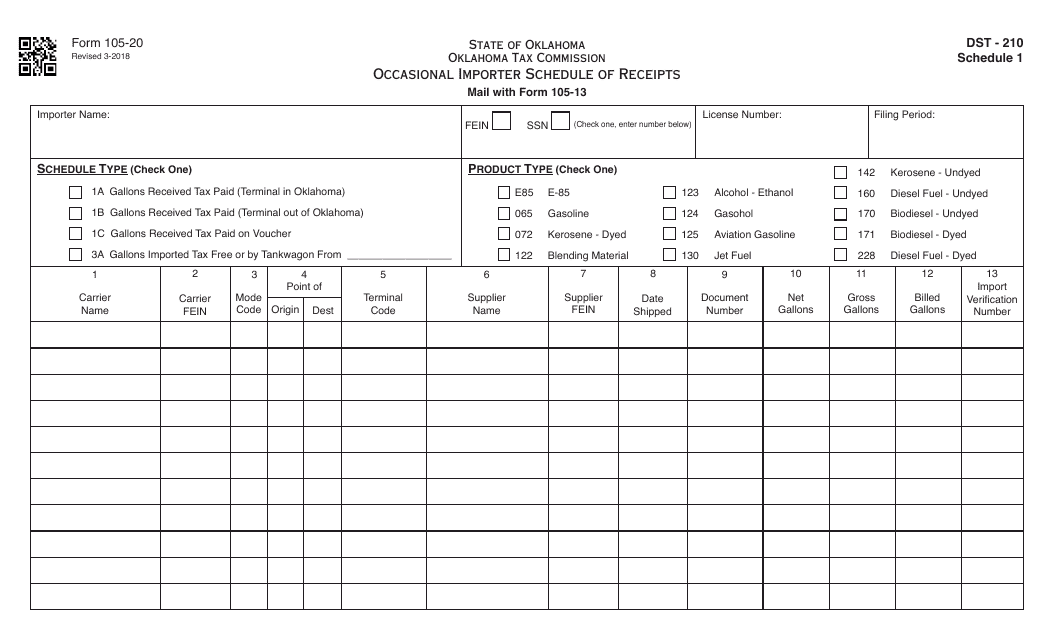

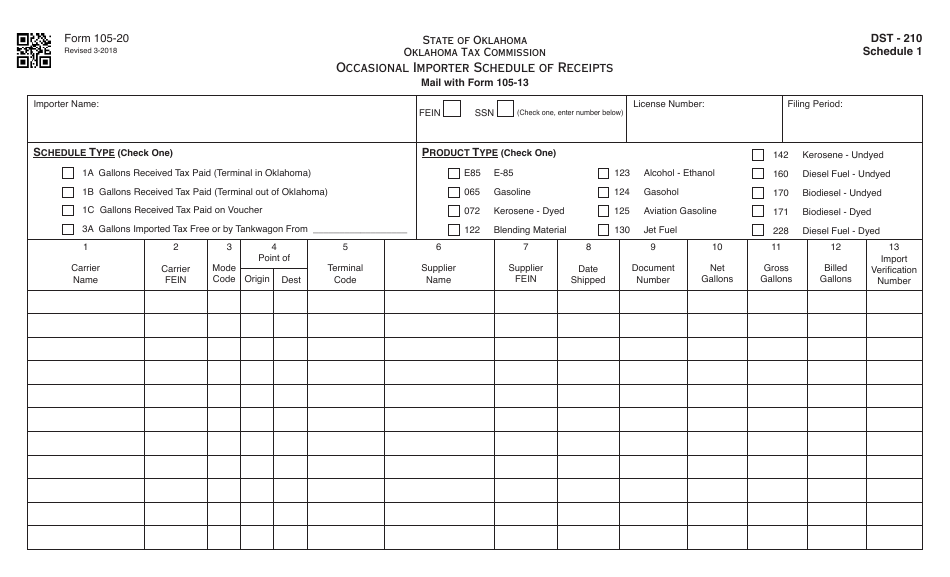

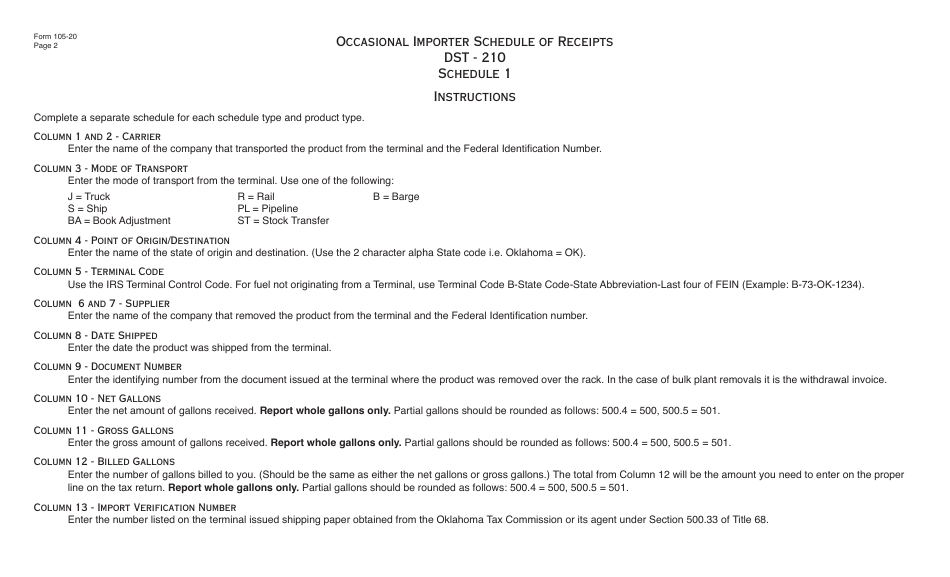

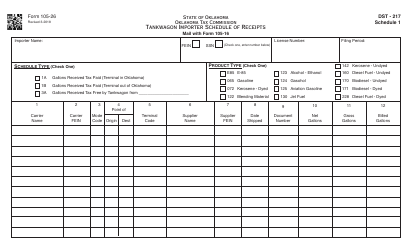

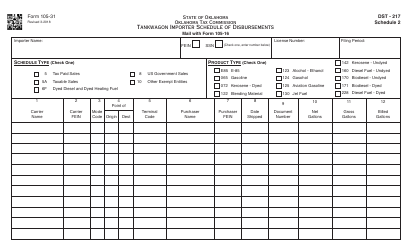

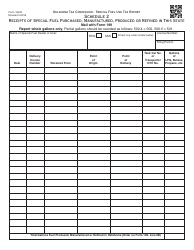

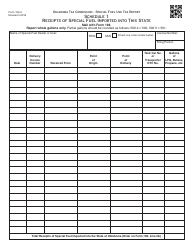

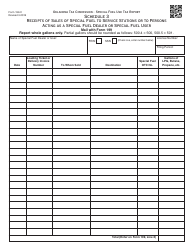

OTC Form 105-20 Occasional Importer Schedule of Receipts - Oklahoma

What Is OTC Form 105-20?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-20?

A: OTC Form 105-20 is the Occasional Importer Schedule of Receipts.

Q: What is the purpose of OTC Form 105-20?

A: The purpose of OTC Form 105-20 is to report the importation of goods by occasional importers in Oklahoma.

Q: Who needs to file OTC Form 105-20?

A: Occasional importers in Oklahoma need to file OTC Form 105-20.

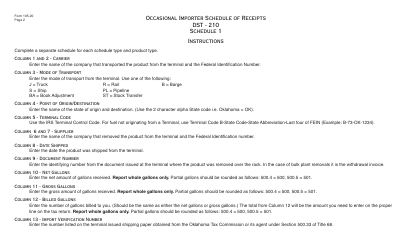

Q: What information is required on OTC Form 105-20?

A: OTC Form 105-20 requires information such as the description of the imported goods, the value of the goods, and the import date.

Q: Are there any fees associated with filing OTC Form 105-20?

A: There are no fees associated with filing OTC Form 105-20.

Q: When is the deadline to file OTC Form 105-20?

A: The deadline to file OTC Form 105-20 is determined by the Oklahoma Tax Commission and may vary.

Q: What happens if I don't file OTC Form 105-20?

A: Failure to file OTC Form 105-20 may result in penalties or other enforcement actions by the Oklahoma Tax Commission.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-20 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.