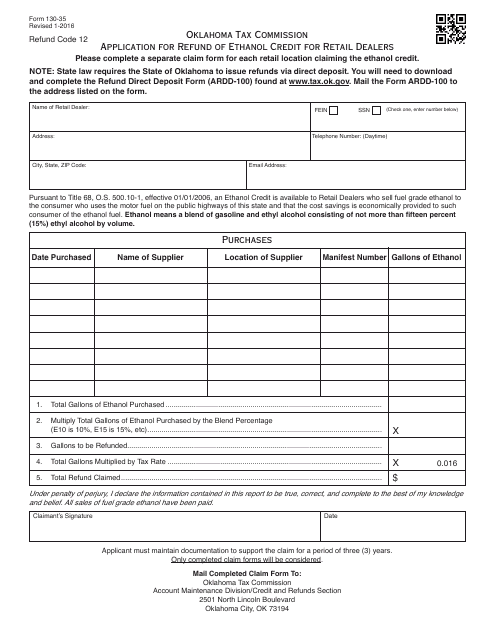

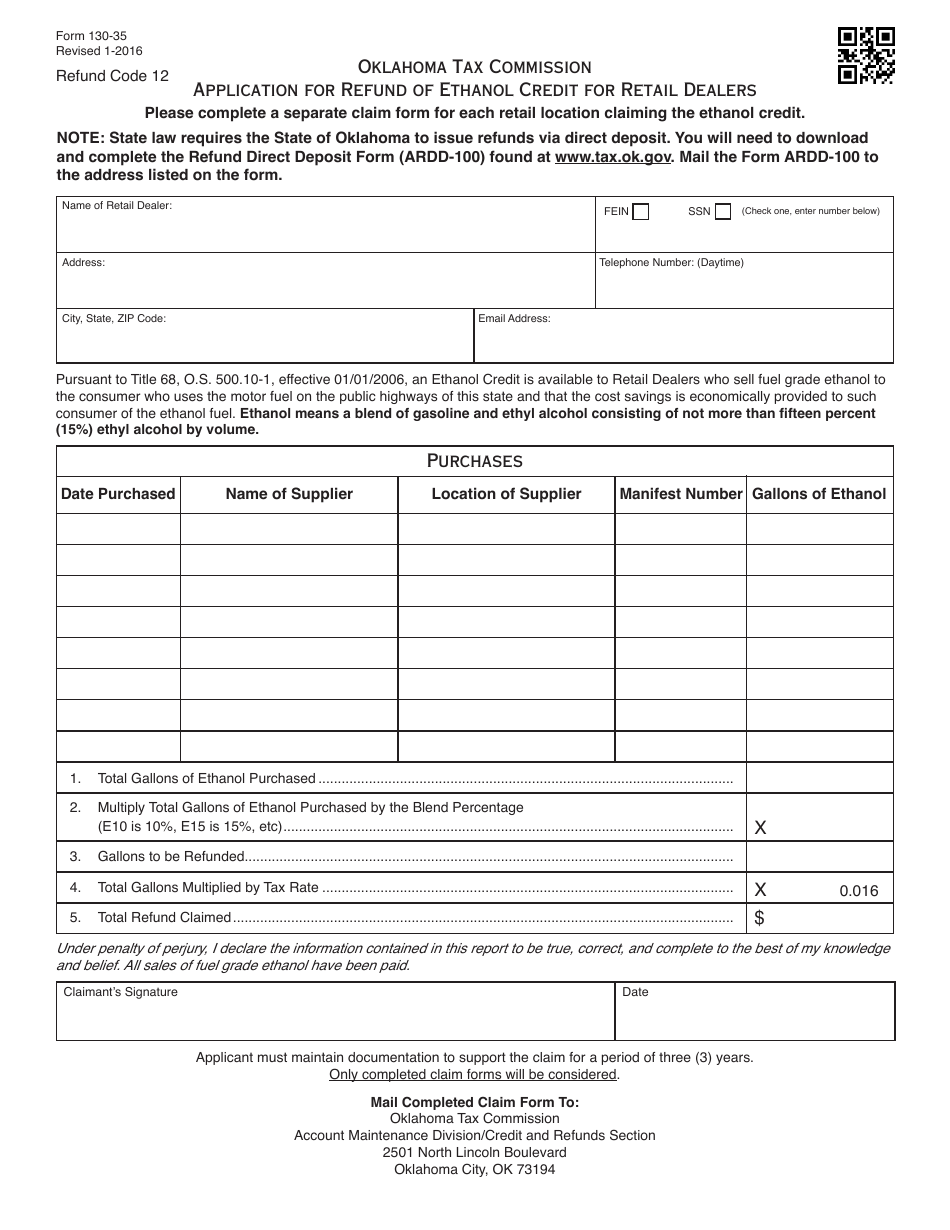

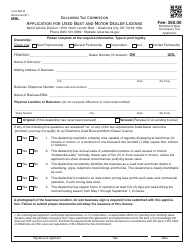

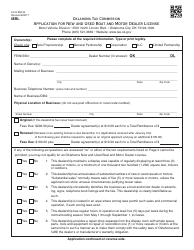

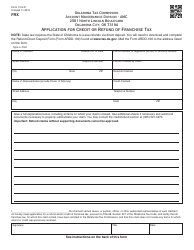

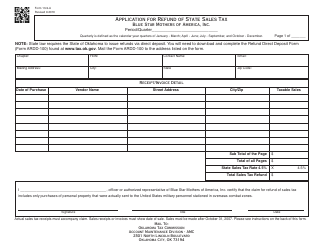

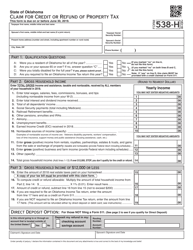

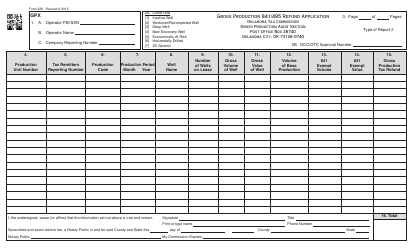

OTC Form 130-35 Application for Refund of Ethanol Credit for Retail Dealers - Oklahoma

What Is OTC Form 130-35?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 130-35?

A: OTC Form 130-35 is an application form for retail dealers in Oklahoma to apply for a refund of ethanol credit.

Q: Who can use OTC Form 130-35?

A: Retail dealers in Oklahoma who are eligible for ethanol credit can use this form.

Q: What is the purpose of OTC Form 130-35?

A: The purpose of this form is to allow retail dealers in Oklahoma to apply for a refund of ethanol credit.

Q: What should I include when submitting OTC Form 130-35?

A: When submitting the form, you should include all required information and any supporting documents as specified in the instructions.

Q: Is there a deadline for submitting OTC Form 130-35?

A: Yes, the form must be submitted within the timeframe specified by the Oklahoma Tax Commission.

Q: How long does it take to process OTC Form 130-35?

A: The processing time may vary, and it is advisable to contact the Oklahoma Tax Commission for information on current processing times.

Q: Can I file OTC Form 130-35 electronically?

A: Yes, the Oklahoma Tax Commission allows electronic filing of OTC Form 130-35.

Q: Is there a fee for submitting OTC Form 130-35?

A: There is no fee associated with submitting OTC Form 130-35.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 130-35 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.