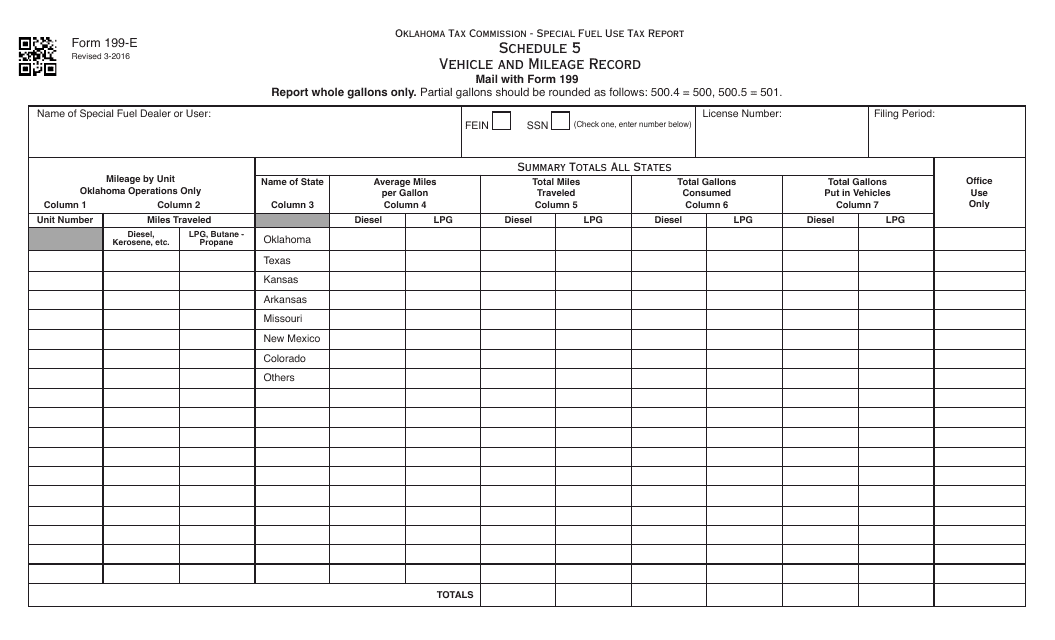

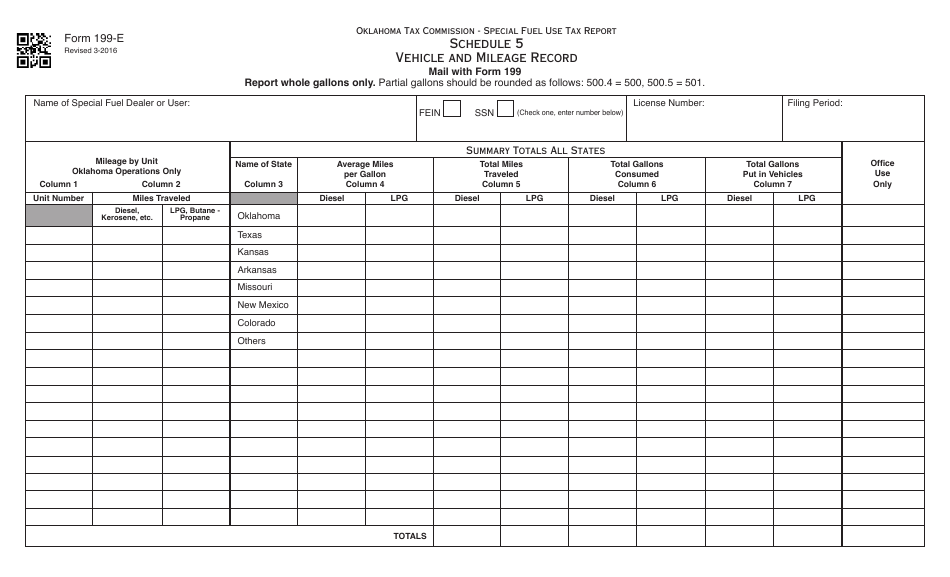

OTC Form 199-E Schedule 5 Vehicle and Mileage Record - Oklahoma

What Is OTC Form 199-E Schedule 5?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 199-E Schedule 5?

A: OTC Form 199-E Schedule 5 is a Vehicle and Mileage Record form used in Oklahoma.

Q: What is the purpose of OTC Form 199-E Schedule 5?

A: The purpose of OTC Form 199-E Schedule 5 is to record vehicle and mileage information.

Q: Who needs to use OTC Form 199-E Schedule 5?

A: Individuals and businesses in Oklahoma who need to keep a record of their vehicle and mileage information.

Q: What information do I need to provide on OTC Form 199-E Schedule 5?

A: You will need to provide information such as vehicle identification number (VIN), make and model of the vehicle, beginning and ending mileage, and the purpose of use.

Q: Do I need to keep a copy of OTC Form 199-E Schedule 5?

A: Yes, it is important to keep a copy of OTC Form 199-E Schedule 5 for your records.

Q: Are there any fees associated with OTC Form 199-E Schedule 5?

A: No, there are no fees associated with OTC Form 199-E Schedule 5.

Q: When do I need to submit OTC Form 199-E Schedule 5?

A: You are not required to submit OTC Form 199-E Schedule 5 to the Oklahoma Tax Commission, but you should keep it for your own records.

Q: What should I do if I made a mistake on OTC Form 199-E Schedule 5?

A: If you made a mistake, you can correct it by completing a new OTC Form 199-E Schedule 5 with the correct information.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 199-E Schedule 5 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.