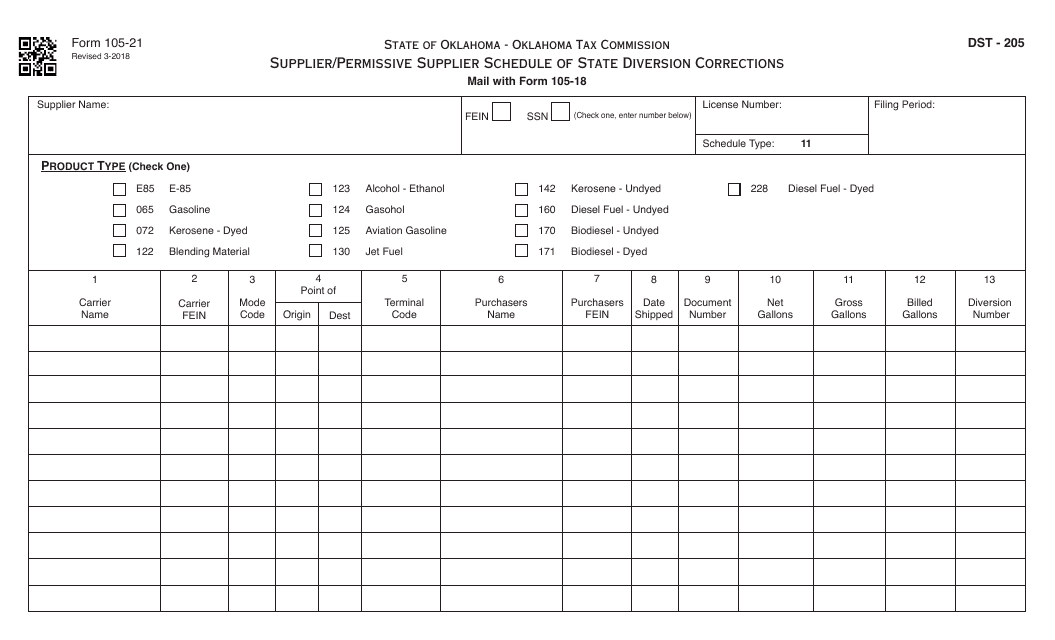

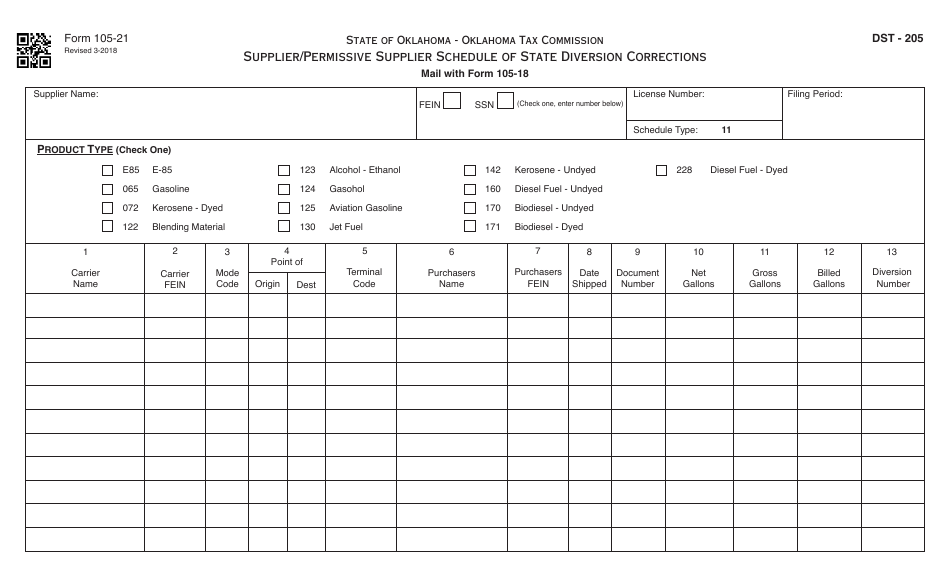

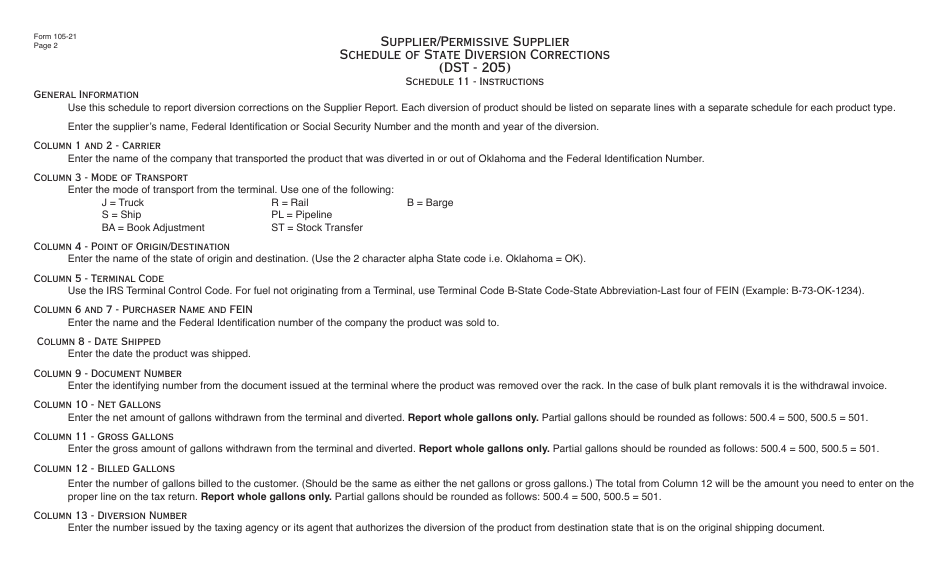

OTC Form 105-21 Supplier / Permissive Supplier Schedule of State Diversion Corrections - Oklahoma

What Is OTC Form 105-21?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-21?

A: OTC Form 105-21 is a Supplier/Permissive Supplier Schedule of State Diversion Corrections form.

Q: What is the purpose of OTC Form 105-21?

A: The purpose of OTC Form 105-21 is to report and correct any diversion of controlled substances by suppliers and permissive suppliers in the state of Oklahoma.

Q: Who is required to fill out OTC Form 105-21?

A: Suppliers and permissive suppliers in Oklahoma are required to fill out OTC Form 105-21.

Q: What is meant by 'diversion' in the context of this form?

A: 'Diversion' refers to the unauthorized distribution or use of controlled substances.

Q: Are there any penalties for not filing OTC Form 105-21?

A: Yes, failure to file OTC Form 105-21 or providing false information can result in penalties or legal consequences.

Q: How often do suppliers and permissive suppliers need to submit OTC Form 105-21?

A: OTC Form 105-21 must be submitted on a monthly basis by the 15th day of the following month.

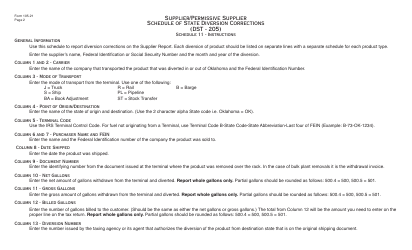

Q: What information is required to be included in OTC Form 105-21?

A: OTC Form 105-21 requires information such as the supplier's name, address, controlled substance distributions, and any corrections made.

Q: Is there a fee associated with filing OTC Form 105-21?

A: No, there is no fee associated with filing OTC Form 105-21.

Q: Who should I contact if I have questions or need assistance with OTC Form 105-21?

A: For questions or assistance with OTC Form 105-21, you can contact the Oklahoma Tax Commission (OTC) directly.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-21 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.