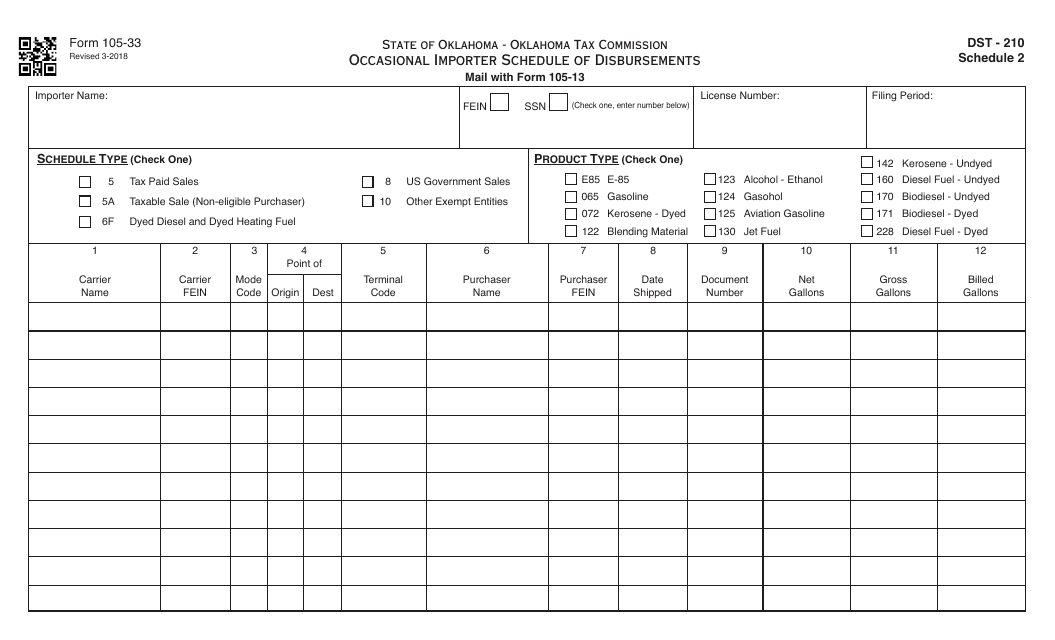

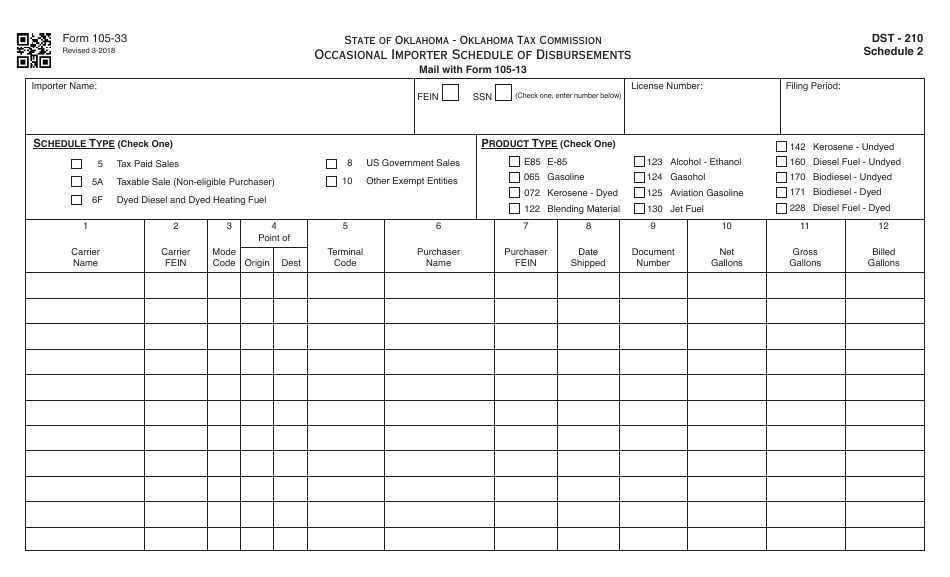

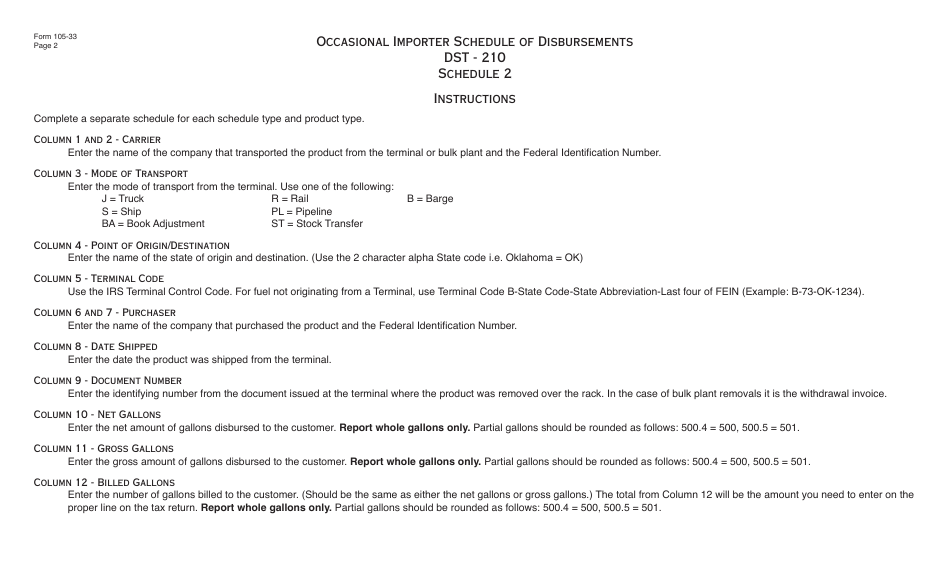

OTC Form 105-33 Occasional Importer Schedule of Disbursements - Oklahoma

What Is OTC Form 105-33?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-33?

A: OTC Form 105-33 is the Occasional Importer Schedule of Disbursements form.

Q: Who needs to file OTC Form 105-33?

A: Occasional importers in Oklahoma need to file OTC Form 105-33.

Q: What is the purpose of OTC Form 105-33?

A: The purpose of OTC Form 105-33 is to report and document the disbursements made by occasional importers in Oklahoma.

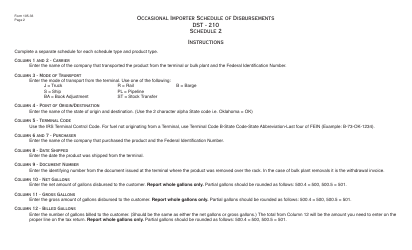

Q: What information is required on OTC Form 105-33?

A: OTC Form 105-33 requires information such as the importer's name, address, and taxpayer identification number (TIN), as well as details of the disbursements made.

Q: Are there any fees or penalties associated with filing OTC Form 105-33?

A: There may be fees or penalties for late or non-filing of OTC Form 105-33, as determined by the OTC.

Q: Is OTC Form 105-33 specific to Oklahoma?

A: Yes, OTC Form 105-33 is specific to occasional importers in Oklahoma.

Q: Is OTC Form 105-33 a one-time filing or a recurring filing?

A: OTC Form 105-33 is a recurring filing that occasional importers in Oklahoma need to submit on a regular basis.

Q: What should I do if I have more questions about OTC Form 105-33?

A: If you have more questions about OTC Form 105-33, you should contact the Oklahoma Tax Commission (OTC) for further assistance.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-33 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.