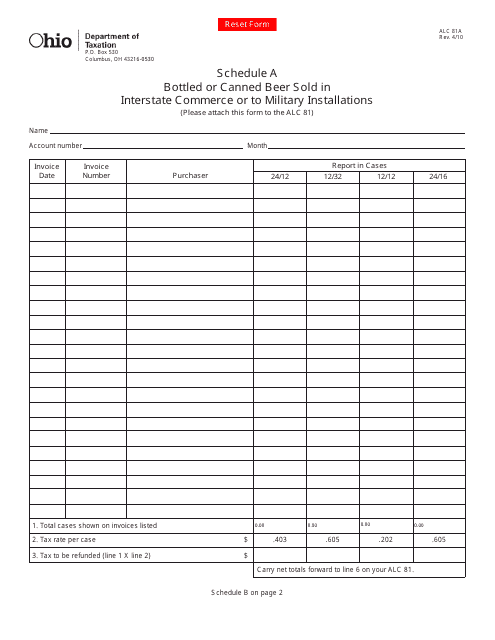

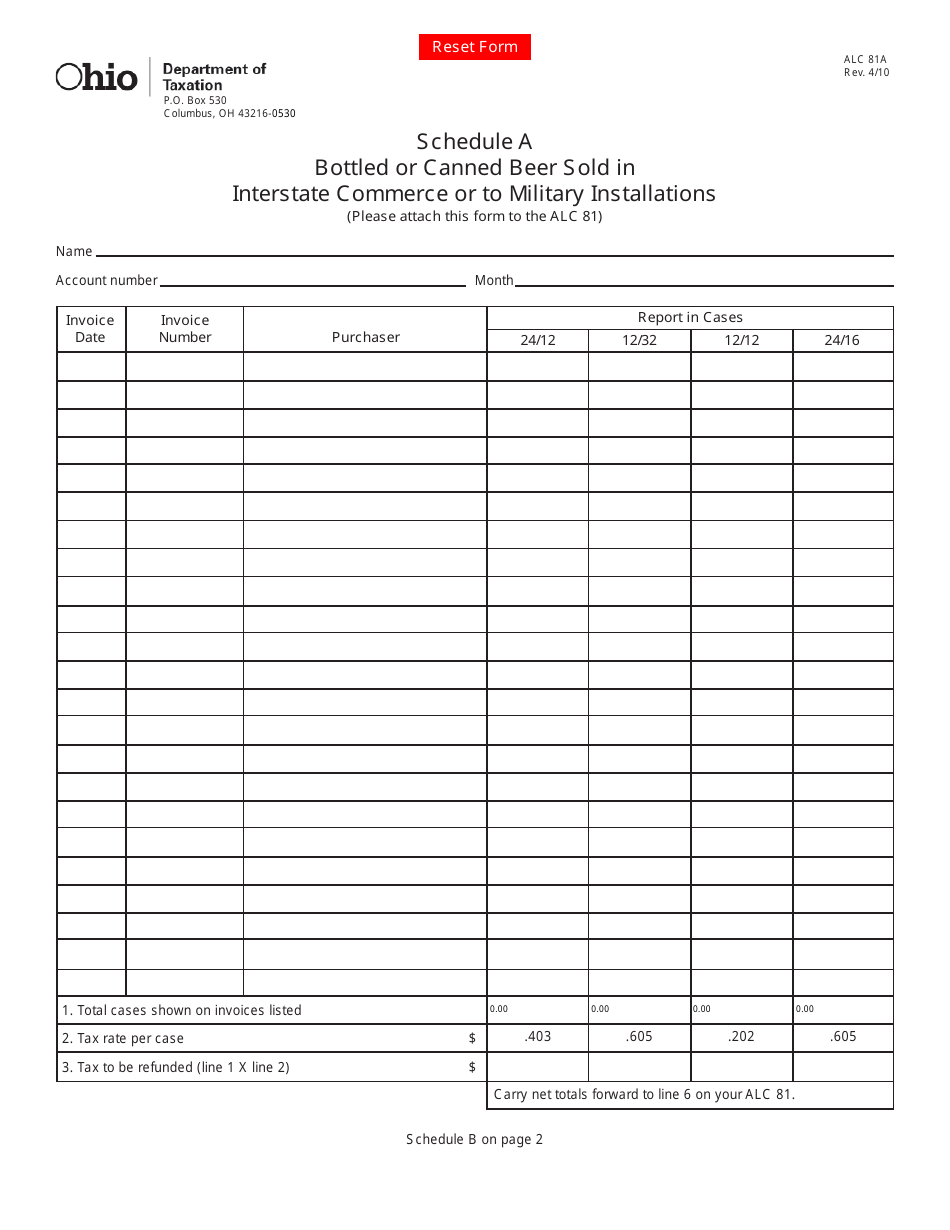

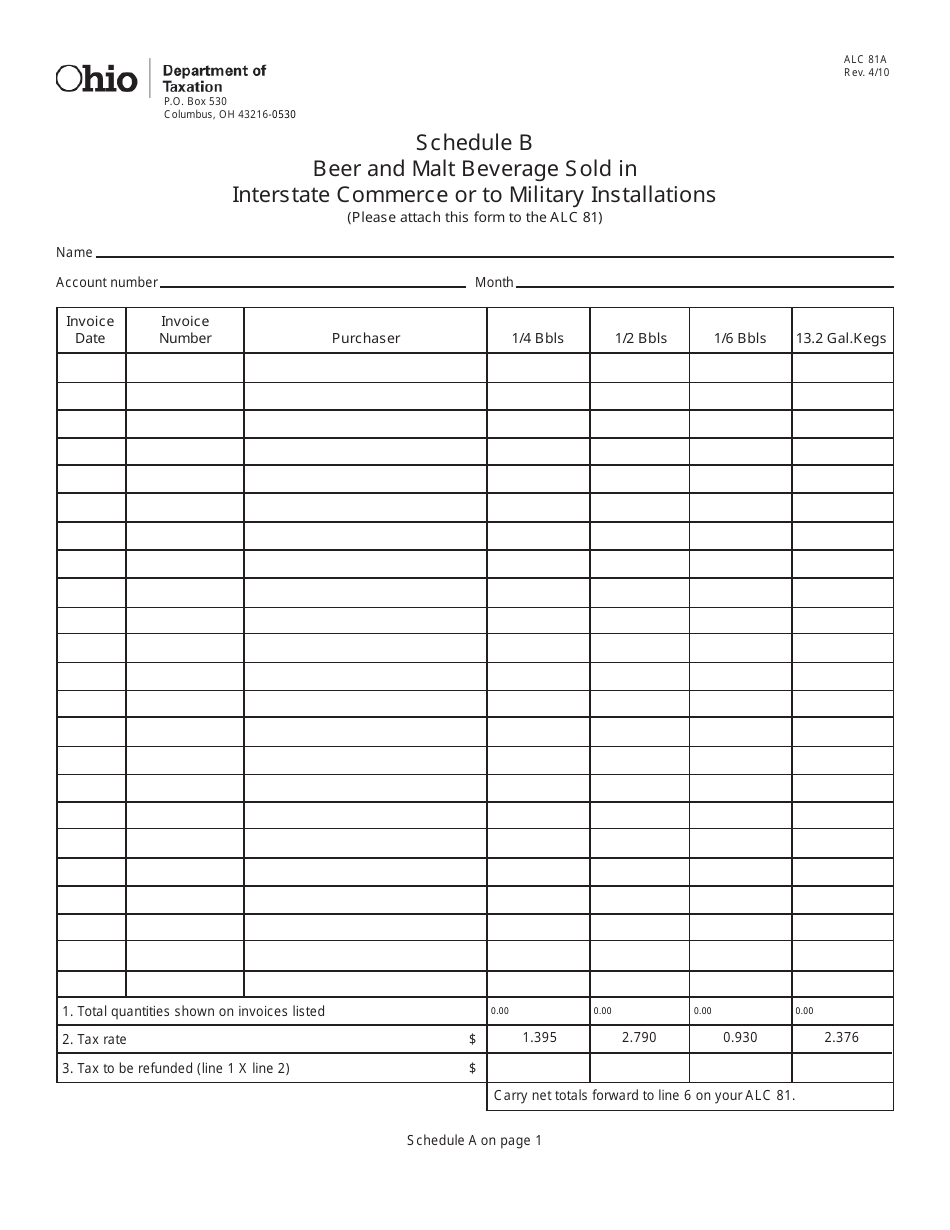

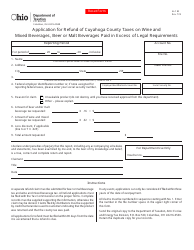

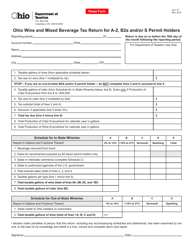

Form ALC81A Schedule A Bottled or Canned Beer Sold in Interstate Commerce or to Military Installations - Ohio

What Is Form ALC81A Schedule A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ALC81A?

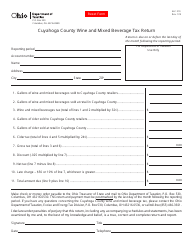

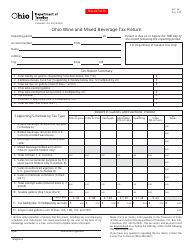

A: Form ALC81A is a schedule used to report the sales of bottled or canned beer in interstate commerce or to military installations in Ohio.

Q: Who needs to fill out Form ALC81A?

A: Businesses that sell bottled or canned beer in interstate commerce or to military installations in Ohio need to fill out Form ALC81A.

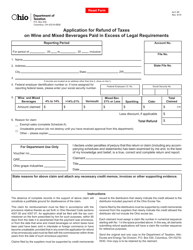

Q: What information is required on Form ALC81A?

A: Form ALC81A requires information such as the name and address of the wholesaler, the name and address of the purchaser, and the quantity and value of the beer sold.

Q: Are there any deadlines for filing Form ALC81A?

A: Yes, Form ALC81A must be filed on a monthly basis, and it must be submitted to the Ohio Department of Commerce, Division of Liquor Control by the 15th day of the following month.

Q: Are there any fees associated with filing Form ALC81A?

A: There are no fees associated with filing Form ALC81A.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC81A Schedule A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.