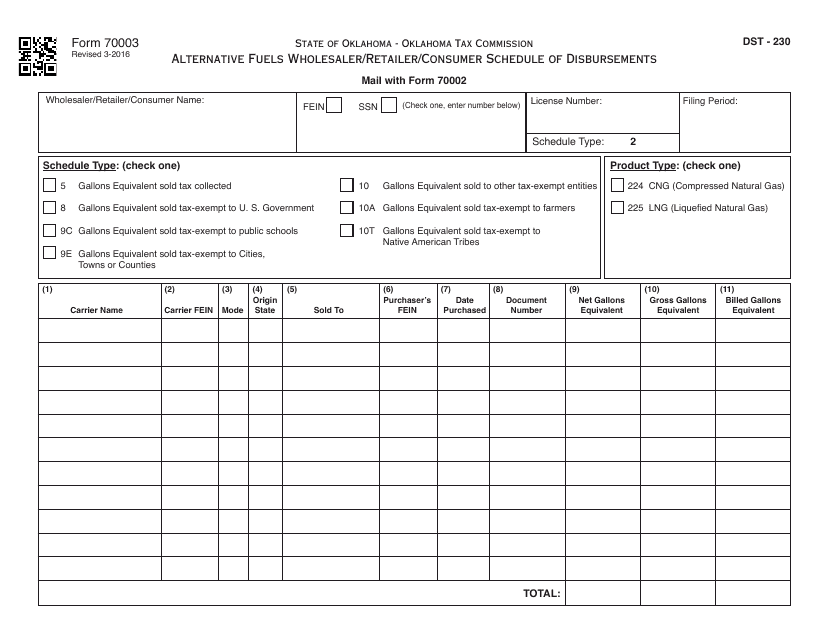

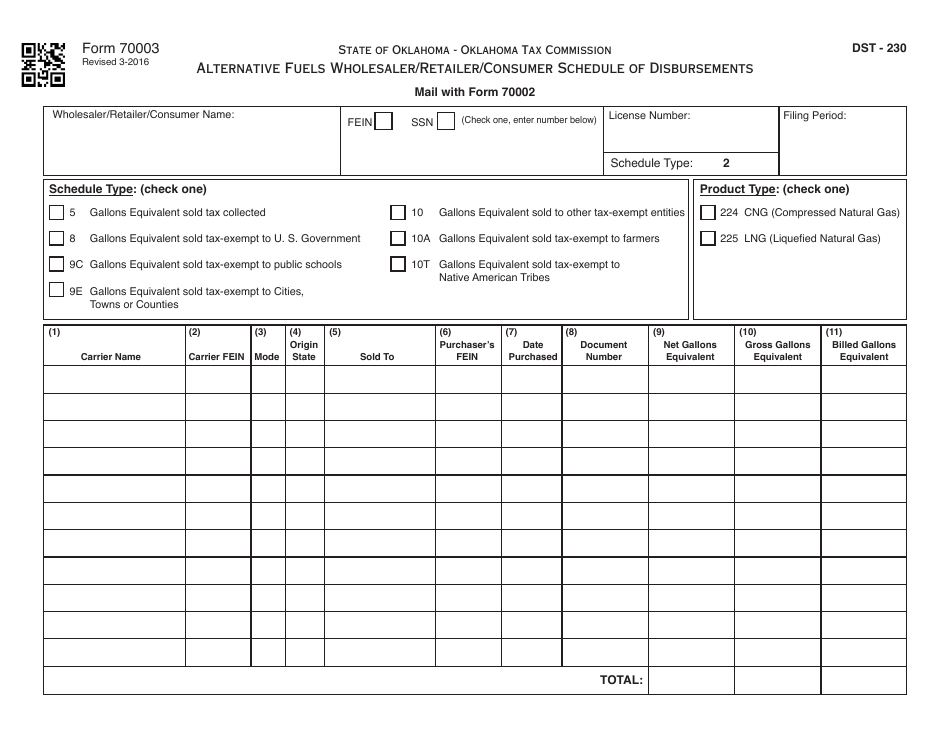

OTC Form 70003 Alternative Fuels Wholesaler / Retailer / Consumer Schedule of Disbursements - Oklahoma

What Is OTC Form 70003?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

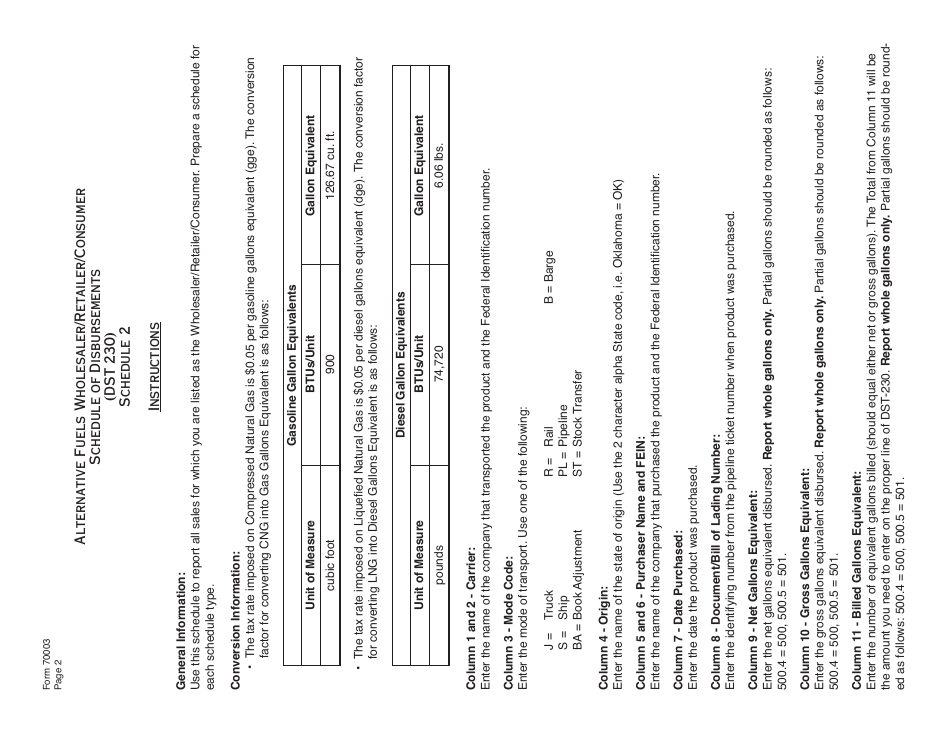

Q: What is OTC Form 70003 Alternative Fuels Wholesaler/Retailer/Consumer Schedule of Disbursements?

A: OTC Form 70003 is a schedule used in Oklahoma for reporting disbursements related to alternative fuels by wholesalers, retailers, and consumers.

Q: Who needs to file OTC Form 70003?

A: Wholesalers, retailers, and consumers involved in the sale or use of alternative fuels in Oklahoma need to file OTC Form 70003.

Q: What is the purpose of OTC Form 70003?

A: The purpose of OTC Form 70003 is to document and report disbursements related to alternative fuels, including the purchase, sale, and use of such fuels.

Q: What information is required on OTC Form 70003?

A: OTC Form 70003 requires information about the buyer, seller, and disbursement amounts, as well as details about the alternative fuels involved.

Q: When is OTC Form 70003 due?

A: OTC Form 70003 is due on or before the 20th day of the month following the month in which the disbursement occurred.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 70003 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.