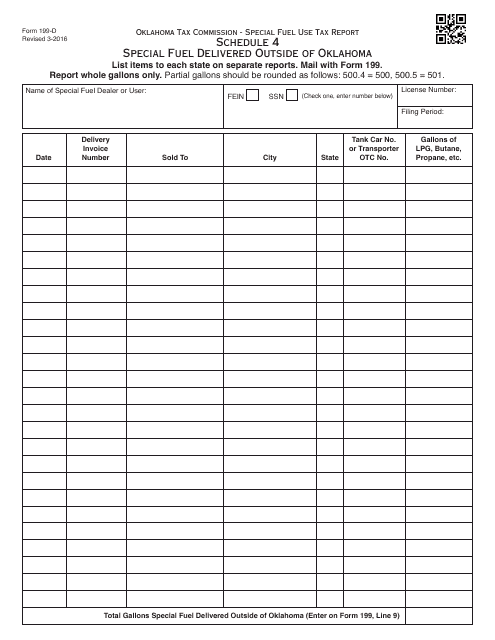

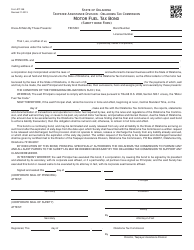

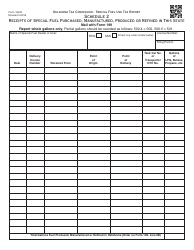

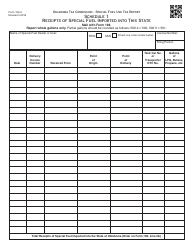

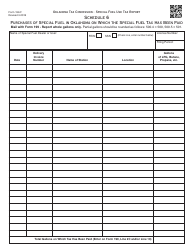

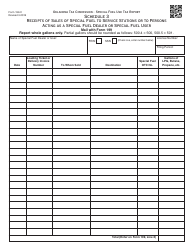

OTC Form 199-D Schedule 4 Special Fuel Delivered Outside of Oklahoma - Oklahoma

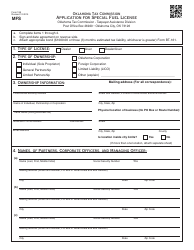

What Is OTC Form 199-D Schedule 4?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

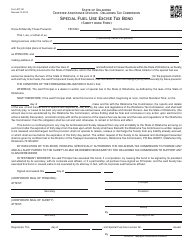

Q: What is OTC Form 199-D?

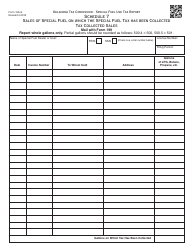

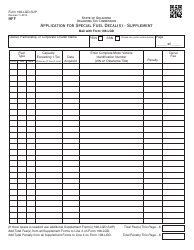

A: OTC Form 199-D is a tax form used for reporting special fuel delivered outside of Oklahoma.

Q: What is Schedule 4?

A: Schedule 4 is a specific section on OTC Form 199-D used for reporting special fuel delivered outside of Oklahoma.

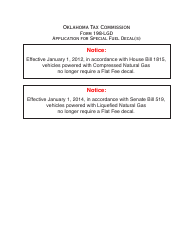

Q: What is special fuel?

A: Special fuel refers to fuel products such as gasoline, diesel, and propane.

Q: When is OTC Form 199-D Schedule 4 used?

A: OTC Form 199-D Schedule 4 is used when reporting special fuel delivered outside of Oklahoma.

Q: Why is special fuel delivery outside of Oklahoma important?

A: Special fuel delivery outside of Oklahoma may have different tax implications and reporting requirements.

Q: Are there any penalties for not filing OTC Form 199-D Schedule 4?

A: Failure to file OTC Form 199-D Schedule 4 may result in penalties or fines.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 199-D Schedule 4 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.