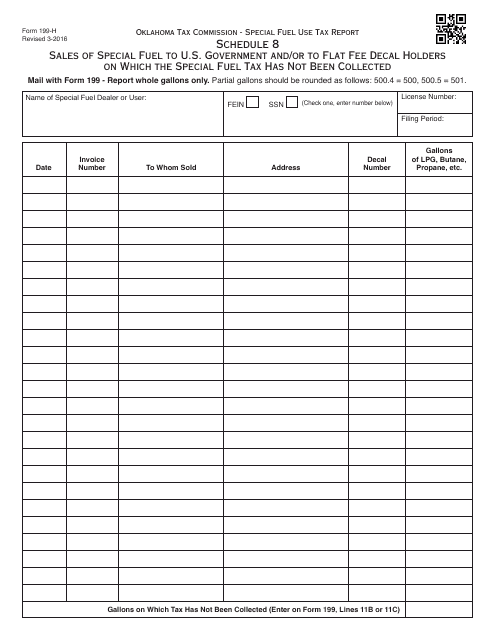

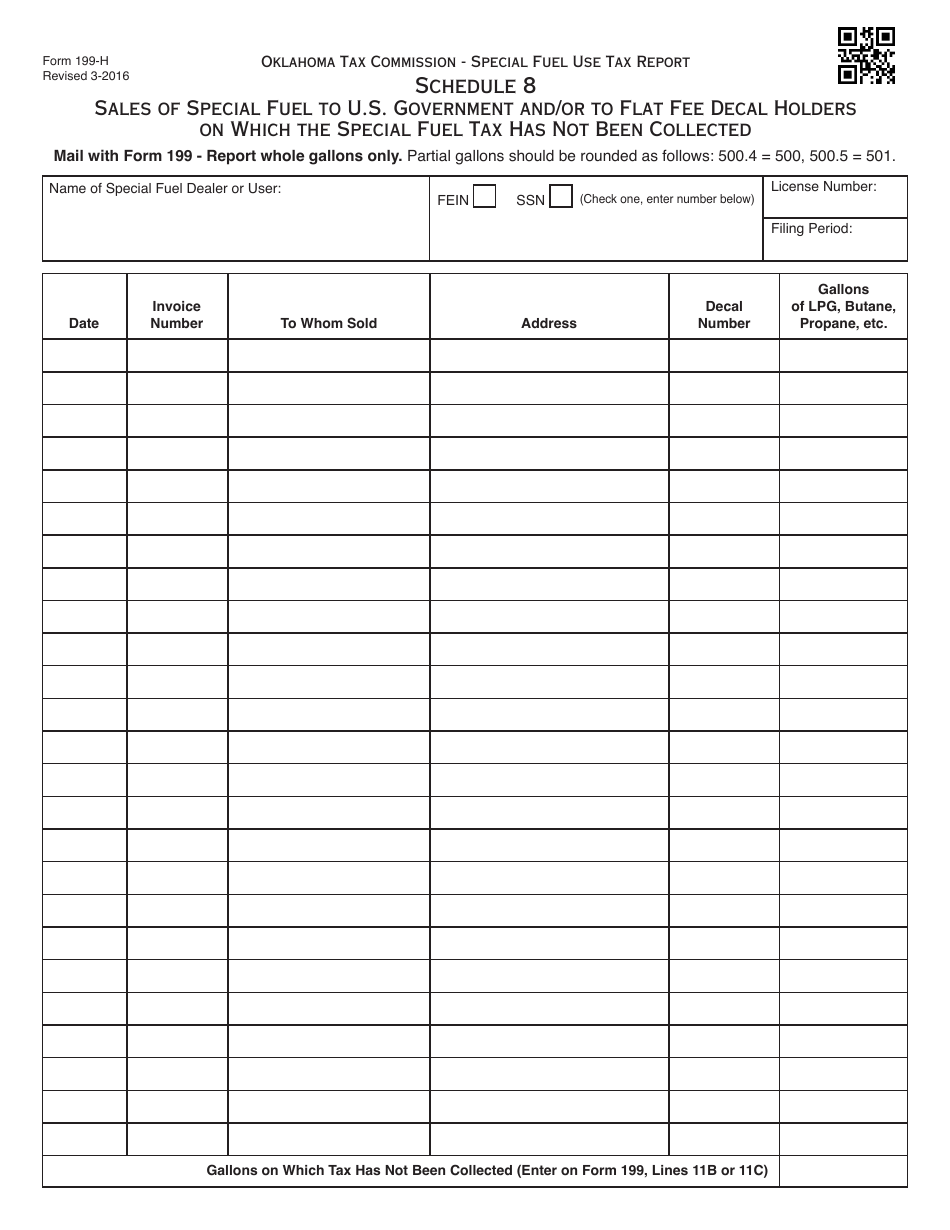

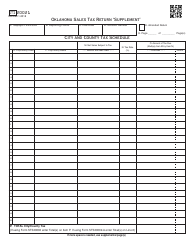

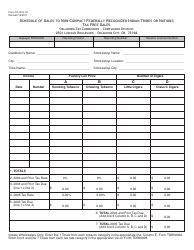

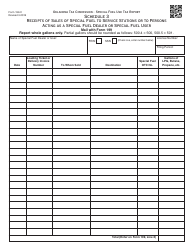

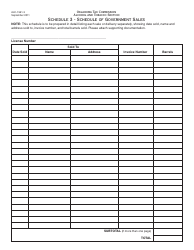

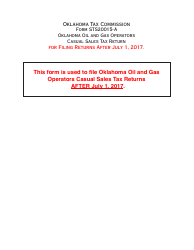

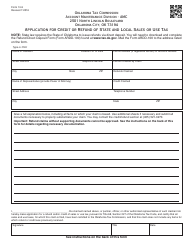

OTC Form 199-H Schedule 8 Sales of Special Fuel to U.S. Government and / or to Flat Fee Decal Holders on Which the Special Fuel Tax Has Not Been Collected - Oklahoma

What Is OTC Form 199-H Schedule 8?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 199-H Schedule 8?

A: OTC Form 199-H Schedule 8 is a form used in Oklahoma to report sales of special fuel to the U.S. Government and/or to Flat Fee Decal Holders on which the special fuel tax has not been collected.

Q: Who needs to fill out OTC Form 199-H Schedule 8?

A: Businesses or individuals who sell special fuel to the U.S. Government and/or to Flat Fee Decal Holders on which the special fuel tax has not been collected in Oklahoma need to fill out this form.

Q: What is special fuel?

A: Special fuel refers to motor fuel or diesel fuel that is not gasoline, and is used to power motor vehicles.

Q: What is a Flat Fee Decal?

A: A Flat Fee Decal is a special decal that allows certain vehicles to pay a flat fee instead of the regular motor fuel or diesel fuel tax.

Q: What is the purpose of OTC Form 199-H Schedule 8?

A: The purpose of this form is to report sales of special fuel to the U.S. Government and/or to Flat Fee Decal Holders on which the special fuel tax has not been collected, ensuring compliance with tax regulations.

Q: Are there any penalties for not filing OTC Form 199-H Schedule 8?

A: Yes, failure to file this form or filing it incorrectly may result in penalties and fines imposed by the Oklahoma Tax Commission.

Q: When is the deadline for filing OTC Form 199-H Schedule 8?

A: The deadline for filing this form is typically at the end of the month following the reporting period.

Q: Do I need to attach any supporting documents with OTC Form 199-H Schedule 8?

A: Yes, you may need to attach supporting documents such as invoices or sales records to support the information provided on the form.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 199-H Schedule 8 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.