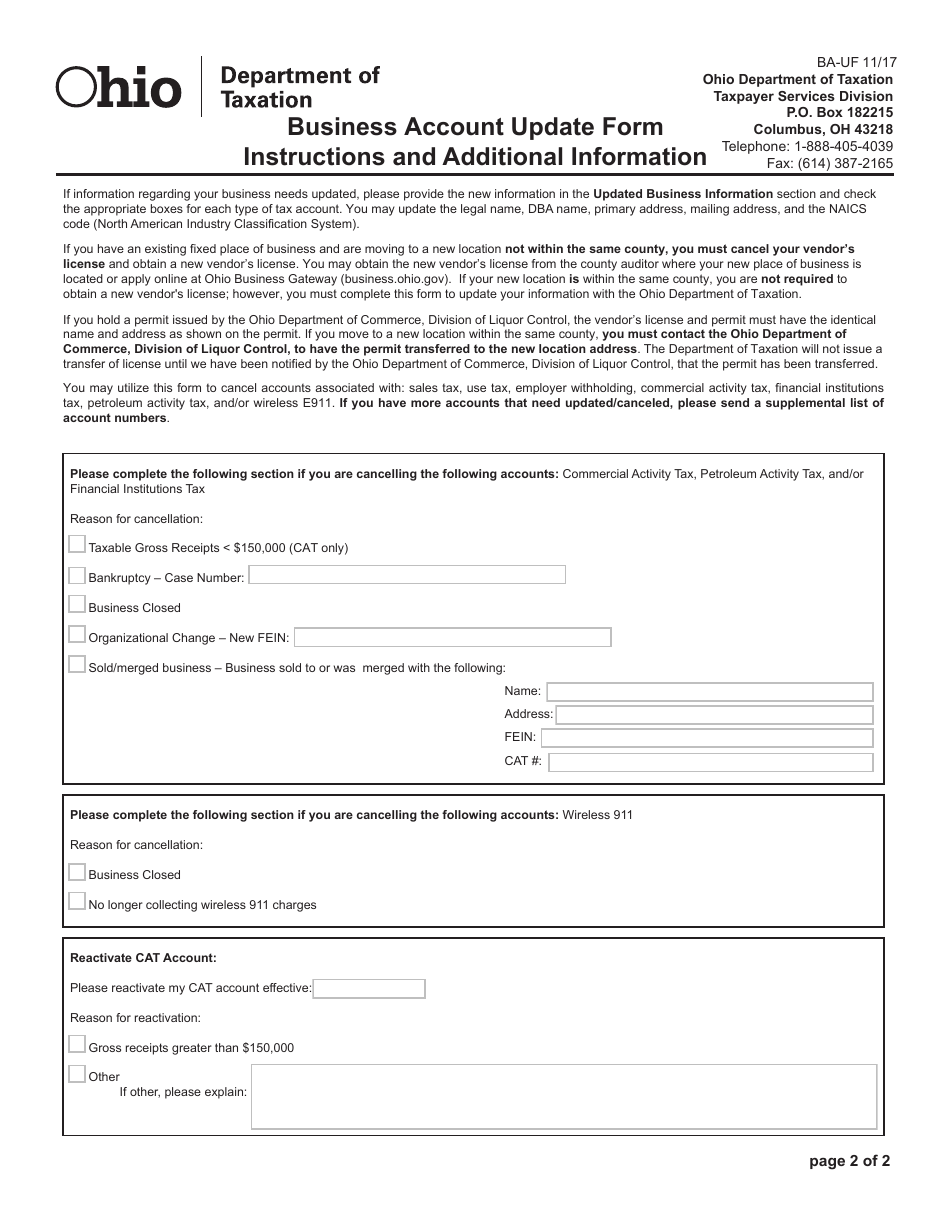

This version of the form is not currently in use and is provided for reference only. Download this version of

