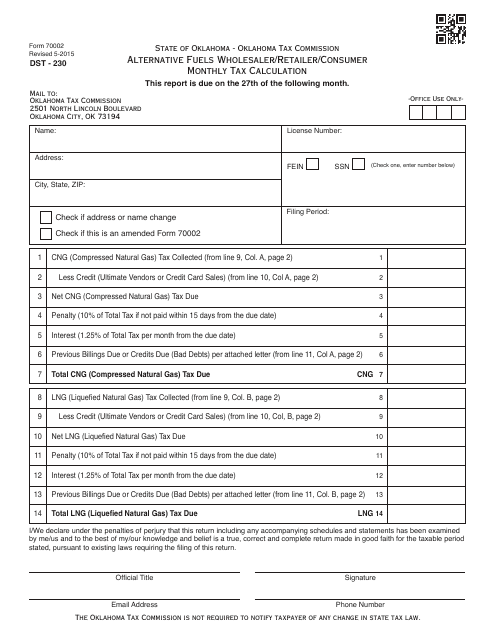

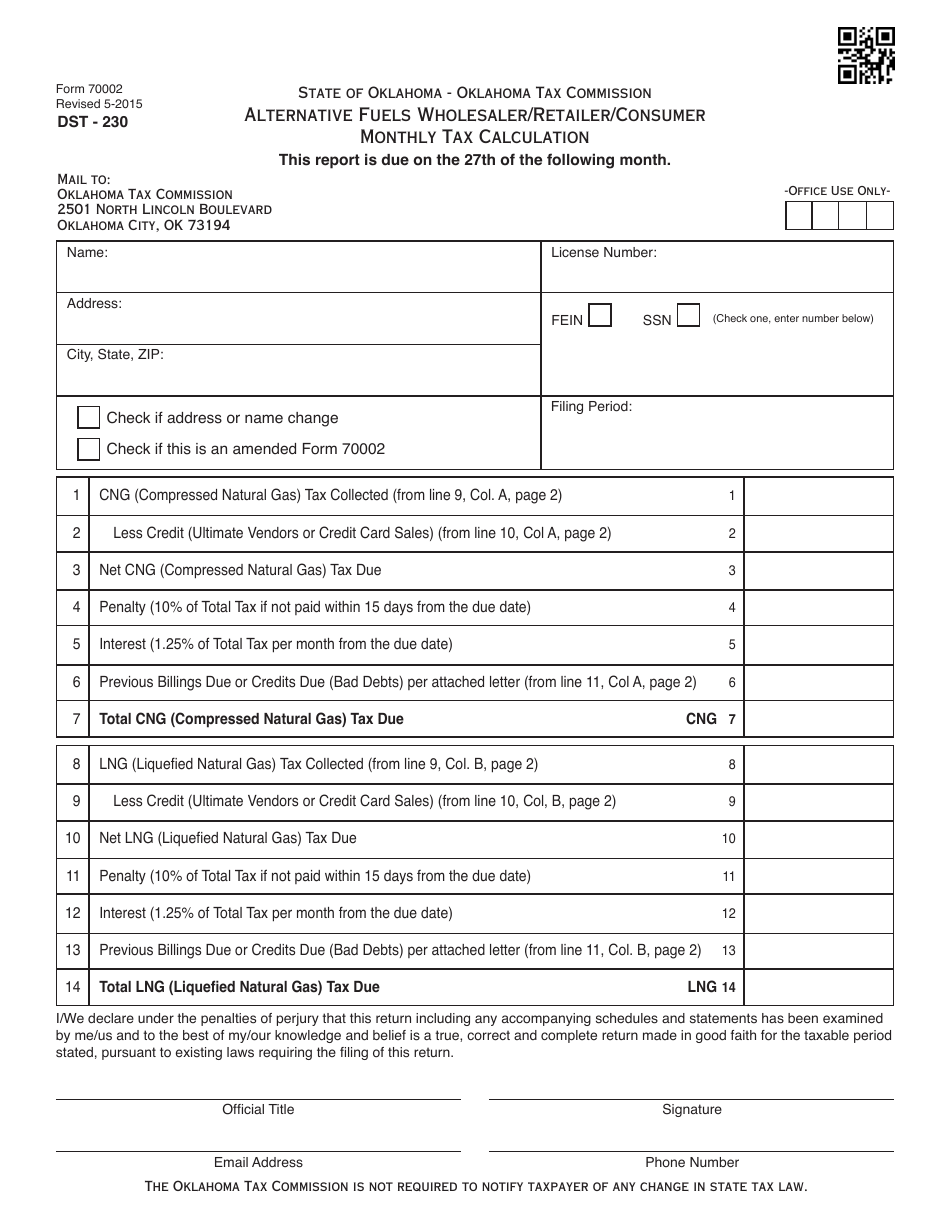

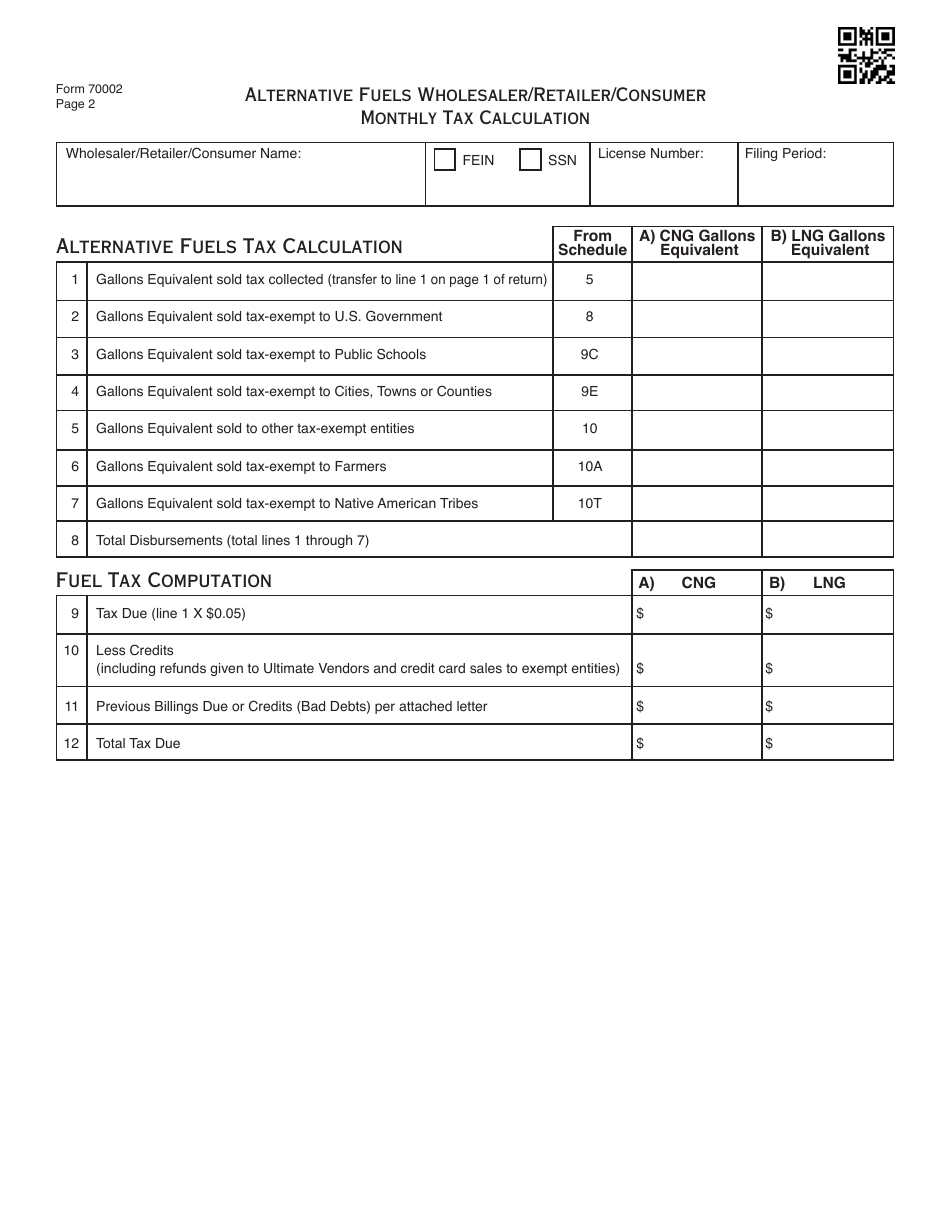

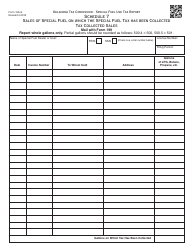

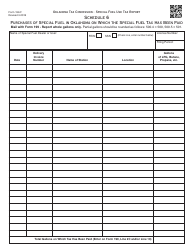

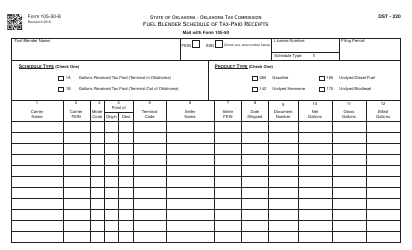

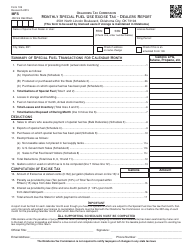

OTC Form 70002 Alternative Fuels Wholesaler / Retailer / Consumer Monthly Tax Calculation - Oklahoma

What Is OTC Form 70002?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 70002?

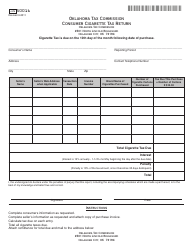

A: OTC Form 70002 is a tax calculation form for alternative fuels wholesalers, retailers, and consumers in Oklahoma.

Q: Who needs to file OTC Form 70002?

A: Alternative fuels wholesalers, retailers, and consumers in Oklahoma need to file OTC Form 70002.

Q: What is the purpose of OTC Form 70002?

A: The purpose of OTC Form 70002 is to calculate and report monthly taxes related to alternative fuels.

Q: What types of alternative fuels are covered in this form?

A: OTC Form 70002 covers various types of alternative fuels, including compressed natural gas, liquefied natural gas, and propane.

Q: How often do I need to file OTC Form 70002?

A: OTC Form 70002 needs to be filed monthly.

Q: What taxes are calculated in OTC Form 70002?

A: OTC Form 70002 calculates taxes such as excise tax, inspection fee, and preservation fee for alternative fuels.

Q: Are there any exemptions or credits available?

A: Yes, there are exemptions and credits available for alternative fuels used in certain situations, such as for agricultural purposes or government-owned vehicles.

Q: Are there penalties for not filing OTC Form 70002?

A: Yes, there can be penalties for late or non-filing of OTC Form 70002, including interest charges on unpaid taxes.

Q: Is there any assistance available for filling out OTC Form 70002?

A: Yes, the Oklahoma Tax Commission provides resources and assistance for filling out OTC Form 70002.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 70002 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.