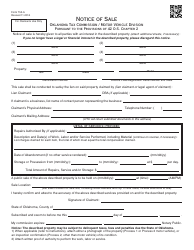

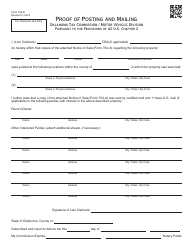

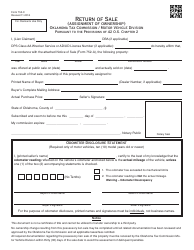

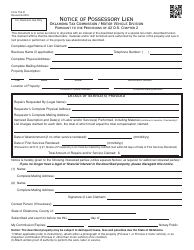

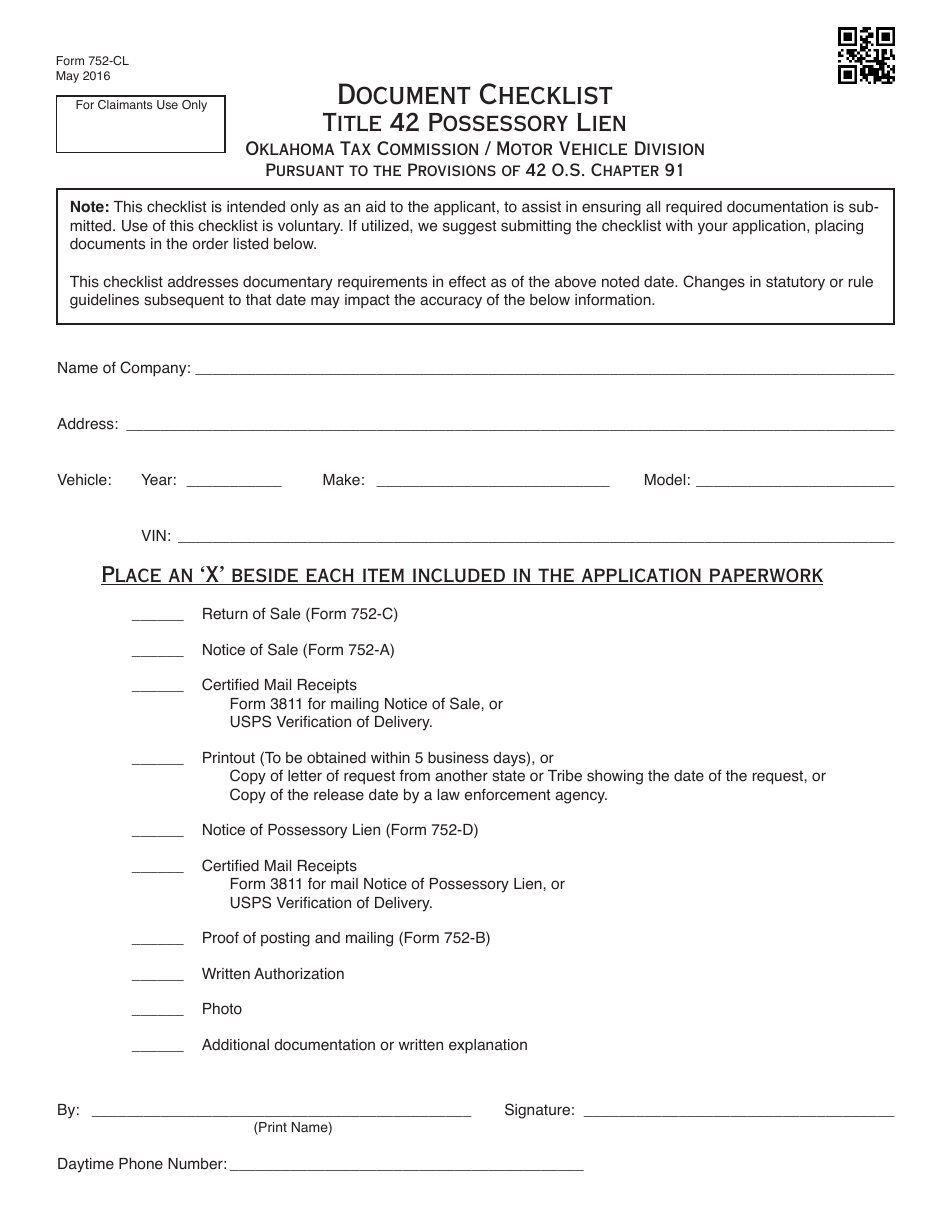

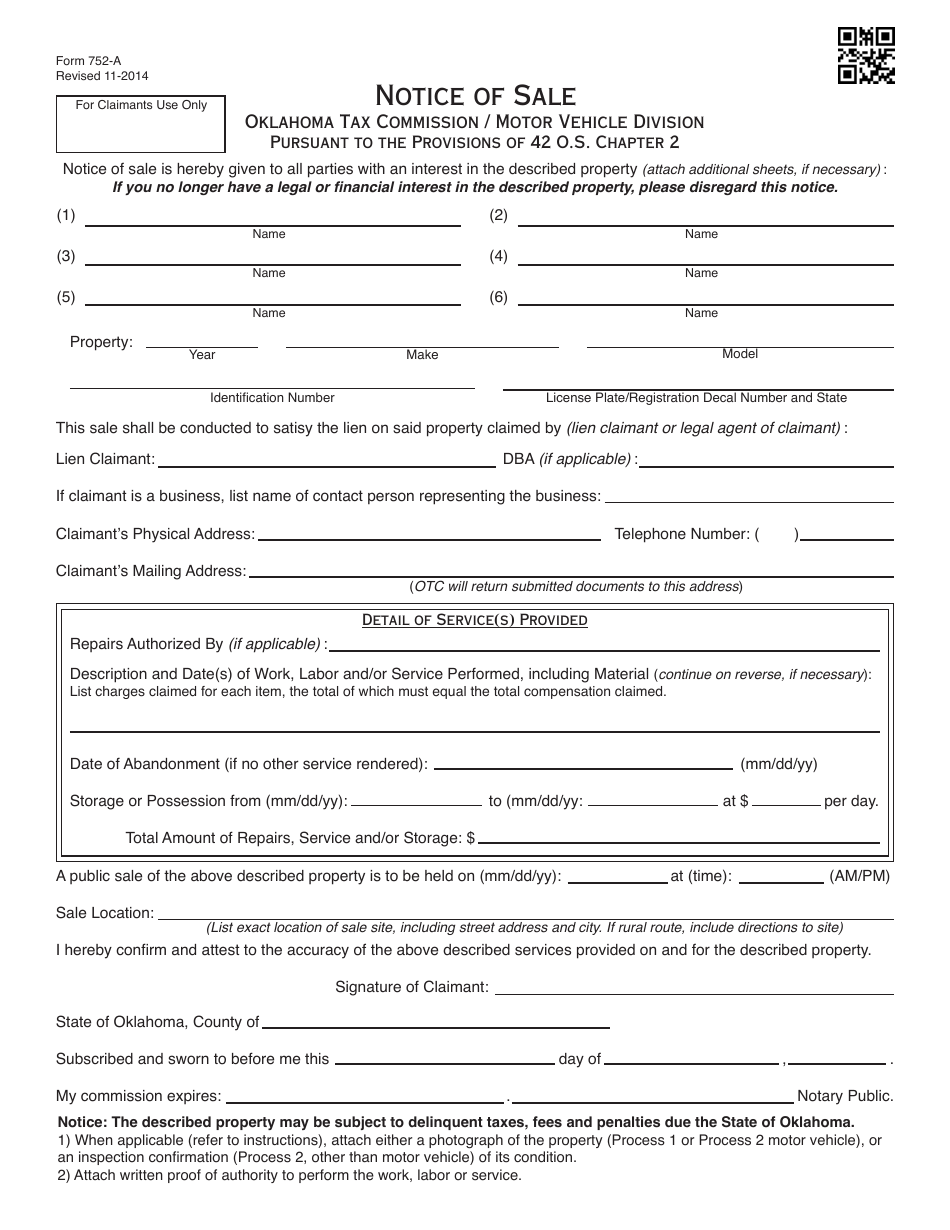

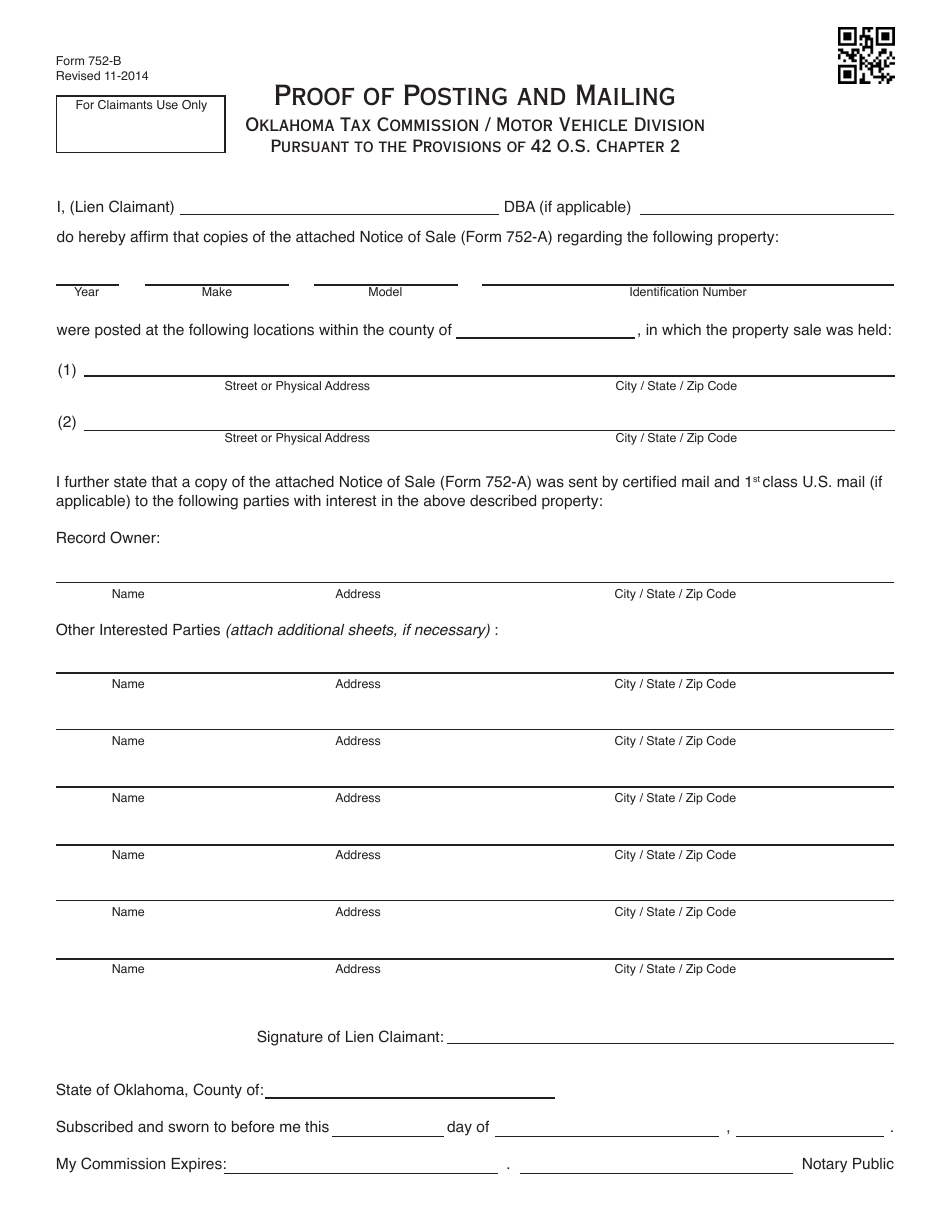

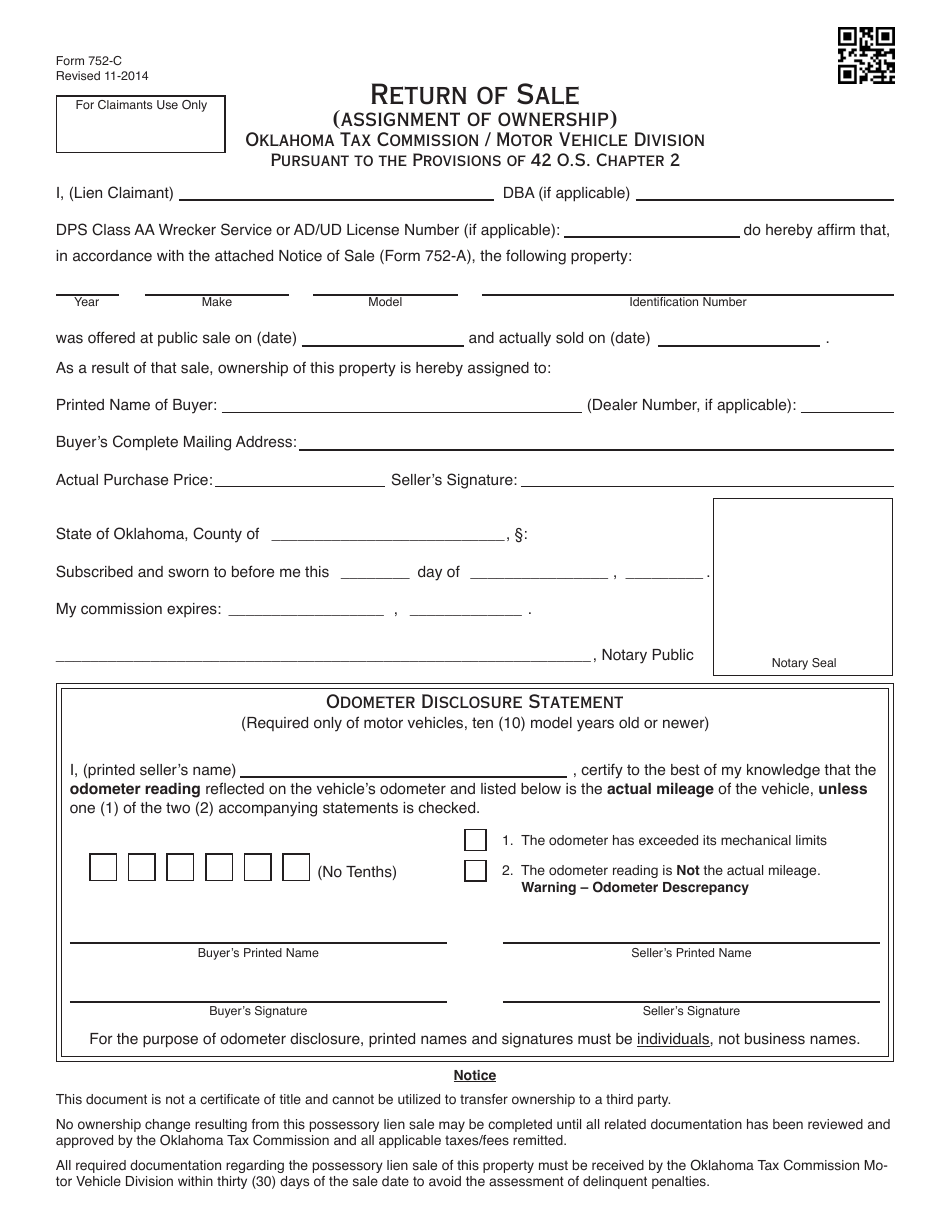

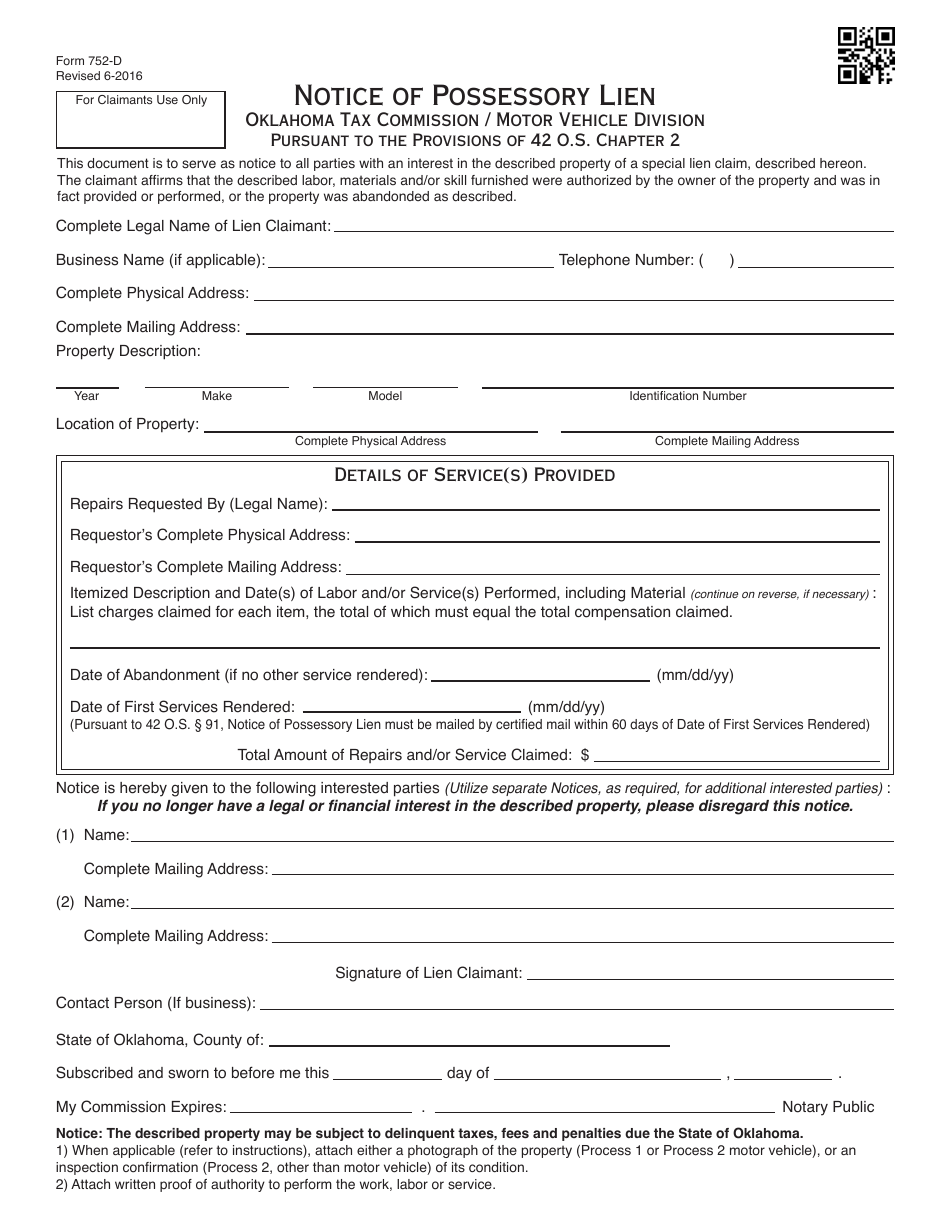

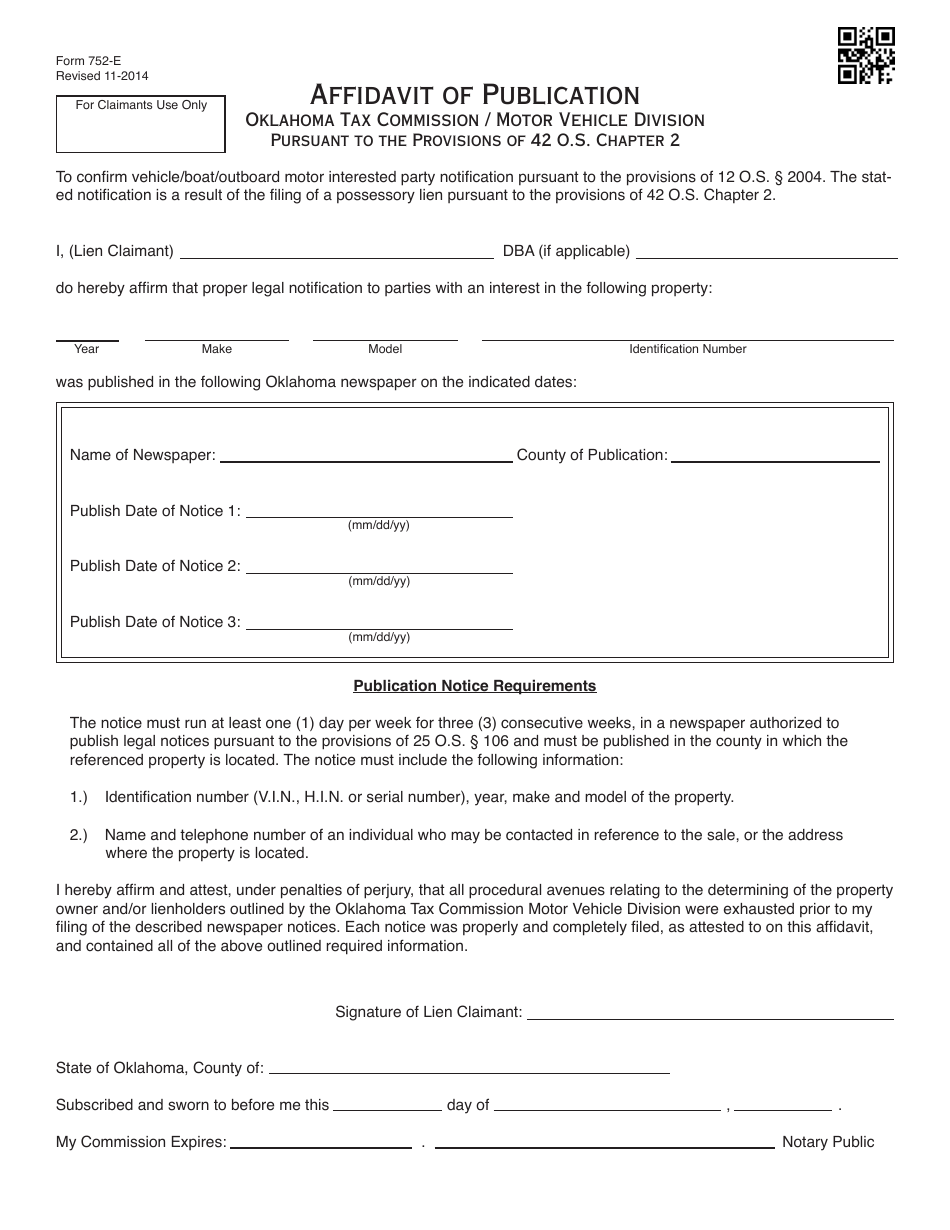

