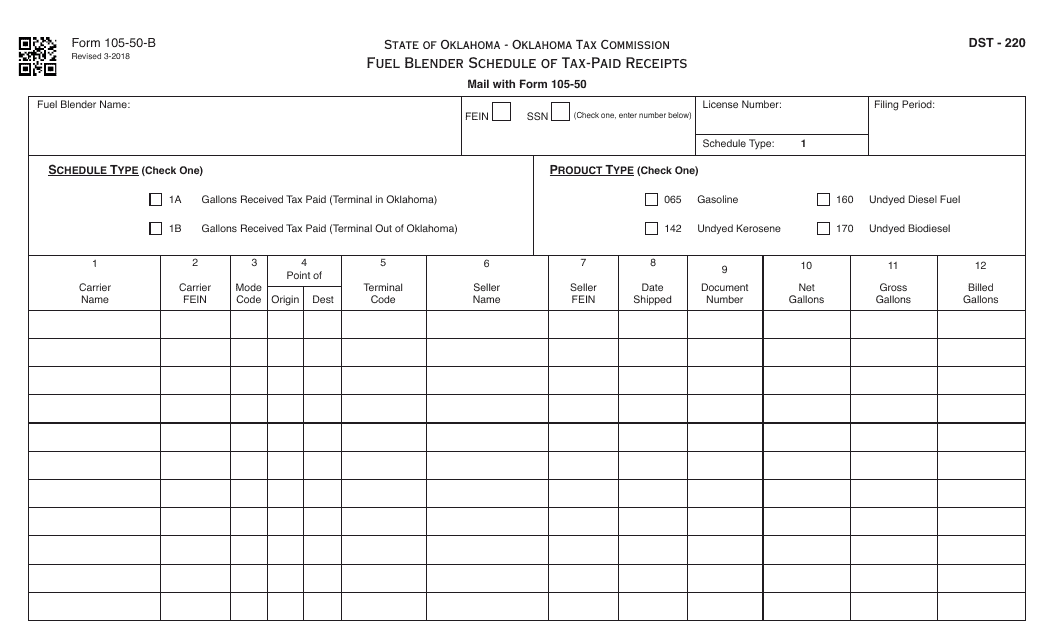

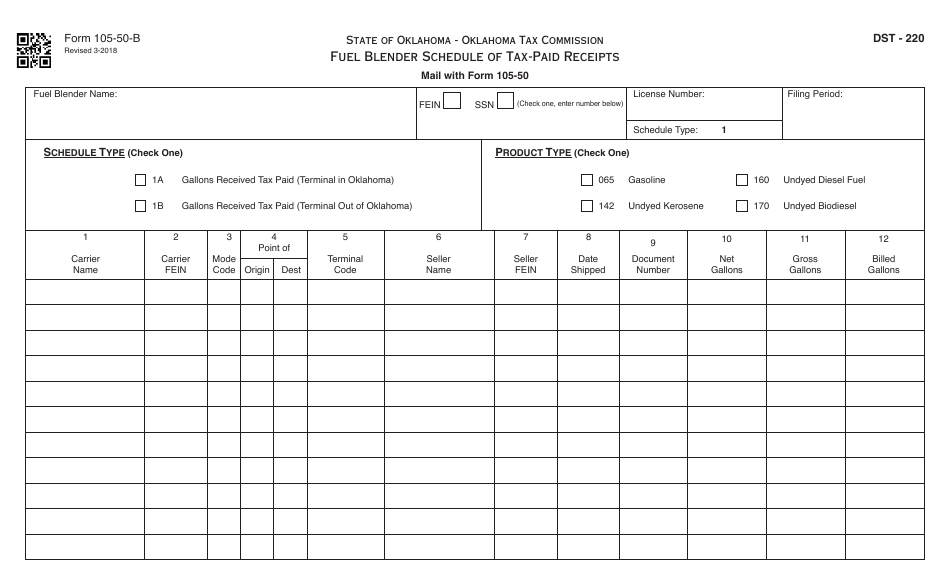

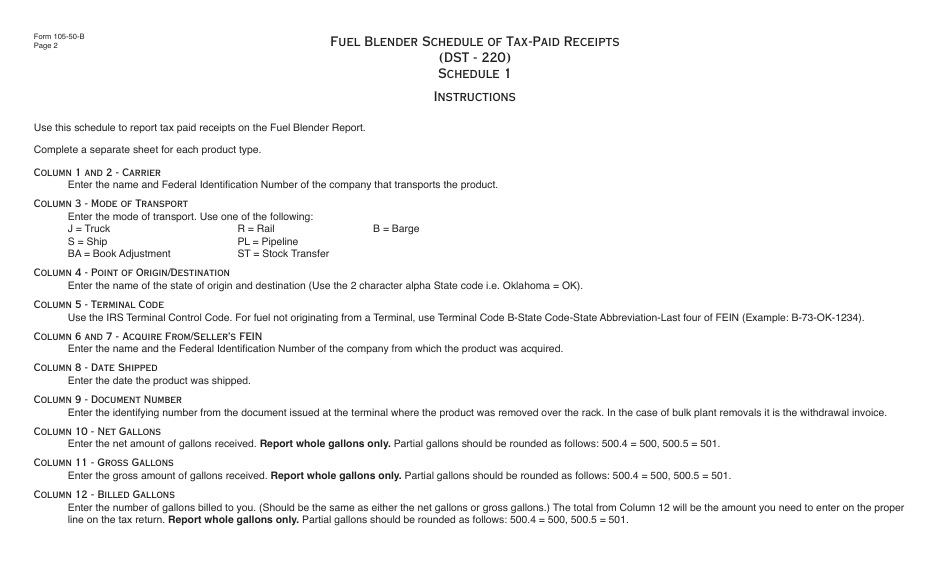

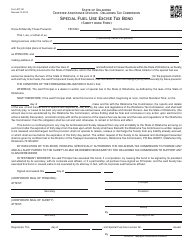

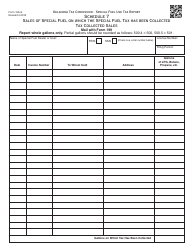

OTC Form 105-50-B Fuel Blender Schedule of Tax-Paid Receipts - Oklahoma

What Is OTC Form 105-50-B?

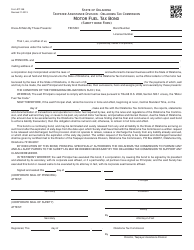

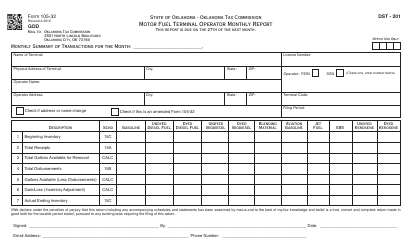

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form 105-50-B?

A: The OTC Form 105-50-B is a form used in Oklahoma for reporting tax-paid receipts for fuel blenders.

Q: Who uses the OTC Form 105-50-B?

A: Fuel blenders in Oklahoma use the OTC Form 105-50-B.

