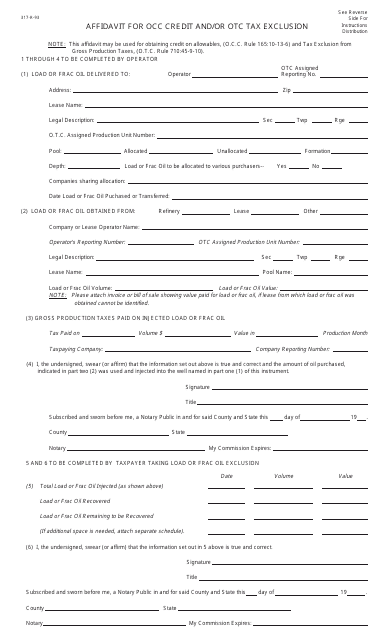

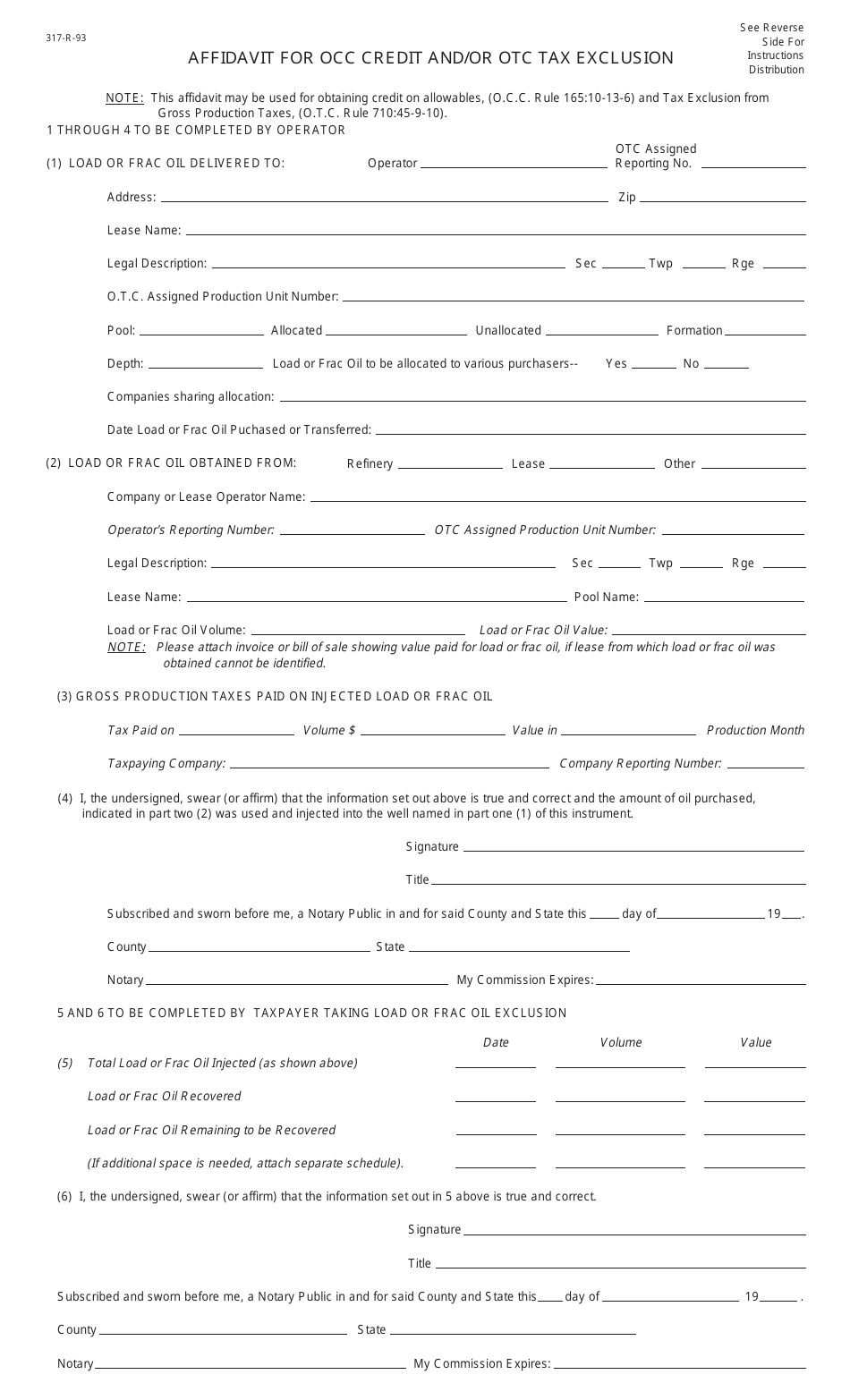

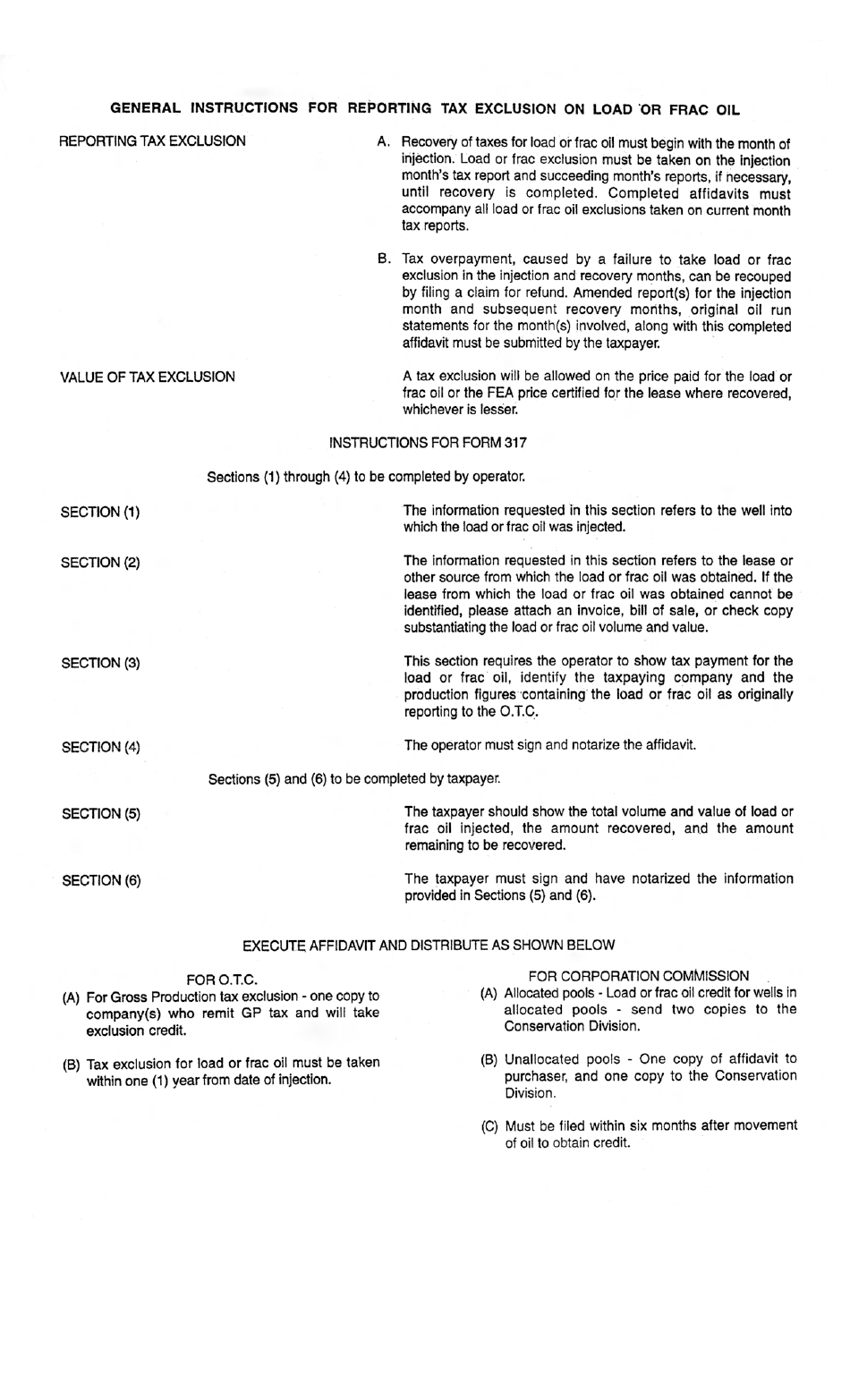

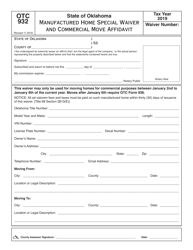

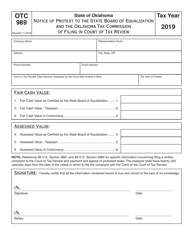

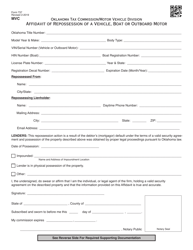

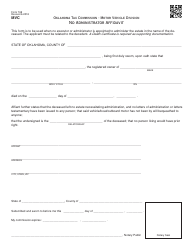

OTC Form 317-R-93 Affidavit for Occ Credit and / or OTC Tax Exclusion - Oklahoma

What Is OTC Form 317-R-93?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 317-R-93?

A: OTC Form 317-R-93 is an Affidavit for Occasional Credit and/or OTC Tax Exclusion in Oklahoma.

Q: What is the purpose of OTC Form 317-R-93?

A: The purpose of OTC Form 317-R-93 is to claim an occasional credit and/or tax exclusion in Oklahoma.

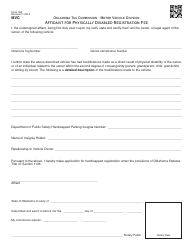

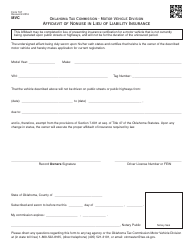

Q: Who can use OTC Form 317-R-93?

A: Any individual or business who wants to claim an occasional credit and/or tax exclusion in Oklahoma can use OTC Form 317-R-93.

Q: Do I need to submit any supporting documents with OTC Form 317-R-93?

A: Yes, you may need to submit supporting documents depending on the nature of your claim. Please refer to the instructions on the form for more information.

Q: Is there a deadline for submitting OTC Form 317-R-93?

A: Yes, the deadline for submitting OTC Form 317-R-93 is determined by the Oklahoma Tax Commission. Please check the instructions or contact the commission for the deadline.

Q: What should I do if I have questions or need assistance with OTC Form 317-R-93?

A: If you have questions or need assistance with OTC Form 317-R-93, you can contact the Oklahoma Tax Commission directly for guidance.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of OTC Form 317-R-93 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.