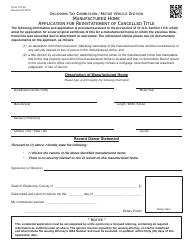

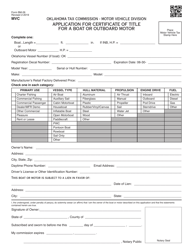

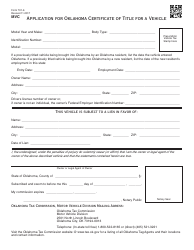

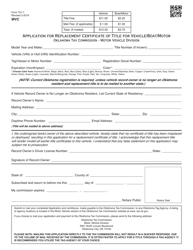

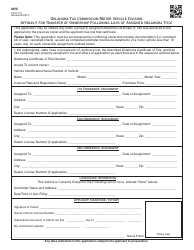

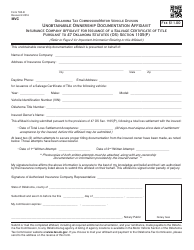

OTC Form 752 Title 42 Possessory Lien Procedures on Vehicles, Manufactured Homes, Commercial Trailers, Boats and Outboard Motors - Oklahoma

What Is OTC Form 752?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 752?

A: OTC Form 752 is a form used in Oklahoma for Possessory Lien Procedures on Vehicles, Manufactured Homes, Commercial Trailers, Boats and Outboard Motors.

Q: Who can use OTC Form 752?

A: OTC Form 752 can be used by individuals or businesses in Oklahoma who want to assert a possessory lien on vehicles, manufactured homes, commercial trailers, boats, or outboard motors.

Q: What is a possessory lien?

A: A possessory lien is a legal right to retain possession of someone's property until a debt is paid.

Q: What types of property can a possessory lien be asserted on with OTC Form 752?

A: OTC Form 752 can be used to assert a possessory lien on vehicles, manufactured homes, commercial trailers, boats, and outboard motors in Oklahoma.

Q: What is the purpose of OTC Form 752?

A: The purpose of OTC Form 752 is to provide a standardized procedure for asserting and enforcing possessory liens on certain types of property in Oklahoma.

Q: What information is required to complete OTC Form 752?

A: OTC Form 752 requires detailed information about the property, the owner, the lienholder, and the debt that is the basis for asserting the possessory lien.

Q: What can I do if someone asserts a possessory lien on my property using OTC Form 752?

A: If someone asserts a possessory lien on your property using OTC Form 752, you may have legal options to dispute or resolve the matter, such as contacting an attorney or filing a complaint with the appropriate authorities.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 752 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.