Q: What is the purpose of the OTC Form 105-50-B?

A: The form is used to report tax-paid receipts for fuel blending in Oklahoma.

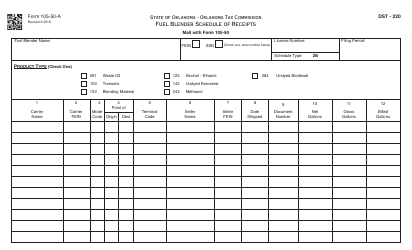

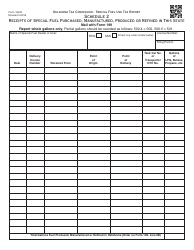

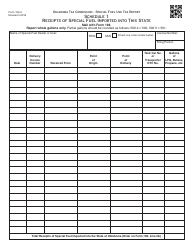

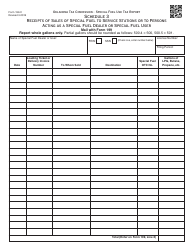

Q: What information is included in the OTC Form 105-50-B?

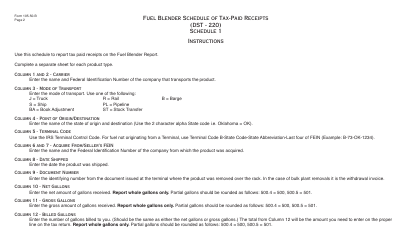

A: The form includes information such as the date of receipt, type of fuel received, and the amount.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-50-B by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.