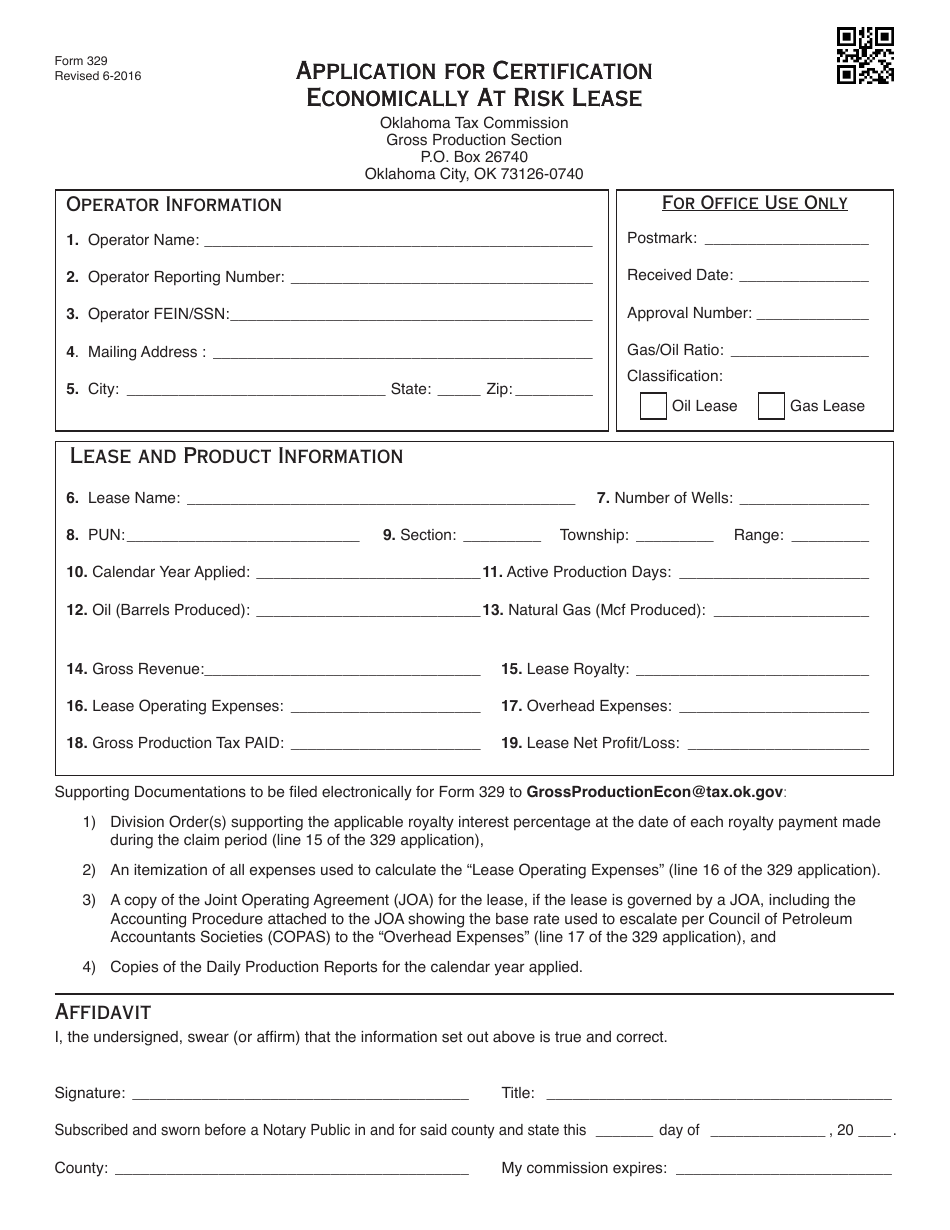

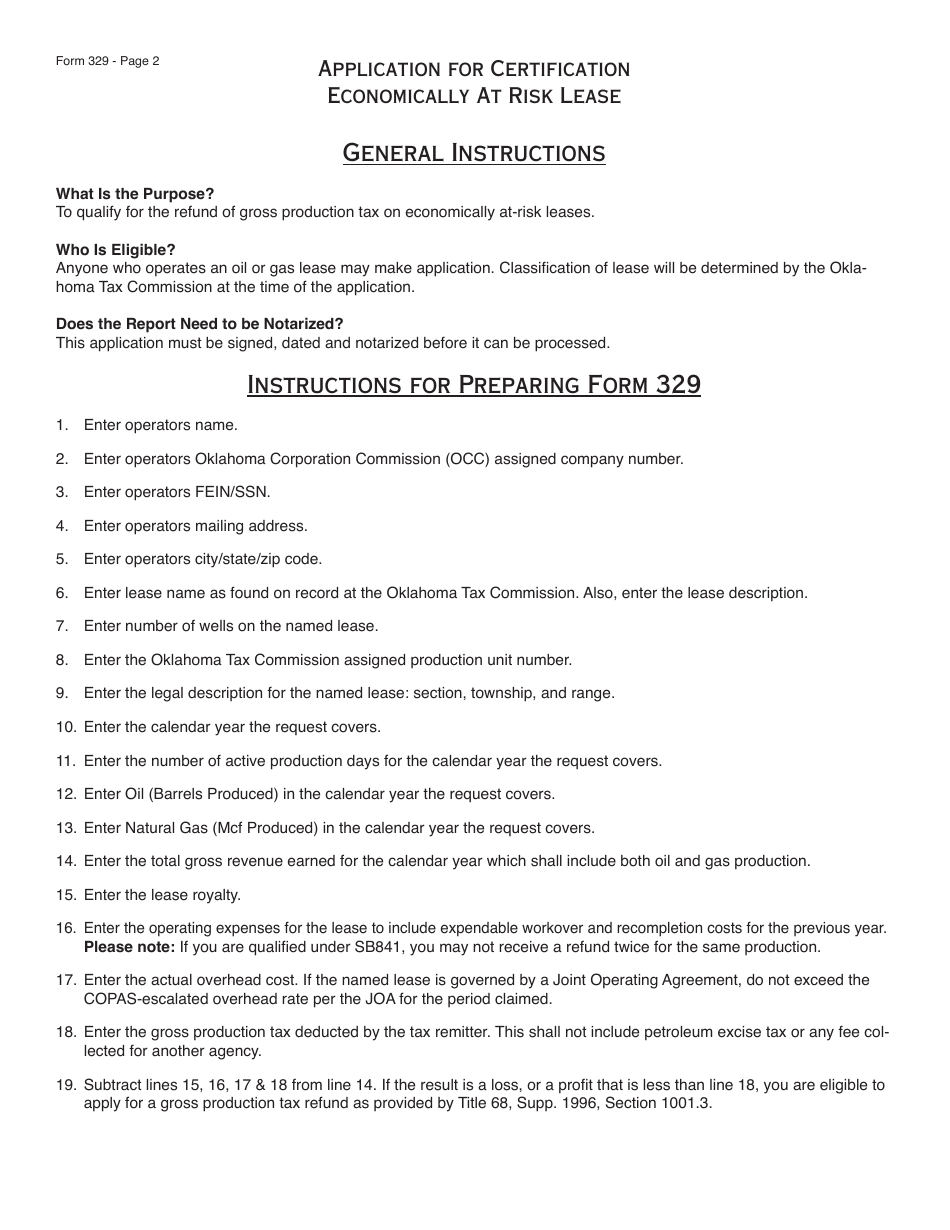

OTC Form 329 Application for Certification Economically at Risk Lease - Oklahoma

What Is OTC Form 329?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 329?

A: OTC Form 329 is an application for certification of an economically at-risk lease in Oklahoma.

Q: What does OTC Form 329 certify?

A: OTC Form 329 certifies that a lease in Oklahoma is economically at-risk.

Q: Who should complete OTC Form 329?

A: The leaseholder or operator of an economically at-risk lease should complete OTC Form 329.

Q: What is an economically at-risk lease?

A: An economically at-risk lease is a lease that is not generating sufficient income to cover its expenses.

Q: Why is OTC Form 329 important?

A: OTC Form 329 is important because it allows for the reduction of ad valorem taxes on economically at-risk leases in Oklahoma.

Q: Are there any fees associated with OTC Form 329?

A: No, there are no fees associated with submitting OTC Form 329.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 329 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.