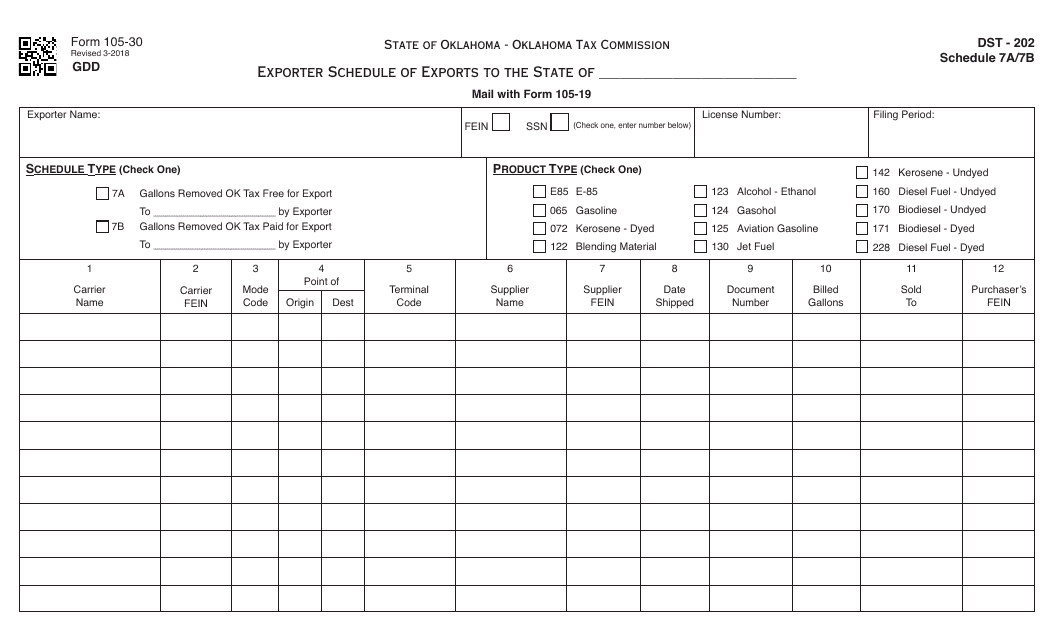

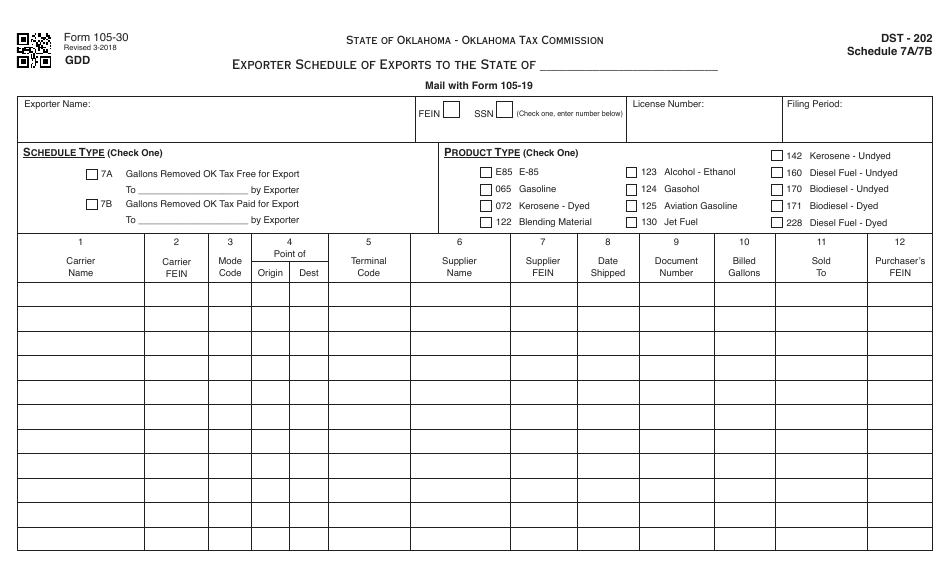

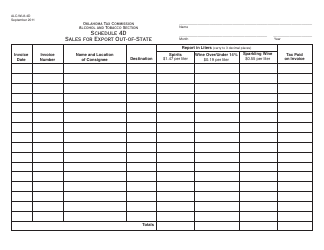

OTC Form 105-30 Exporter Schedule of Exports - Oklahoma

What Is OTC Form 105-30?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-30?

A: OTC Form 105-30 is the Exporter Schedule of Exports for Oklahoma.

Q: Who needs to file OTC Form 105-30?

A: Exporters located in Oklahoma need to file OTC Form 105-30.

Q: What is the purpose of OTC Form 105-30?

A: The purpose of OTC Form 105-30 is to report exports made by Oklahoma-based exporters.

Q: Is it mandatory to file OTC Form 105-30?

A: Yes, it is mandatory for Oklahoma-based exporters to file OTC Form 105-30.

Q: Are there any penalties for not filing OTC Form 105-30?

A: Yes, there can be penalties for non-compliance with filing OTC Form 105-30.

Q: When is the deadline for filing OTC Form 105-30?

A: The deadline for filing OTC Form 105-30 is usually on a quarterly basis, following the end of each calendar quarter.

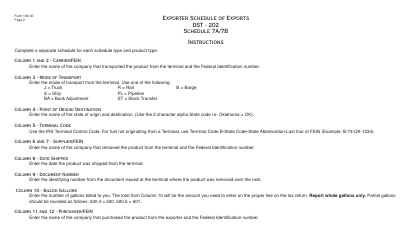

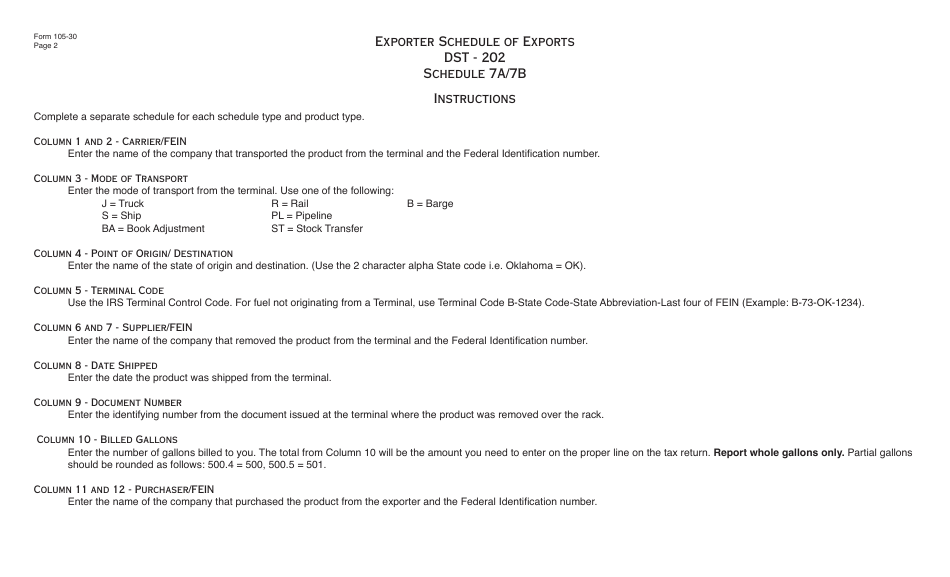

Q: What information is required on OTC Form 105-30?

A: OTC Form 105-30 requires information such as exporter details, export date, destination country, description of goods, and value of exports.

Q: Can I amend OTC Form 105-30 after submitting it?

A: Yes, you can file an amended OTC Form 105-30 if there are any changes or corrections needed to be made.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-30 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.