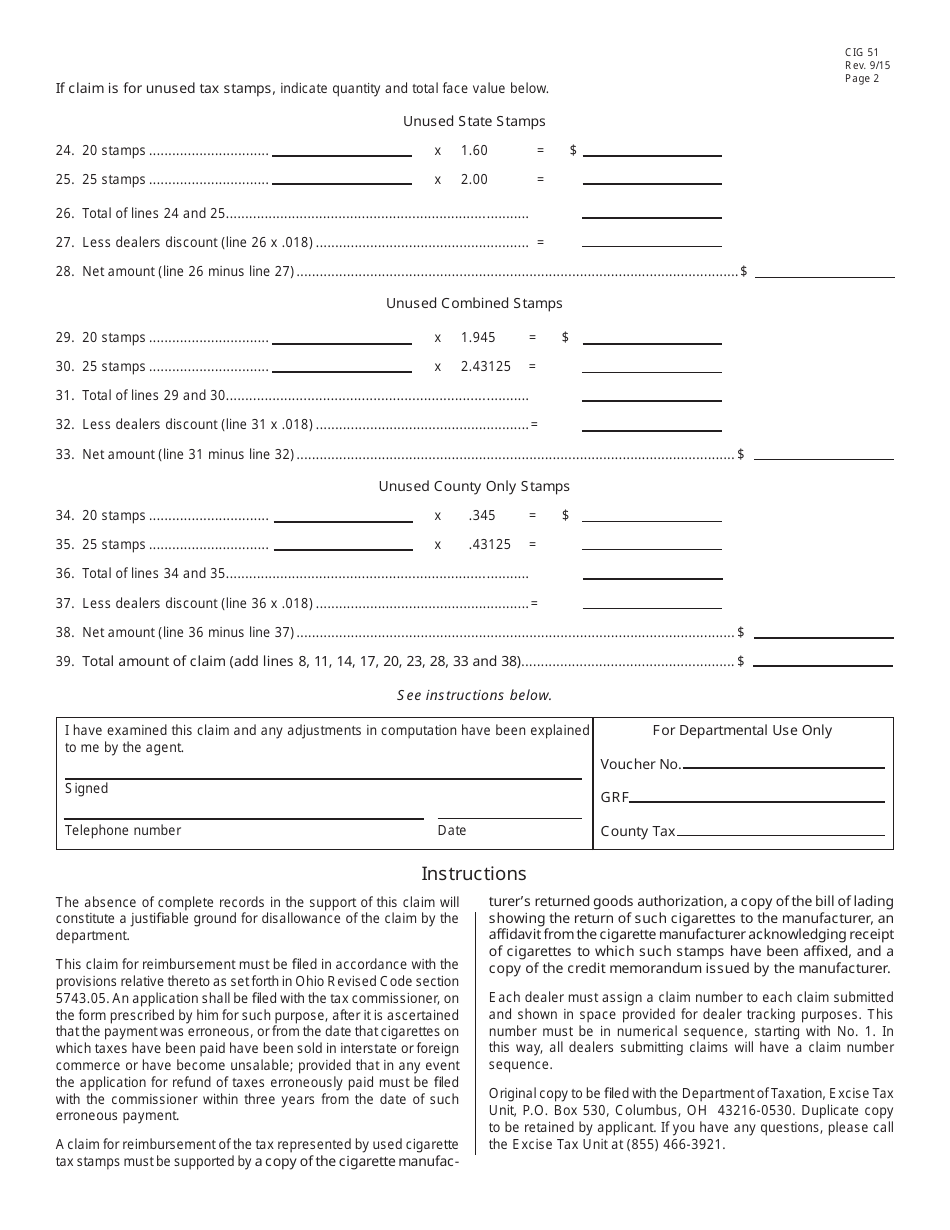

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG51?

A: Form CIG51 is a claim form for reimbursement of cigarette tax illegally or erroneously paid and/or unused cigarette tax stamps in the state of Ohio.

Q: Who can use Form CIG51?

A: Any individual or entity who has paid cigarette tax in Ohio and believes it was done illegally or erroneously, or who has unused cigarette tax stamps, can use Form CIG51.

Q: What is the purpose of Form CIG51?

A: The purpose of Form CIG51 is to request reimbursement from the state of Ohio for cigarette tax paid illegally or erroneously, or to exchange unused cigarette tax stamps for a refund.

Q: What information is required on Form CIG51?

A: Form CIG51 requires information such as the claimant's name, contact information, details of the illegally or erroneously paid cigarette tax or unused tax stamps, and supporting documentation.

Q: Is there a deadline for submitting Form CIG51?

A: Yes, Form CIG51 must be submitted within three years from the date the cigarette tax was paid or the date the tax stamps were purchased.

Q: How long does it take to process a claim submitted on Form CIG51?

A: The processing time for a claim submitted on Form CIG51 can vary, but the Ohio Department of Taxation aims to process claims within 45 days of receipt.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG51 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.