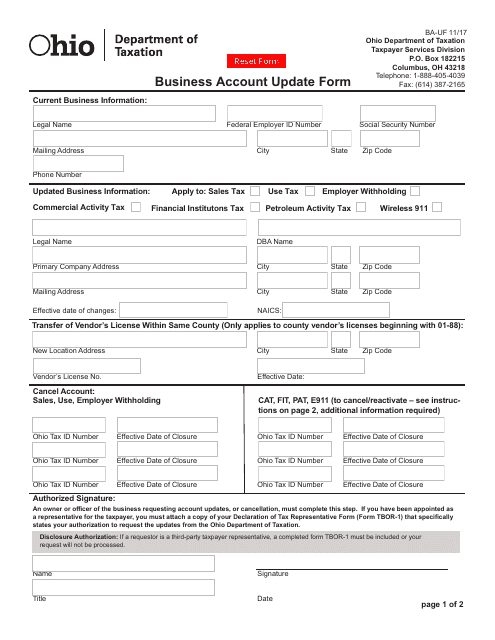

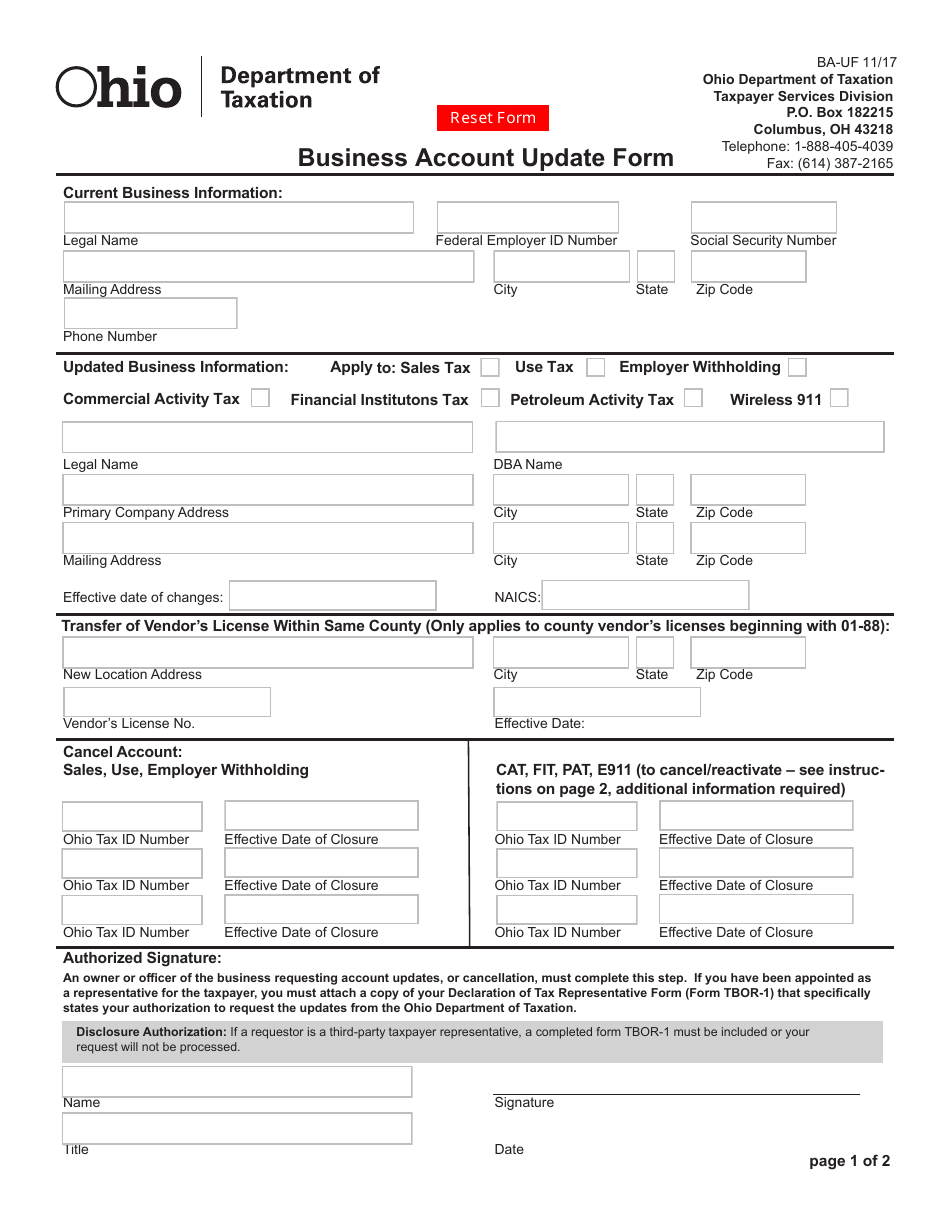

Form BA-UF

for the current year.

Form BA-UF Business Account Update Form - Ohio

What Is Form BA-UF?

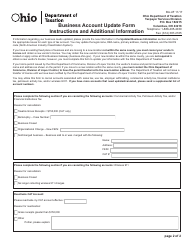

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BA-UF?

A: Form BA-UF is a Business Account Update Form in Ohio.

Q: What is the purpose of Form BA-UF?

A: The purpose of Form BA-UF is to update business account information in Ohio.

Q: Who needs to fill out Form BA-UF?

A: Businesses in Ohio that need to update their account information.

Q: Is there a fee to submit Form BA-UF?

A: There may be a fee associated with submitting Form BA-UF. Check the instructions or contact your local business registration office for more information.

Q: What information is required on Form BA-UF?

A: Form BA-UF requires information such as the business name, address, contact information, and any changes to the business structure or ownership.

Q: What should I do after submitting Form BA-UF?

A: After submitting Form BA-UF, make sure to keep a copy of the confirmation or receipt for your records. It is also recommended to follow up with the business registration office to ensure the changes have been processed.

Q: Are there any penalties for not updating business account information in Ohio?

A: Yes, there may be penalties for not updating business account information in Ohio. It is important to stay compliant with the state's requirements.

Q: Can I use Form BA-UF for other states besides Ohio?

A: No, Form BA-UF is specific to Ohio. Other states may have their own forms for updating business account information.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BA-UF by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.