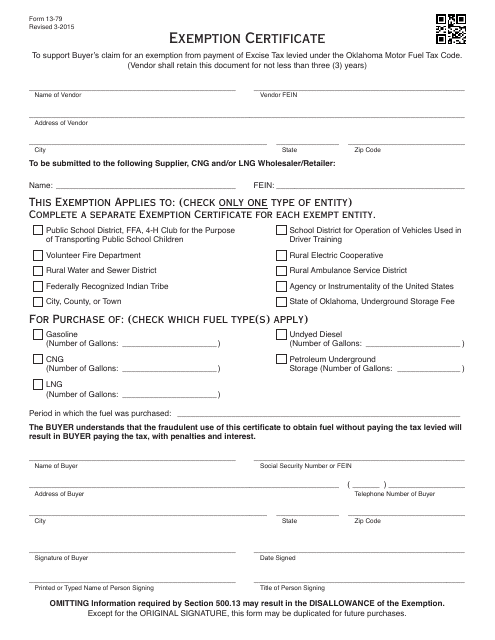

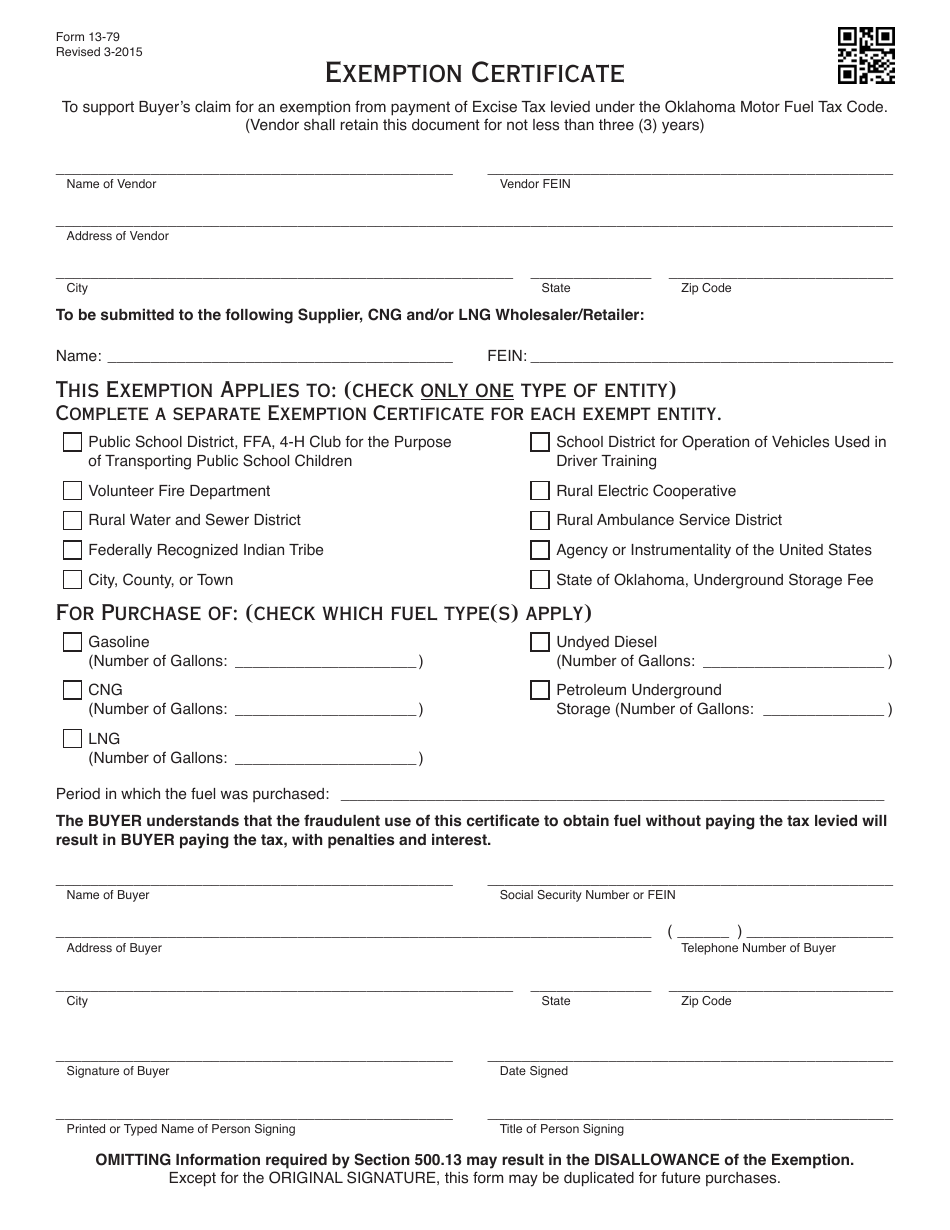

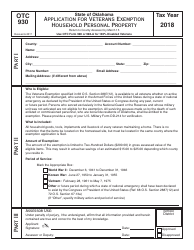

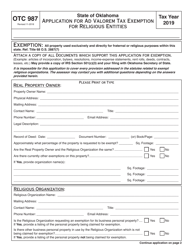

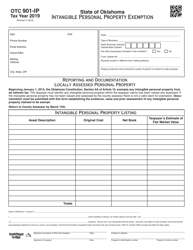

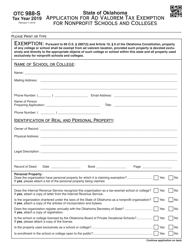

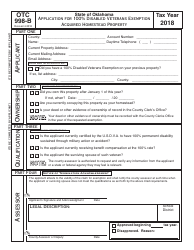

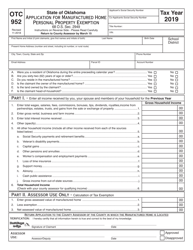

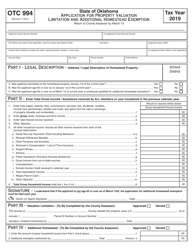

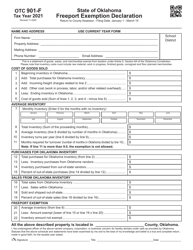

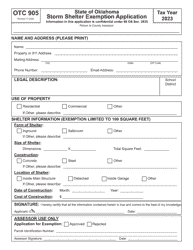

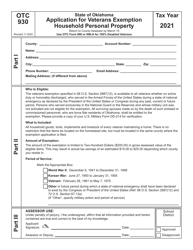

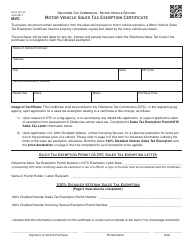

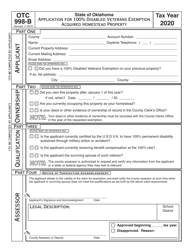

OTC Form 13-79 Exemption Certificate - Oklahoma

What Is OTC Form 13-79?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 13-79?

A: OTC Form 13-79 is an Exemption Certificate used in Oklahoma.

Q: What is an Exemption Certificate?

A: An Exemption Certificate is a document used to claim exemption from certain taxes or obligations.

Q: What is the purpose of OTC Form 13-79?

A: The purpose of OTC Form 13-79 is to claim exemption from Oklahoma sales tax on certain purchases.

Q: Who can use OTC Form 13-79?

A: OTC Form 13-79 can be used by individuals or businesses who qualify for specific exemptions from Oklahoma sales tax.

Q: What information is required on OTC Form 13-79?

A: OTC Form 13-79 requires the taxpayer's name, address, sales tax permit number (if applicable), and a description of the exemption being claimed.

Q: What should I do with OTC Form 13-79 once completed?

A: Once completed, OTC Form 13-79 should be retained by the taxpayer and provided to vendors or sellers as proof of exemption.

Q: Are there any restrictions on using OTC Form 13-79?

A: Yes, there may be restrictions on using OTC Form 13-79, depending on the specific exemption being claimed. It is important to review the instructions and guidelines provided by the Oklahoma Tax Commission.

Q: Can OTC Form 13-79 be used for all types of exemptions?

A: No, OTC Form 13-79 is specifically for claiming exemption from Oklahoma sales tax. Other types of exemptions may require different forms or documentation.

Q: What should I do if I have questions about OTC Form 13-79 or exemptions?

A: If you have questions about OTC Form 13-79 or exemptions, it is recommended to contact the Oklahoma Tax Commission directly for assistance.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-79 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.